Market Fear Suggests Potential Upswing for Savvy Investors

The stock market is facing significant downturns currently. However, a contrarian indicator points to the possibility that stocks could be nearing a major bottom—before potentially rebounding by about 30% over the next year.

Warren Buffett famously advised, “Be greedy when others are fearful.” This sentiment seems particularly relevant now.

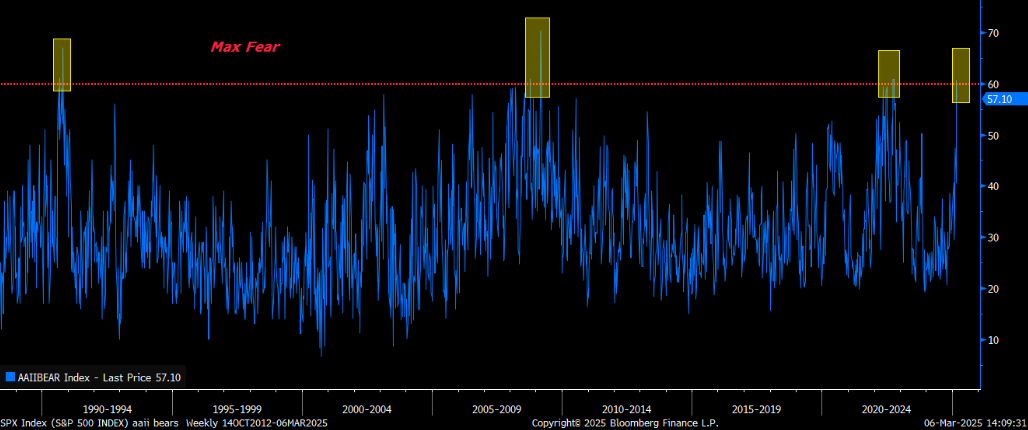

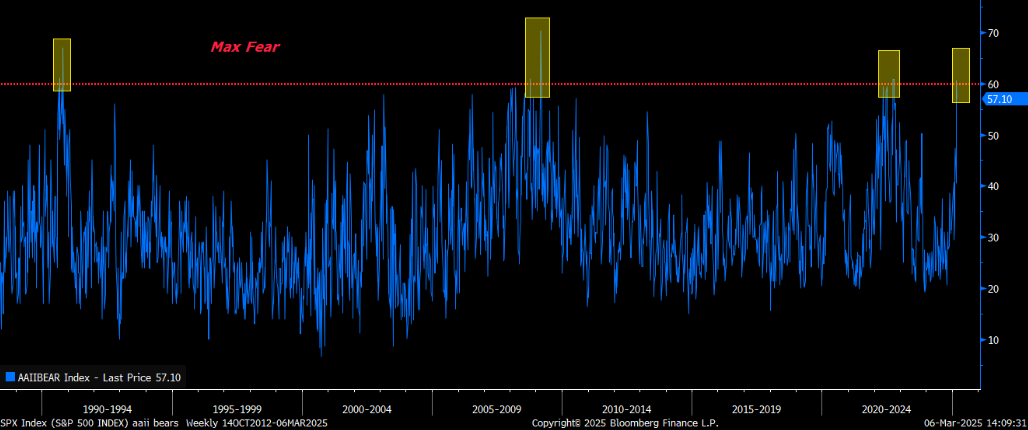

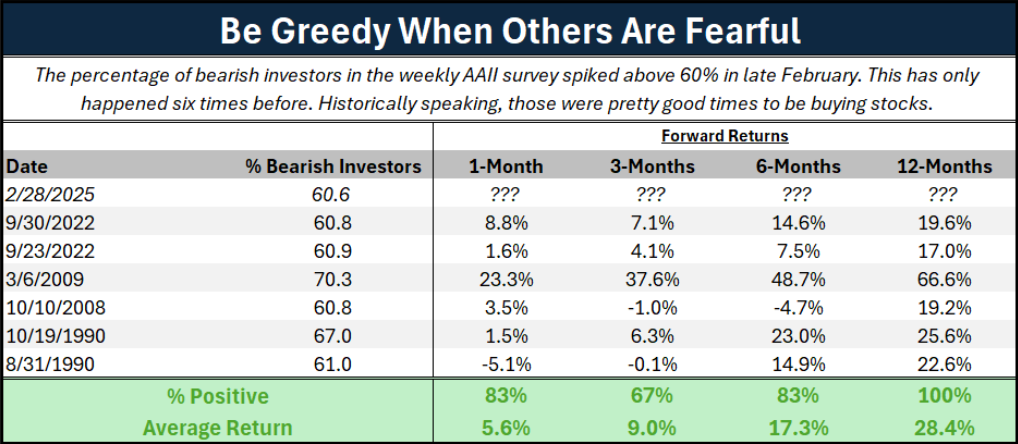

Investor fear is palpable. Recent data from the American Association of Individual Investors (AAII) shows that approximately 60% of individual investors are bearish about the market.

