Stocks Stage Comeback

Amidst a sea of red, stocks staged a triumphant turnaround on Thursday, rallying behind chip leader Nvidia’s standout fourth-quarter performance. The feast continued, with the S&P 500 and Dow Jones Industrial Average setting record-high closing figures, fueling hopes of more momentum in this bullish spree. As the week drew to a close, the S&P 500 notched a 1.63% gain, closely followed by the Dow with a respectable 1.14% increase.

The Nasdaq, with all eyes on deck, came within touching distance of its historical peak. A looming question hangs in the air – Can the Nasdaq leap over this major hurdle in the upcoming trading session? The index showed promise as it started the day on an upward trajectory, signaling potential breakthroughs on the horizon.

Economic Crossroads

Interpreting the economic runes, minutes from the recent Fed meeting hinted at a cautious stance on premature interest rate cuts. The majority of officials erred on the side of prudence, wary of loosening the monetary policy too hastily. Treading a fine line, with a resilient job market and robust consumer activity, the Fed shows no urgency to pull the rate-reduction trigger, leading to a mere 2.5% possibility of a slash come March.

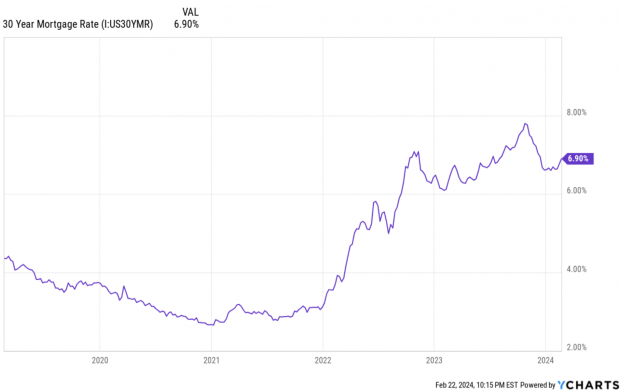

The housing market, meanwhile, presents a mixed canvas. January saw a surge in sales of existing homes, thanks to marginal rate dips. However, whispers of climbing mortgage rates hint at stormy weather ahead. Amidst this seesaw, market pundits anticipate a flurry of activity post-rate reductions, balancing optimism with the looming shadow of economic data.

Building Materials Reach New Heights

Turning away from the tech limelight, the building material and product sector emerges as a prominent player in this year’s market stage. Ranking in the top 22%, the Zacks Building Products – Retail industry group shines in a constellation of industries. Market wizards foresee a brighter future for this segment, fueled by promising valuation metrics and a robust historical performance trend.

Recent months witnessed this sector soar above market expectations:

Leading the charge, GMS, a key player in the sector, rides high on a crest of success. With a dazzling 65% surge last year and a solid earnings trajectory, this Wall Street darling continues its upward trajectory, beckoning investors with a siren song of growth potential.

Fastenal Company, donning the mantle of a Zacks Rank #2 (Buy), unfurls a tale of consistent earnings surprises and a bountiful 40% return over the past year, signifying a prime spot in the sun for investors.

Builders FirstSource shines brightest in the constellation, boasting a robust fourth-quarter earnings report and a stellar 40.6% earnings surprise streak. With a Zacks Rank #1 (Strong Buy) and favorable Style Scores, this star is set to dazzle even the most discerning market-watchers.

Steering Through the Rally

The market’s present momentum hints at a promising trajectory. Amplified by potent sectors like consumer discretionary and technology, the market shows signs of bullish fervor. The rise of building products stocks and homebuilders as key players in the market narrative adds weight to this optimism.

However, caution remains the guiding star in this volatile sea. With many stocks sailing in extended territories, a prudent approach is key. Strategically scaling into positions to offset timing uncertainties emerges as a savvy move in the current market landscape, ensuring smoother sailing through uncertain waters.

As the market shows its teeth, embracing both the feast and famine, investors tread a precarious tightrope, balancing optimism with caution. With a careful eye on the horizon, vigilant investors chart their course amidst the market’s tumultuous waves.

Just Released: Zacks Top 10 Stocks for 2024

Hurried whispers of a stock utopia drift through the market air. Zacks Director of Research, Sheraz Mian, beckons investors with promises of grandeur. Delve into the treasure trove of the Zacks Top 10 Stocks for a chance to unearth hidden gems. Venture forth and seize the opportunity, for the early bird catches the worm!