“`html

Bitcoin’s Rollercoaster: What Lies Ahead After Recent Volatility

Most investors anticipated stability, yet the cryptocurrency market has instead delivered a whirlwind of volatility.

Following his enthusiastic endorsement during the campaign, President Trump initially propelled cryptocurrencies higher. However, mirroring other financial markets, cryptocurrencies have faced wild fluctuations since the November election, testing the resolve of even the most experienced investors.

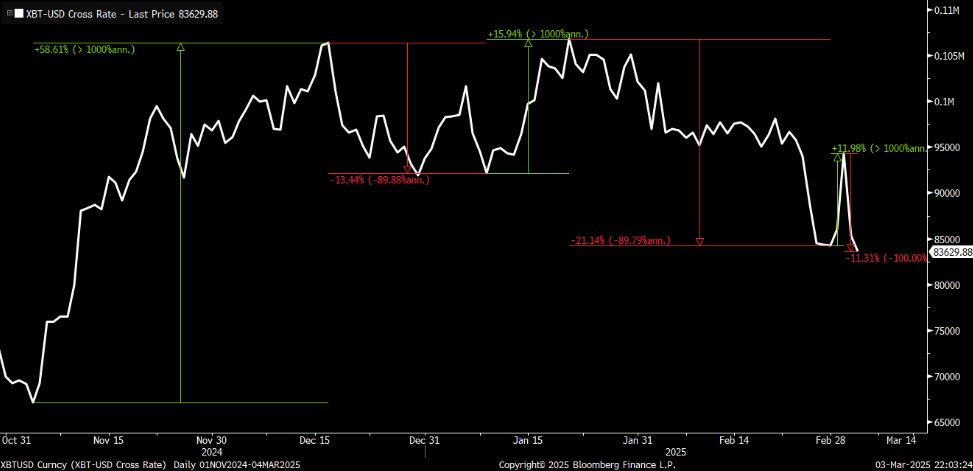

Bitcoin (BTC/USD) witnessed a remarkable surge of 60% in the month post-election, fueled by optimism for pro-crypto policies from Washington. However, concerns over reinflation triggered a sharp 15% drop in Bitcoin’s value.

After inflation worries eased, Bitcoin rebounded by 15%, only to experience a subsequent 20% plunge fueled by tariff concerns.

In recent developments, Bitcoin surged by 10% this past weekend after news that Trump plans to establish a strategic national reserve for cryptocurrencies. However, following the president’s announcement of additional tariffs on Monday, Bitcoin relinquished all its gains.

This tumultuous period raises the natural question: What’s on the horizon?

We predict a significant rally is on the way.

Positive Signs Ahead

Surprisingly, our optimism centers around Trump.

After the election, Bitcoin rallied from $60,000 to $100,000, driven by expectations of supportive pro-crypto policies. Since then, however, Bitcoin has struggled due to concerns that Trump was prioritizing other issues over cryptocurrencies.

In his early weeks in office, Trump implemented tariffs and federal spending cuts swiftly, while his promises on crypto advancements lagged, leading to frustration among supporters.

This may change later this week.

On Friday, March 7, Trump is set to host the first-ever White House Crypto Summit, featuring key industry founders, CEOs, and investors.

We anticipate significant announcements at this summit.

Trump understands the challenges facing crypto markets, and recognizes the disappointment from investors who supported him during his campaign.

This could be why he announced the creation of a strategic national reserve for cryptocurrencies.

A Strategic Approach to Cryptos

The timing of this announcement was critical.

The previous week, cryptocurrencies suffered due to fears of an escalating trade war, leading Bitcoin to a low not seen since 2025 and resulting in its largest selloff since 2022. The situation appeared dire.

In a bid to stabilize the markets, Trump attempted to address crypto concerns with the announcement regarding a national reserve, something that has been highly sought after by industry proponents.

This announcement led to a brief surge, with Bitcoin rising from $84,000 to $95,000 within hours. However, the next day, renewed tariff anxieties saw Bitcoin retreat back to $84,000.

Trump’s efforts to bolster the crypto market only provided temporary relief.

We believe he will take more significant action during Friday’s summit.

The lack of detail in the previous announcement likely triggered the market’s swift decline. While Trump mentioned creating a strategic reserve that would encompass Bitcoin and other major altcoins, specifics on implementation and Congressional approval remained unclear.

This gap in information left traders unfazed, leading to a sell-off once the initial excitement dissipated.

We anticipate that Friday’s summit could provide substantial details on the proposed reserve. If this occurs, we expect traders will respond positively by buying on the dip.

In fact, we could see Bitcoin aiming for $100,000 by the weekend.

Conclusion: Looking Ahead in Crypto Markets

However, significant risks stem from factors unrelated to cryptocurrencies—specifically, tariffs.

Trump’s recent imposition of new 25% tariffs on Mexico and Canada, along with additional tariffs on China, has ignited concerns over a global trade conflict. Potential retaliatory tariffs from these countries could further complicate matters.

Anxiety surrounding this trade war has already affected all financial markets, with stocks, cryptocurrencies, commodities, and bond yields all experiencing declines.

The trade dispute is far from resolved. This narrative will continue to evolve in the coming months.

Nevertheless, we believe that crypto markets could shift from trade war fears to optimism regarding policy developments, especially if Trump elaborates on the strategic national reserve during the summit. We expect he may announce further partnerships and initiatives with major crypto firms at this event.

Thus, despite the recent turbulence in crypto markets, we are optimistic about potential growth.

“`# Crypto Market Update: Potential for Major Gains This Weekend

The cryptocurrency market is poised for significant movement as we approach the weekend. Analysts predict the possibility of Bitcoin rising back to $100,000, with several altcoins potentially increasing by more than 100%.

To strategically position ourselves for this anticipated rally, we are utilizing a proprietary quant algorithm. This tool assists in identifying “Stage 2” tokens that appear ready for substantial technical breakouts.

Historical backtests suggest this algorithm has previously highlighted some of the most successful altcoin winners during market booms.

For instance, on November 13, 2023, this effective system identified a relatively unknown cryptocurrency named Agoras (AGRS/USD). The subsequent performance of AGRS was noteworthy…

Within less than a month, the price of AGRS surged from 33 cents to over $6.

This means that those who acted on this alert could have seen a return of nearly 1,800% in under 30 days. This represents an almost 18X investment increase in less than one month.

We believe that our algorithm can continue to identify major opportunities in the coming weeks.

Find out more about this algorithm before Friday’s crucial White House summit.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. For ongoing insights, consider following Luke’s latest market analysis through our Daily Notes. Updates can be found on your Innovation Investor or Early Stage Investor subscriber sites.