To understand the significance of this figure, it’s essential to note that the AAII has conducted this survey since the late 1980s. Historically, the percentage of bearish investors has only exceeded 60% on six prior occasions. We observed such spikes twice at the end of 1990, during both phases of the 2008 financial crisis, and again during the challenges of 2022’s inflation surge.

Historically negative investor sentiment is prevalent at this moment.

Who can blame the investors for their fear?

Currently, the global trade environment is experiencing severe disruptions, with the largest trade war seen in nearly a century. Last month, job layoffs surged to their highest level since July 2020, marking an increase of 245% to 172,017 announcements. The University of Michigan’s survey indicates a -9.8% decline in consumer sentiment since January. Furthermore, impending federal spending cuts are putting additional pressure on the job market. One estimated forecast for U.S. GDP growth has dramatically dropped from +2.3% to -2.8% in just one quarter.

Given these circumstances, it is understandable why investors are feeling pessimistic.

Yet, history indicates that periods of investor bearishness often present buying opportunities for stocks.

Understanding Bearishness as a Contrarian Indicator

In late 1990, when AAII reported bearish investor sentiment above 60%, the stock market was nearing the end of a significant downturn. Between mid-July and mid-October, the S&P 500 experienced a decline of about 18%. Subsequently, the index rebounded, rising more than 20% in the following year.

Similarly, in late 2008 and early 2009, another increase in bearish investor sentiment above 60% occurred. At that juncture, the stock market faced its final phases of decline. Stocks plummeted roughly 30% between mid-October and mid-March, but then they soared over 60% higher within the next 12 months.

Again, in late 2022, the AAII survey recorded a spike in bearish investors exceeding 60%. This coincided with another downturn, where stocks fell over 16% from mid-August to the end of September. Remarkably, the market then rebounded, gaining about 20% over the subsequent year.

Each instance when investor sentiment matched today’s negativity indicated that stocks were in the process of bottoming after a decline, followed by significant gains in the year ahead.

The average returns over the next 12 months were nearly 30%!

Final Thoughts

While historical data provides a compelling perspective, it does not guarantee that stocks will rise over the next year.

However, these trends suggest that the current climate of fear may just signal an opportune time for careful investors to consider their positions.

Market Watch: Potential Rebound at S&P 500’s Key Support Level

Current market trends present an intriguing opportunity for investors, particularly as the S&P 500 hovers near its 200-day moving average, a critical support level. Following the wisdom of Warren Buffett, now may be the time to adopt a greedy stance as others exhibit fear.

S&P 500 at a Crossroads

The S&P 500 is currently positioned around its decisive support level. A bounce back from this point may indicate a strong buy signal for traders. Observing such market behavior could be a pivotal moment for those looking to capitalize on a potential recovery.

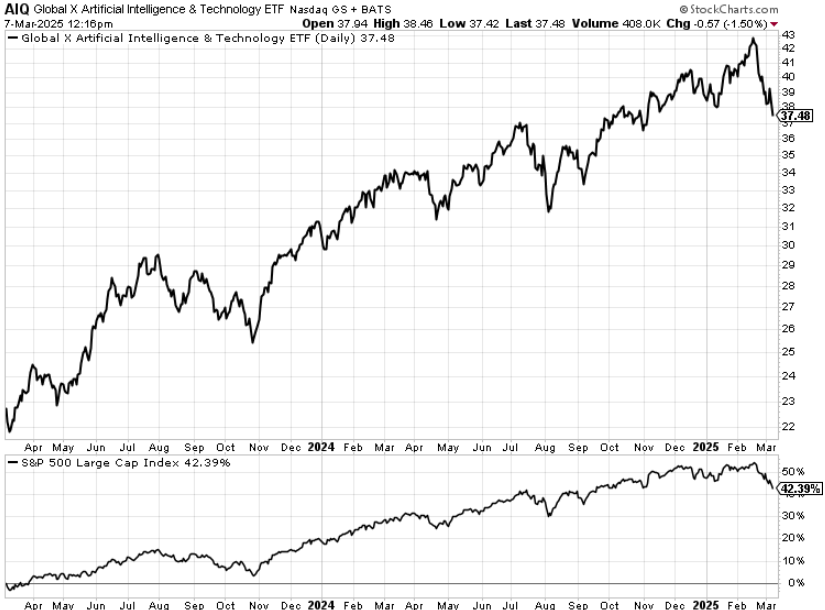

AI Stocks Show Steady Growth

Investors should consider steering their focus toward artificial intelligence stocks, which have demonstrated consistent growth over the past two years. The Global X Artificial Intelligence and Technology ETF (AIQ) represents a solid benchmark for the sector, having surged more than 40% from March 2023 to the present.

Sector Growth Looks Promising

We anticipate continued robust growth in the artificial intelligence sector, making it a compelling area for investment. However, there are specific stocks within this category that may present even greater opportunities for significant returns.

Discover more about these promising stocks before they gain momentum.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the mentioned securities.

P.S. To stay updated with Luke’s latest market insights, read our Daily Notes! You can access the newest issues on your Innovation Investor and Early Stage Investor subscriber sites.