Getty Images’ Stock Surges After Merger Announcement with Shutterstock

Today’s Big News: Major Merger Creates $3.7 Billion Powerhouse in Visual Content

Shares of Getty Images Holdings, Inc. GETY saw a significant increase on Tuesday following the announcement of its merger with Shutterstock, Inc. SSTK. This merger will result in a combined company valued at $3.7 billion.

The movement of Getty’s shares highlights an intriguing aspect of the market. Even amid substantial news, technical patterns can influence stock behavior. This is why Getty Images is our Stock of the Day.

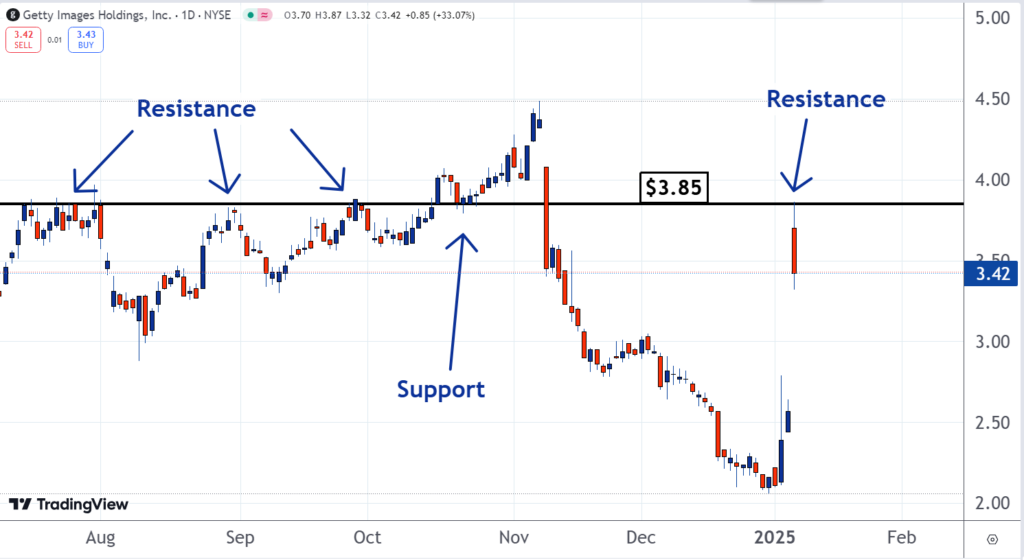

In the stock market, certain price levels carry greater weight than others. For Getty Images, the $3.85 mark has been significant since July, as illustrated in the chart below.

This level acted as resistance in August and September before turning into support in October. Interestingly, it has now flipped back to resistance.

Despite the merger’s positive implications, Getty’s shares encountered resistance at $3.87 this morning and retracted, demonstrating how accurate trading can be around key thresholds.

Traders who bought shares at $3.85 in October likely felt pleased when the stock price increased shortly thereafter.

However, in November, the shares fell below that support level, sparking significant declines. This decline caused some investors to reconsider their purchase decisions, leading to feelings of ‘buyer’s remorse.’

Many of these investors chose to hold their shares in hopes of trading at a time when they wouldn’t incur a loss. As a result, when the stock price rebounded to around $3.85 today, these hesitant investors placed sell orders. The concentration of sell orders created resistance at the same price level that once provided support, establishing a temporary ceiling on Getty’s stock.

A sell-off often occurs when a stock hits a resistance point. Investors may become anxious that prices will drop further, prompting them to lower their asking prices to sell quickly. This can lead to a cascading effect where more sellers continue to drive prices down.

Similar sell-offs happened for Getty at $3.85 in July, August, and September, and it seems to be repeating itself now.

In the stock market, impactful news can lead to distinct price movements. Yet, as the situation with Getty Images shows, technical factors can also significantly influence stock trajectories.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs