Challenges Ahead for ON Semiconductor Amidst Industry Downturn

ON Semiconductor ON is grappling with challenges in the cyclic chip market, worsened by difficulties in the electric vehicle (EV) and industrial sectors.

In early February, ON Semi released its Q4 results and provided disappointing earnings guidance.

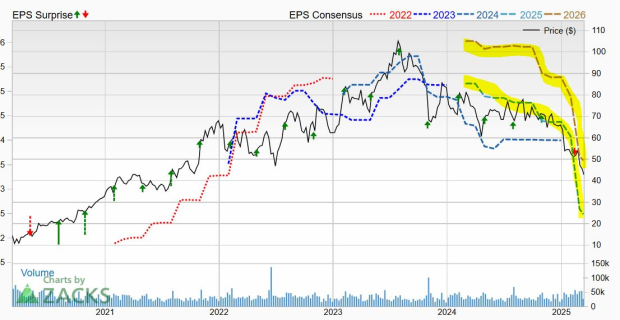

Over the past three years, ON stock has fallen by 22%, contrasting with a 50% rise in the Zacks Tech Sector. Wall Street’s sentiment has shifted negatively towards the chip manufacturer due to changing industry dynamics that have negatively impacted its earnings and revenue.

Current Issues Afflicting ON Stock

ON Semiconductor specializes in analog chip solutions for the automotive and industrial sectors. The company’s recent focus has been on improving profit margins and discontinuing low-margin, non-core products. A significant acquisition in 2021 positioned ON Semi as a supplier of silicon carbide, a crucial material for EVs, chargers, and energy infrastructure.

During 2021 and 2022, ON Semi experienced strong growth driven by the soaring demand for EVs and increases in investments in sustainable energy and industrial automation. Nonetheless, it operates within a cyclical industry heavily influenced by the spending patterns of the automotive and industrial sectors.

Image Source: Zacks Investment Research

Currently, the EV market is witnessing a downturn after rapid expansion, while industrial markets are also slowing down. ON Semi saw a revenue decline of 14% in 2024, on the heels of a 1% drop in 2023. Earnings fell by 23% last year after a 3% decline in FY23.

On February 10, the company issued bleak EPS guidance resulting in a 45% decrease in its Q1 consensus estimate. Earnings estimates for 2025 and 2026 have been revised down by 40% and 29%, respectively, leading to its Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

Despite these short-term challenges, ON Semi’s long-term outlook appears promising. Leadership remains optimistic about overcoming current pressures. CEO Hassane El-Khoury emphasized the company’s transformation over the last four years, stating, “We are a structurally different company that is well-equipped to navigate prolonged volatility.”

However, potential investors may need to tread carefully. Predicting a bottom for ON Semi could prove difficult given the heightened uncertainty in both the stock market and the broader economy, further complicated by ongoing tariff disputes.

Zacks’ Research Chief Identifies Promising Stock

Our expert team has identified five stocks with significant potential for gaining over 100% in the coming months. Among these, Director of Research Sheraz Mian highlights one stock expected to deliver the highest growth.

This leading choice is dynamic within the financial sector, boasting a rapidly growing customer base of over 50 million and a diverse array of innovative solutions. While not every pick guarantees success, this stock could outperform others, similar to previous prime selections like Nano-X Imaging, which surged by 129.6% in just nine months.

Free: See Our Top Stock And 4 Runners Up

ON Semiconductor Corporation (ON): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.