Markets Tumble as Tariffs Shake Investor Confidence

Market Downturn Linked to Tariff Policies

The market troubles began in late February when China’s DeepSeek disrupted Wall Street’s booming artificial intelligence sector. Since then, the situation escalated sharply. The Trump administration’s tariff policy, announced for the “Liberation Day” on April 2nd, turned out to be more severe than Wall Street had predicted. As a result, the S&P 500 Index has declined by more than 17% since its peak on February 19th, marking one of the largest drawdowns since 2022 and one of the worst annual starts on record.

Insights from Treasury Secretary Scott Bessent

Business leaders, Wall Street investors, and CEOs have expressed frustration over the Trump administration’s unclear policies. The overall tariff strategy lacks clarity about whether it serves as a negotiating tool or a revenue source. This uncertainty still needs a comprehensive answer. In a recent interview with Tucker Carlson, Treasury Secretary Scott Bessent explained the rationale behind the tariff plan.

During the extensive discussion, Bessent highlighted critical economic issues. He noted that the top 10% of Americans own 88% of equities, while the next 12% own just 12% of the stock market, leaving the bottom 50% in debt. While record numbers of Americans traveled to Europe last summer, an alarming number also relied on food banks. Bessent’s team aims to assist the bottom half of Americans in achieving financial stability. However, it remains uncertain whether this administration’s strategy will succeed, as it requires a fundamental policy shift, which could explain last week’s intense market volatility.

Signs Point to a Possible Market Rebound

Outside of notable investor Warren Buffett, few managed to avert the recent market downturn. However, after over two decades in investing, I have learned that crises often present opportunities. Here are three indicators suggesting the market may experience a significant mean-reversion bounce within the next month:

1. Back-to-Back Drops of 4%: On Thursday and Friday, the S&P 500 experienced declines exceeding 4% for two consecutive sessions. Historically, the only occurrence of a 4% drop over three straight days was during the Great Depression.

2. 1st 90/90 Day: Friday marked a significant trading day where 90% of stocks fell, and 90% of trading volume was within declining stocks—a rare occurrence.

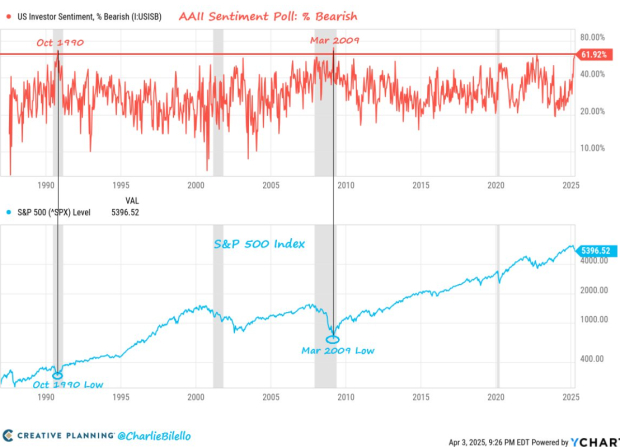

3. Sentiment Reaches Rare Territory: Charlie Bilello from Creative Planning pointed out that the AAII sentiment poll recorded its third-highest bearish sentiment ever. Previous instances occurred in October 1990 and March 2009, both times coinciding with market bottoms.

Image Source: Charlie Bilello, Creative Planning

Implications for Investors

As investors process the shifting tariff policies and their global implications, volatility is expected to continue. A resurgence in demand is crucial for boosting investor confidence in a sustained market uptrend. However, the current extreme levels of fear and panic could lead to a mean-reversion bounce in the coming weeks. The sectors most affected include highly scrutinized stocks, specifically the “Magnificent 7” like Tesla (TSLA) and Nvidia (NVDA), along with small-cap stocks reflected in the Russell 2000 Index ETF (IWM). These could be key indicators for future trends. Additionally, the Fed is scheduled for an unexpected meeting at 11:30 am EST today—emergency measures might be on the agenda.

Top Stock Recommendations from Zacks Research

Our expert team has just released a list of five stocks with the highest potential to gain +100% or more in the upcoming months. Among these selections, Director of Research Sheraz Mian emphasizes one stock that stands out as a strong candidate for significant growth.

This top pick comes from one of the most innovative financial companies, boasting a rapidly expanding customer base of over 50 million and offering a diverse array of advanced solutions. While not all of our elite picks succeed, this one shows promise to surpass previous Zacks’ candidates like Nano-X Imaging, which soared by +129.6% in just over nine months.

Free: See Our Top Stock and 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.