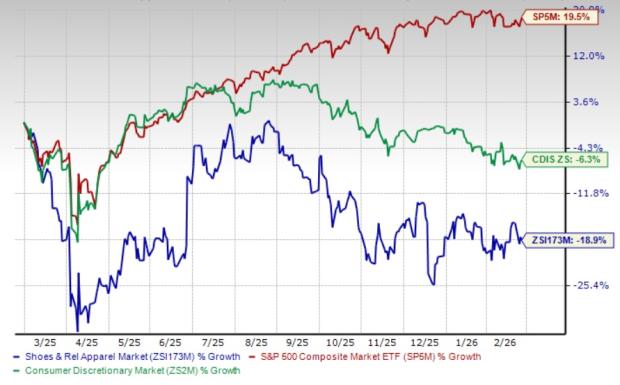

Xerox Holdings Corporation (Ticker: XRX) is experiencing significant challenges in the evolving digital landscape, leading to a notable decline in its business performance. The company, historically a leader in photocopying and printing, has seen gross margins decrease as competition from companies like HP, Canon, and Lexmark intensifies. Over the past 25 years, Xerox’s stock has plummeted by more than 80%, contrasting sharply with the S&P 500’s nearly 800% increase during the same timeframe.

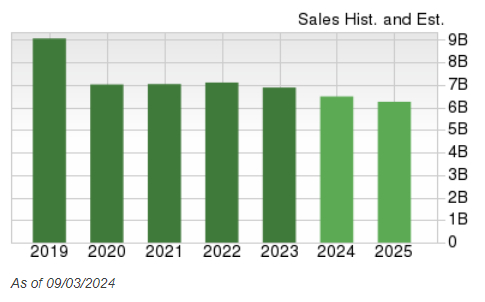

As of now, Xerox has fallen short of Wall Street expectations for three out of the last four quarters, with an average earnings surprise of -25.39%. This stagnation in sales and lack of innovation has resulted in a Zacks Rank of #5 (Strong Sell), reflecting investor concerns about the company’s management and its ability to adapt to a digital-first market.

Overall, Xerox is dealing with declining sales, ongoing commoditization of its services, and a management team perceived as risk-averse, all contributing to its failure to remain competitive in an increasingly digitized environment.