Markel Group Inc. MKL shares have experienced a robust 11% rise in the year-to-date span, diverging significantly from the industry’s downturn of 8.8%. At a current price of $1,574.83, slightly below its 52-week peak of $1,670.24, Markel Group stands out as a beacon of hope, attracting investors and painting a positive outlook for the insurance company’s future.

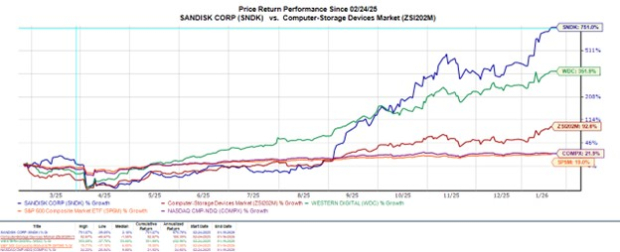

Markel Group Sweeps Industry Competition

Image Source: Zacks Investment Research

Markel Group has seen a staggering 46.2% increase in earnings over the past five years, surpassing the industry standard of 14.4%. This growth trajectory positions MKL favorably in the market. With a fluctuating history of earnings surprises, Markel Group maintains an average beat of 35.4% over the last four quarters.

Markel Group’s Stock on a Steady Climb

Trading comfortably above its 50-day and 200-day simple moving averages at $1,564.30 and $1,512.55, respectively, Markel Group exhibits a strong upward trend. This trading pattern indicates a promising road ahead, leveraging historical price data to anticipate future price movements.

Analyst Sentiments Mix for MKL

Recent projections for MKL show a varied sentiment among analysts, with shifts in estimates for both 2024 and 2025 earnings. Despite a predicted decline in 2024 compared to the previous year, estimates for 2025 reflect a positive upward trajectory, hinting at prospective growth for Markel Group.

Aligned with its climbing fortunes, MKL’s return on invested capital (ROIC) has consistently risen year on year, outperforming the industry average by a substantial margin at 7.7% in the trailing 12 months.

Strengths Fuelling Markel Group’s Momentum

Markel Group’s revenue streams have been fortified by enhanced premiums, a surge in new business volumes, and strategic acquisitions. The bolstering of investment income coupled with strategic buyouts has positioned the company for sustained growth and profitability across its various business segments.

Markel Group’s Wealth Management Tactics

Leveraging its solid capital standing, Markel Group prioritizes wealth distribution to shareholders through share buybacks. With ample cash reserves, the group has allocated a substantial sum for repurchases, underscoring its commitment to creating value for shareholders.

Navigating Risk Terrain

While Markel Group navigates the risk landscape, particularly related to catastrophe losses and escalating operating expenses, it aims to maintain a balance between revenue growth and cost control. Striving to uphold operational efficiency will be crucial in safeguarding the company’s profit margins.

MKL: A Pocket-Friendly Investment

Despite its thriving performance, Markel Group’s shares present an affordable option for investors, trading at a discount compared to industry peers. With a promising forward price-to-book ratio and an enticing Value Score of A, MKL shines as a cost-effective investment choice in the market.

In conclusion, Markel Group’s robust stock performance, strategic business initiatives, and solid financial position make a compelling case for investors to retain their holdings. The company’s growth prospects, backed by prudent capital allocation strategies, indicate a promising trajectory for future gains. Markel Group, with its Zacks Rank #3 (Hold), holds potential for further growth and value creation in the market.

Ready to dive deeper into potential market opportunities? Visit Zacks Investment Research for more insights and analysis.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.