Market Selloff Drives Mag 7 Down Amidst Earnings Resilience

Mag 7 Led Selloff in Q1 as All Caps Indexes Enter Correction

Last week, we discussed how tariffs and ongoing policy uncertainty negatively impacted small business and consumer sentiment, contributing to the recent market selloff.

In the time since, several key developments have emerged:

- The reciprocal tariffs scheduled for April 2 are expected to be more targeted than initially anticipated.

- Consumer expectations have plummeted to a 12-year low, driven by concerns over tariffs and the stock market.

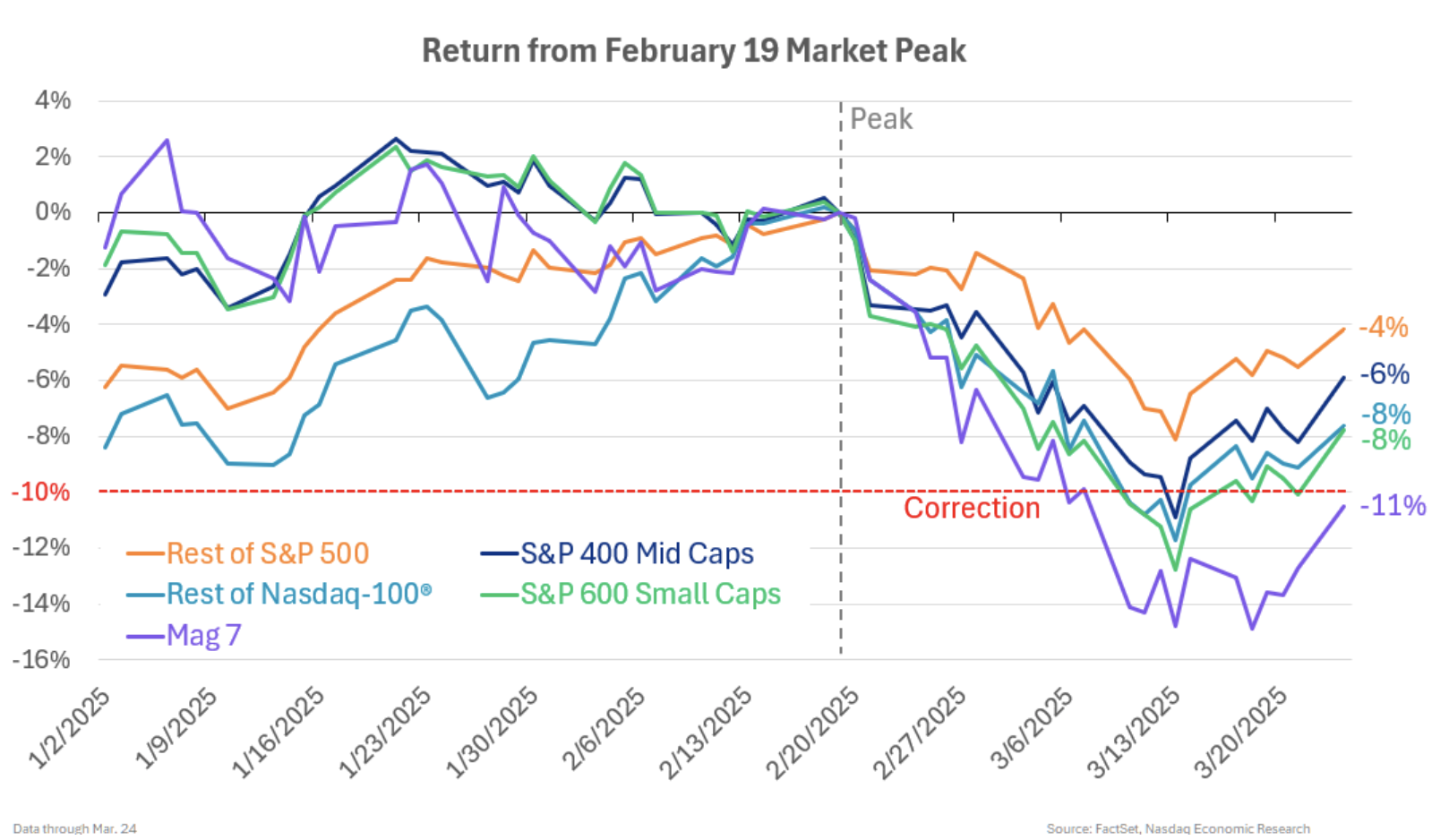

Consumer worries regarding the stock market are justified. From mid-February, both Large Caps, Mid Caps, and Small Caps experienced corrections, each dropping more than 10% by mid-March (as illustrated in the chart below, red line) and igniting discussions about a potential recession.

The selloff particularly affected the Mag 7 (purple line), which faced a sharper decline of 15%, while the rest of the Nasdaq-100® fell by 12% (lighter blue line) and the broader S&P 500 experienced an 8% drop (orange line).

