Dow and S&P 500 Extend Gains Despite Weak Economic Data

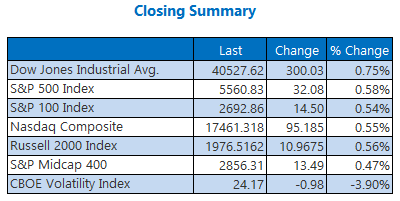

Both the Dow and S&P 500 recorded a sixth straight gain, marking their longest uptrends since July and September, respectively. This achievement comes despite disappointing confidence data, which fell to its lowest point in nearly five years, largely due to concerns over jobs and tariffs.

Tomorrow, the “Magnificent Seven” are slated to begin their earnings reports. Today, however, several other prominent blue-chip companies provided updates, sparking interest among investors. Additionally, drama surrounding Amazon.com (AMZN) surfaced as they may introduce tariff surcharges on products, leading to a tense response from the White House.

Continue reading for more on today’s market, including:

- 2 fintechs seeing a post-earnings surge.

- Why this healthcare stock withstood a bear note.

- A preview of Roku’s earnings; highlighting a silver lining; and the blunder concerning SPOT’s earnings.

5 Things to Know Today

- United Airlines (UAL) is potentially the last contender for the elusive JetBlue (JBLU) partnership. (CNBC)

- The Canadian Liberal Party secured a fourth consecutive election victory, appointing Mark Carney as Prime Minister. (Bloomberg)

- Roku’s stock is on a winning streak ahead of its upcoming earnings.

- Last week, stocks exhibited quiet strength, a potentially positive signal.

- Mixed quarterly results have pushed Spotify’s stock lower.

Crude Prices Decline to Two-Week Low

Crude oil prices fell, dipping to a two-week low. June-dated West Texas Intermediate (WTI) crude dropped by $1.63, or 2.6%, closing at $60.42 per barrel.

This decrease in crude prices coincided with a decline in gold prices due to easing trade tensions. June-dated gold fell by 1.1%, settling around $3,310.20 per ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.