# Federal Reserve Holds Steady on Interest Rates Amid Changing Market Dynamics

Editor’s Note: On Wednesday, the Federal Open Market Committee (FOMC) decided to keep interest rates unchanged. This decision comes despite recent inflation data indicating a cooling trend.

Many analysts, including my colleague Luke Lango, anticipate a summer rally in the stock market. He has developed a quant tool to assist investors in identifying profitable stocks based on various factors such as rising revenue and analyst attention. This tool, Auspex, simplifies the investment process.

For further insights, Luke will elaborate on this summer rally shortly…

********************

Market Reaction to FOMC Decision

Anticipation was high leading up to the FOMC announcement on Wednesday. Prior to this, I noted in my Daily Notes to subscribers that Fed Chair Jerome Powell’s press conference would be crucial in determining the market’s direction.

Powell’s press conference may clarify the Fed’s stance for June. A dovish tone could lead to a rate cut and boost stock prices, whereas a hawkish approach would likely result in declines.

However, the outcome was far from spectacular. The FOMC opted to maintain its benchmark rate at 4.25% to 4.5%, an expected decision. Powell reiterated a message consistent with past months—avoiding hasty decision-making regarding rate cuts.

Market response mirrored the lackluster announcement, with major indices closing slightly up, indicating no significant gains or losses.

Looking Ahead: Summer Rally Potential

Despite the recent downturn, stocks have shown resilience after one of the swiftest market drops in history. Earlier in April, stocks fell by 10% in just two days. Until last week, they were on track for one of their worst yearly performances, down over 12% in the first 74 trading days.

Remarkably, signs of de-escalation in the global trade war have led to an impressive rally in the market. This momentum build-up suggests that more gains could be on the horizon.

As we transition into May, there are indications that significant trade deals may soon be finalized, particularly with key allies. Such developments would alleviate inflation fears and provide much-needed clarity for the Fed, potentially prompting a rate cut at the June meeting.

By July, further economic measures, including expected tax cuts, could amplify this rally, leading to favorable earnings reports in the second quarter.

Focus on Stock Picking in a Volatile Environment

Current market conditions demand a strategic approach. The landscape is characterized by volatility, making traditional buy-and-hold strategies less effective.

To navigate this complexity, my team has developed a quantitative stock-picking engine designed to identify investment opportunities in this climate. This tool focuses on stocks that are:

- Experiencing growth in earnings, revenues, and profit margins.

- Exhibiting upward trends in both short- and long-term technicals.

- Attracting attention from analysts and traders alike.

The stocks identified through this methodology are among the strongest in the market. We carefully evaluate and select which of those stocks to recommend to subscribers, who stand to benefit in the current and upcoming market conditions.

# Howmet Aerospace and Market Movements: Key Financial Insights

## Consistent Performance Amid Market Volatility

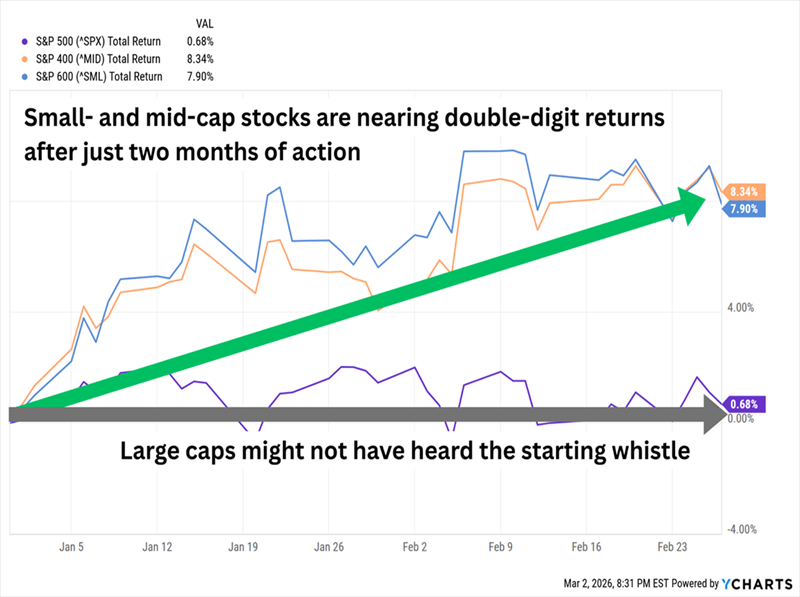

The S&P 500 has shown resilience, often sidestepping major downturns and capitalizing on market rebounds. Notably, between July and December of 2024, while the S&P remained relatively stagnant, investors using certain models could have realized a **24.3% return**.

## Minimal Commitment for Strategic Investing

Utilizing specific investment models does not require extensive research or constant monitoring. Devoting just 30 minutes each month can yield valuable insights and signals for potential trades.

## S&P 500 in April: A Month of Fluctuations

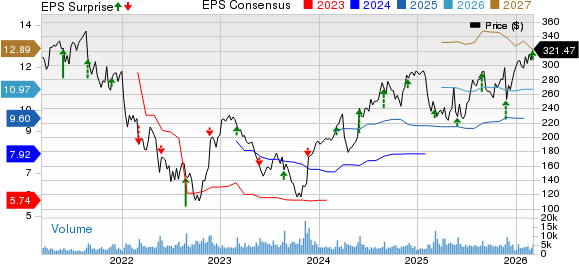

In April, a month notable for its volatility, the S&P 500 briefly entered bear market territory before recovering slightly to finish with nearly a 1% loss. Amid this turbulence, **Howmet Aerospace Inc. (HWM)** stood out, achieving a **13.4% gain** during the same period.

## Performance Highlights in May

Our proprietary stock screener re-selected Howmet Aerospace early this month, and the results have been impressive, with HWM shares up **6.2%** so far in May, making it the top performer in our portfolio. In comparison, the S&P 500 has only risen by less than 2%.

## Testing the Tool: Live Results

In June 2024, we began using this tool in real-time across 10 monthly portfolios. The performance data shows that, in six of those months, our model outperformed the market and tied it once.

## Exploring Further: A Unique Opportunity

To demonstrate the capabilities of this stock screener, I have participated in an event providing an in-depth look at how this tool operates. The event is free for viewers.

For more details, you can access the event here.

Sincerely,

Luke Lango

Senior Analyst