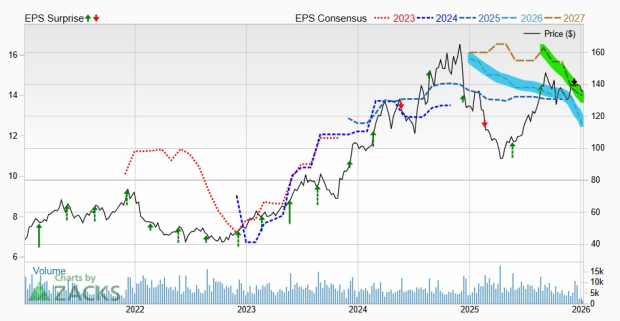

Toll Brothers, Inc. (TOL), one of the leading luxury homebuilders in the U.S., issued disappointing earnings guidance on December 8, 2023, amidst “soft demand across many markets.” For FY26, the company projects a revenue decline of 4.2% year-over-year and earnings to drop by 6.5%. This downturn follows a more than 10% drop in consensus earnings estimates since the Q4 earnings report.

The company currently holds a Zacks Rank #5 (Strong Sell) due to these earnings revisions and the underperformance of the homebuilding industry, which is in the bottom 3% of Zacks’s nearly 250 industry categories. Factors such as increased mortgage rates and home prices continue to exert pressure on the market. Despite the short-term challenges, Toll Brothers remains optimistic about long-term growth potential, given the ongoing need for more housing supply in the U.S.