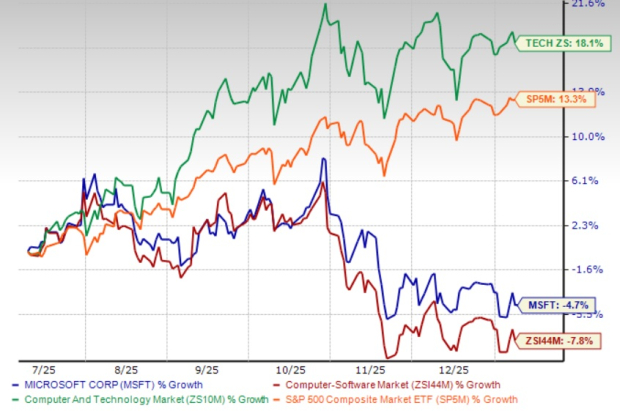

On Thursday, the S&P 500 Index closed up 0.01%, the Dow Jones rose 0.55%, and the Nasdaq 100 fell 0.57% amid mixed market performance. Notably, March E-mini S&P futures increased by 0.01%, while March E-mini Nasdaq futures declined by 0.57%. A rotation out of AI-related stocks into small caps, compounded by weakness in chipmakers and software firms, contributed to this mixed performance.

Key economic indicators showed labor market strength: US December Challenger job cuts dropped to 35,553, a 17-month low, while weekly initial unemployment claims rose by 8,000 to 208,000, below the expected 212,000. Additionally, Q3 nonfarm productivity rose by 4.9%, slightly below expectations, while unit labor costs fell 1.9%, exceeding projections. The US trade deficit unexpectedly shrank to $29.4 billion, the smallest in 16 years.

Looking ahead, December nonfarm payrolls are anticipated to increase by 70,000, while the unemployment rate is expected to dip to 4.5%. Market participants are currently assigning a 12% probability of a 25 basis point rate cut at the Federal Reserve’s next meeting on January 27-28.