AMD’s Market Position Amid Competitive Semiconductor Landscape

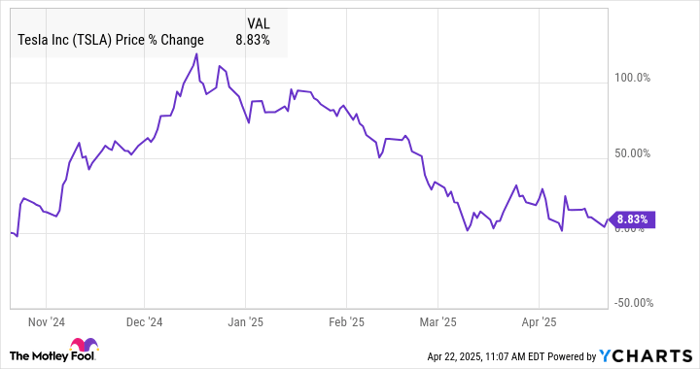

While competing with a major rival may not be the most appealing scenario, Advanced Micro Devices Inc. AMD capitalizes on this situation. The semiconductor industry often finds itself in the spotlight due to the success of Nvidia Corp. NVDA, known for its superior graphics processors and advanced technology. Despite the competition, AMD continues to offer its own innovative solutions.

For investors seeking a potential bargain, AMD presents an attractive option. While Nvidia’s stock trades at over 20 times last year’s sales, AMD’s revenue multiple stands at approximately six times. Although this figure is not necessarily an indicator of the lowest valuation, investors seeking semiconductor exposure may find better value with AMD.

Investor Sentiment and Market Transactions

Investor confidence in AMD is further evidenced by recent trading activity. Analysts have options opinions, but substantial trades demonstrate commitment. According to Benzinga’s options scanner, there has been noticeable bullish activity, predominantly in the form of long-expiry call options.

These trades are classified as debit-based transactions, indicating that traders expect specific outcomes to materialize by the option contract’s expiration. This type of activity implies a strong sense of confidence regarding AMD’s potential performance.

Geopolitical Concerns Affecting AMD

Despite the positive outlook, challenges remain. Political uncertainties threaten AMD as U.S. governmental restrictions on AI chip exports to China and other regions loom. Although President Donald Trump has shown a willingness to negotiate, relations with Beijing remain tense.

Some investors view the current undervaluation of AMD stock as a buying opportunity. However, the unpredictability of tariff exemptions and negotiations creates added anxiety in the market.

Exploring Direxion ETFs

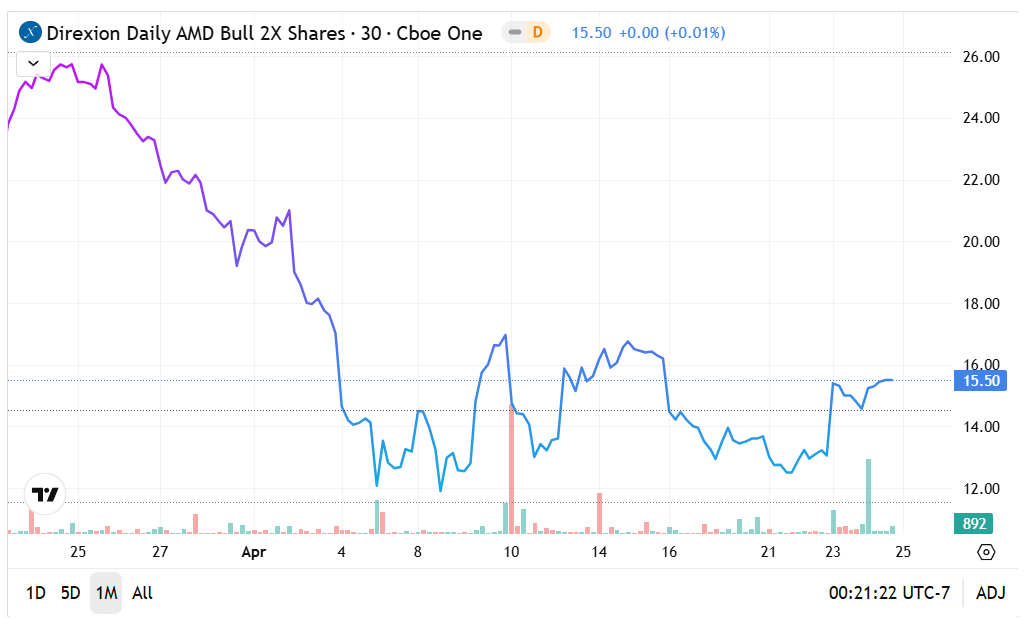

In the midst of market volatility, financial services provider Direxion offers opportunities through its exchange-traded funds (ETFs). Earlier this year, the firm launched two new funds focused on AMD: the Direxion Daily AMD Bull 2X Shares AMUU and the Direxion Daily AMD Bear 1X Shares AMDD.

These specialized funds offer investors convenience. The AMUU ETF aims for daily investment returns of 200% of AMD stock, while the AMDD seeks to deliver 100% of the inverse performance. Unlike options, ETF shares can be traded like any other public security.

However, it is vital for participants to be aware that Direxion’s leveraged and inverse funds are meant for short-term speculation. Investors should expect high volatility and are advised to avoid holding positions beyond a single day to prevent value loss due to compounding volatility effects.

Performance of AMUU and AMDD ETFs

Due to the tumultuous landscape in the tech sector this year, the AMUU ETF has experienced a challenging start, declining 38% since its introduction.

- Before the steep drop occurred in April, the AMUU ETF attempted to establish a support level around $18.50, which could be seen as a potential rebound target.

- Recently, the bulls seem to be gaining momentum, influenced by the Trump administration’s diplomatic overtures towards China.

In contrast, the AMDD ETF has benefitted marginally from the downturn in tech but has gained only 6% since its launch.

- During its peak performance, the inverse AMD fund temporarily surpassed the $34 mark, indicating brief investor interest which has since diminished.

- Currently, AMDD is trading within a narrow range, as investors await new catalysts that might influence market direction.

Featured image by Chris from Pixabay.