Correction Driven by Declining Valuations as Earnings Remain Strong

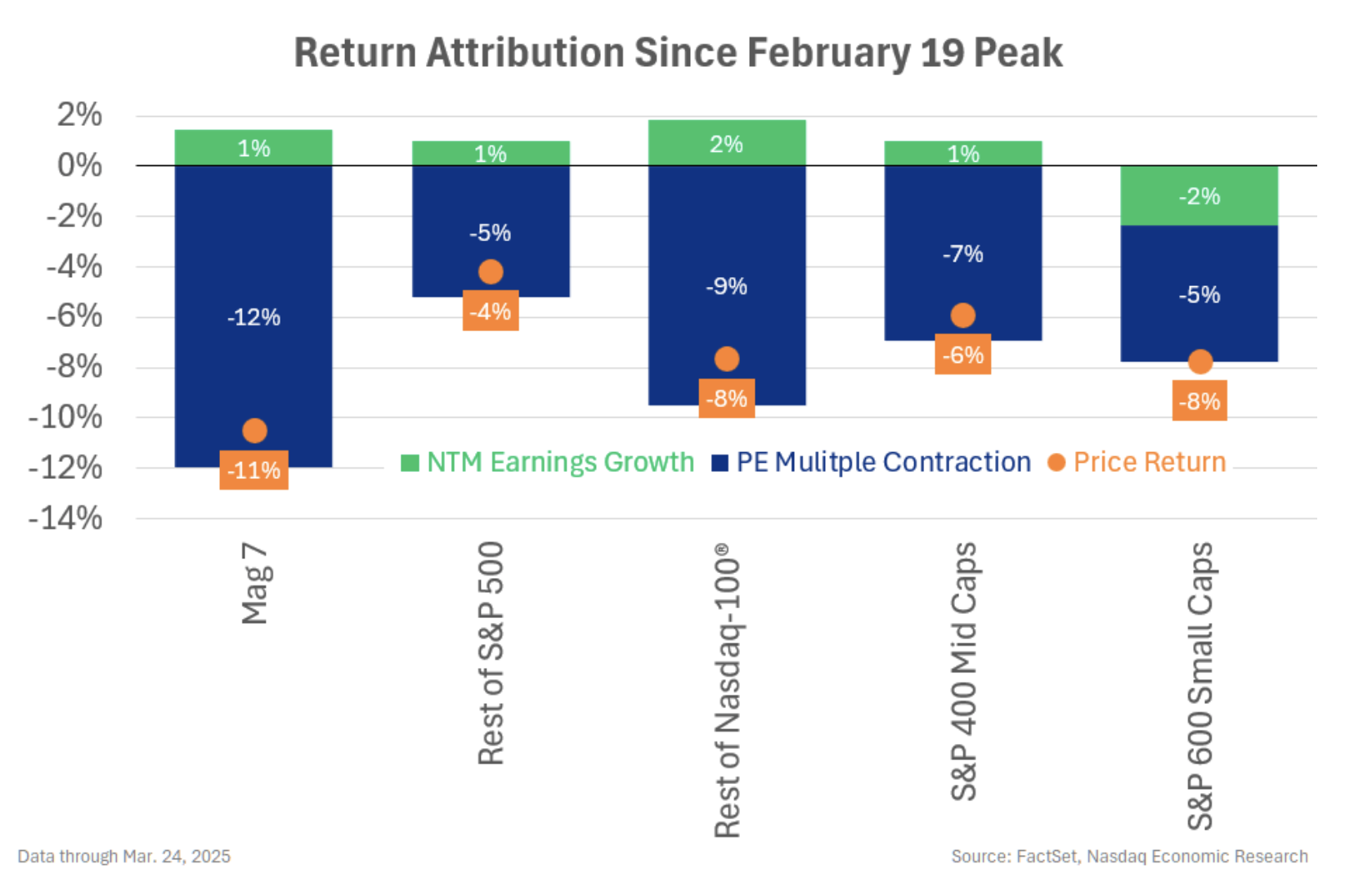

The Mag 7 faced significant impacts from this selloff due to declining PE multiples (depicted in the chart below, blue bars). Investors are increasingly cautious about paying high prices for anticipated earnings.

Before the selloff, US PE multiples were near historic highs, suggesting stocks were “priced for perfection.” The Mag 7’s valuations were even more stretched than other stocks.

As a result, several factors such as tariffs, growing uncertainty, and slower growth made it difficult to maintain these valuations. Currently, they have moderated to less precarious (yet still elevated) levels.

Moreover, the Mag 7 faces challenges such as increased AI and competition, alongside other unique factors, resulting in their forward PEs dropping by 12% in merely five weeks.

Importantly, the selloff was not fueled by weak fundamentals. In fact, earnings for Large Caps and Mid Caps have been increasing since the market peak (green bars), indicating that the risk of a recession remains low at this time, with only Small Caps reporting decreasing earnings.

Analysts Suggest the Worst of the Selloff May be Over

Currently, with earnings remaining stable, the market’s recent behavior appears to be a correction to address slower growth and heightened uncertainty—rather than a signal of recession. Some analysts are starting to conclude that the most challenging part of the selloff may be concluded.

With the Nasdaq-100 rising by +5% and the S&P 500 up +4% from their mid-March lows, their observations might hold validity. We will see how this unfolds.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved.