Trump’s Victory Sparks Stock Market Surge: Key Sectors to Watch

Donald Trump has officially returned to the White House, defeating Kamala Harris to become the 47th President of the United States.

The financial markets welcomed this news with enthusiasm, as the S&P 500, Nasdaq, and Dow Jones all gained over +2% on Wednesday.

With 291 electoral votes clinched, Trump’s administration may impact several stocks and sectors positively.

Oil Stocks: “Drill Baby Drill”

While today’s oil stock performance was mixed, Trump’s push for the U.S. to remain the top oil and gas producer is notable.

His slogan “Drill baby drill” underscores a commitment to increasing oil exploration and production, which he views as crucial.

As a result, industry giants like Exxon Mobil XOM and Chevron CVX could see gains. However, Chevron is currently rated a Zacks Rank #4 (Sell) due to falling earnings estimates.

Financial Sector: Mergers & Acquisitions

The financial sector experienced a significant boost on Wednesday, with major banks like JPMorgan JPM and Wells Fargo WFC increasing by over +10%.

Trump’s expected less strict approach on mergers and acquisitions has buoyed bank stocks, allowing them to thrive.

Goldman Sachs GS also surged more than +10% and remains a key player in global M&A activity this year.

One merger to keep an eye on is Kroger’s KR proposed acquisition of Albertsons ACI, which the Biden administration has opposed due to monopoly concerns. A Trump presidency could change the odds for this deal, with Albertsons’ stock rising +2% to $19, still significantly below its acquisition price of $34.10.

The Crypto Landscape

Trump’s support for the cryptocurrency market is good news for regulations in this sector. Bitcoin reached new heights today, exceeding $76,000, marking a +79% increase over the year.

Coinbase COIN, the largest cryptocurrency exchange, boasts a Zacks Rank #2 (Buy). Similarly, Block SQ and Marathon Digital MARA also show potential.

On Wednesday, Coinbase and Marathon Digital saw their stocks soar by +31% and +19%, respectively, while Block shares were up +7%.

Image Source: trading Economics

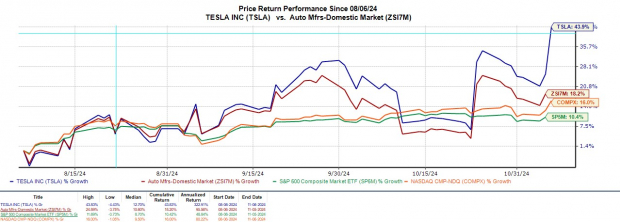

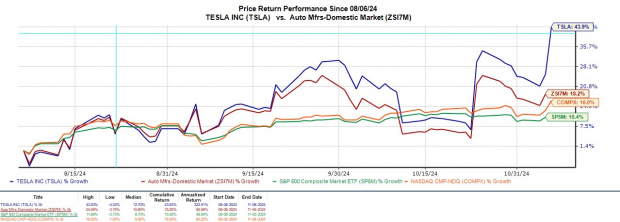

Tesla and the EV Market

Tesla TSLA seems poised for growth with CEO Elon Musk’s close ties to Trump. Musk has generously supported Trump’s campaign with over $100 million and could receive a significant position in the administration focused on efficiency.

Increased tax credits for Tesla and other electric vehicle manufacturers may enhance profitability. Musk may also gain from Trump’s presidency through his ownership stake in SpaceX, a leader in launching satellites.

Tesla shares jumped +15% to a new 52-week high of $289, earning a Zacks Rank #1 (Strong Buy), with analysts raising their earnings outlook for the electric vehicle leader.

Image Source: Zacks Investment Research

Honorable Mention: Trump Media Stock

Details on Trump Media’s performance will be revealed in future trading sessions, although anticipation remains high following his electoral success.

Trump Media’s Speculative Future: A Closer Look at DJT Stock Performance

What You Need to Know About Trump Media & Technology

Trump Media & Technology (DJT) leverages Donald Trump’s political journey and serves as his primary communication outlet through its platform, Truth Social. As the company’s majority shareholder, Trump has a significant stake in its direction.

High Risk, High Reward: The Nature of DJT Stock

Investors should approach this stock with caution as it remains highly volatile. Currently more of a meme stock than a solid investment, Trump Media lacks significant operating revenue and a long history of operations. It also does not possess a Zacks Rank. Nevertheless, DJT saw a +6% increase on Wednesday and has surged over +100% this year, signaling potential amid its risks.

Zacks Identifies Top Semiconductor Stock

While it is just 1/9,000th the size of NVIDIA, which has experienced an impressive increase of over +800% since we first recommended it, this new semiconductor option shows promise for substantial future growth.

Strong earnings and an expanding customer base are setting this stock up to meet the soaring demand for technologies related to Artificial Intelligence, Machine Learning, and the Internet of Things. Predictions indicate that global semiconductor manufacturing will expand from $452 billion in 2021 to $803 billion by 2028.

Want more investment insights? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

Albertsons Companies, Inc. (ACI): Free Stock Analysis Report

Block, Inc. (SQ): Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.