U.S. Stock Markets Decline Amid Economic Concerns and Tariff Pressures

The S&P 500 Index ($SPX) (SPY) today is down -1.50%, the Dow Jones Industrial Average ($DOWI) (DIA) has decreased by -0.65%, and the Nasdaq 100 Index ($IUXX) (QQQ) is lower by -2.19%. March E-mini S&P futures (ESH25) are down -1.50%, and March E-mini Nasdaq futures (NQH25) are down -2.18%.

Today, stock indexes are retreating, as the Nasdaq 100 hits a 5-1/4 month low. Concerns that recent tariffs and potential cuts to the federal workforce could dampen consumer confidence and hinder economic growth are driving this decline. Additionally, comments from President Trump on a Sunday news show further pressured stocks when he indicated the U.S. economy is entering “a period of transition” from his tariff policies. Losses among the Magnificent Seven stocks are also influencing the overall market.

The Impact of Tariffs on Market Sentiment

Concerns that U.S. tariffs could trigger a global trade war, weakening economic growth and corporate earnings, are weighing heavily on stock performance. Last Tuesday, President Trump imposed a 25% tariff on goods from Canada and Mexico while increasing tariffs on Chinese goods from 10% to 20%. Nonetheless, he temporarily exempted U.S. automakers and goods compliant with the United States-Mexico-Canada Agreement (USMCA), promising further reciprocal tariffs starting April 2.

Weakness in China’s economy is becoming apparent, contributing to declining prices and diminishing global growth prospects, shown by February’s Consumer Price Index (CPI), which fell -0.7% year-over-year, exceeding expectations of -0.4% year-over-year, marking the largest drop in 13 months. Additionally, January’s Producer Price Index (PPI) also fell short of expectations, declining -2.2% year-over-year versus an anticipated -2.1% year-over-year.

Focus on Upcoming Economic Reports

The price of Bitcoin (^BTCUSD) fell over -4% to a one-week low, stemming from disappointment regarding President Trump’s order to establish a strategic Bitcoin reserve and an inventory of other digital assets for crypto seized in legal actions.

This week, markets will closely monitor Wednesday’s U.S. CPI report, which is expected to ease slightly to +2.9% year-over-year from +3.0% in January. The core CPI is anticipated to fall to +3.2% from +3.3%. Market participants will also be attentive to trade policy developments, with 25% tariffs on steel and aluminum imports slated to take effect Wednesday. The final February PPI report is anticipated to drop to +3.2% year-over-year from +3.5% in January. Lastly, the University of Michigan’s March consumer sentiment index is projected to decline -1.2 to 63.5, and Congress must act on a spending bill to prevent a government shutdown before the March 15 deadline.

The markets are currently pricing in a 4% probability of a -25 basis point rate cut at the upcoming FOMC meeting on March 18-19.

Overseas Markets: Mixed Results

International stock markets are showing mixed results today. The Euro Stoxx 50 is down -1.14%. China’s Shanghai Composite Index finished lower by -0.19%. Meanwhile, Japan’s Nikkei 225 rebounded from a 5-1/2 month low, finishing the day up +0.38%.

Interest Rates and Bond Markets

June 10-year T-notes (ZNM25) are up +18 ticks, with the 10-year T-note yield down -7.1 basis points to 4.231%. The rise in T-notes can be attributed to increased safe-haven demand following declines in equity markets. European government bonds have also supported T-notes. However, gains may be capped due to upcoming Treasury auctions totaling $119 billion this week, starting with a $58 billion auction of 3-year T-notes on Tuesday.

European bond yields are trending downward, with the 10-year German bund yield falling -4.1 basis points to 2.795%, and the 10-year UK gilt yield decreasing -2.5 basis points to 4.612%.

The Eurozone’s March Sentix investor confidence index increased by +9.8 points to -2.9, surpassing expectations of -9.3.

Germany’s January industrial production increased by +2.0% month-over-month, exceeding projections of +1.5% and marking the largest rise in five months. However, German trade data was mixed, with January exports unexpectedly declining by -2.5% month-over-month against expectations of +0.5%. Conversely, imports rose +1.2% month-over-month, outpacing expectations of +0.5%.

ECB Governing Council member Kazimir emphasized the need for vigilance, noting rising inflation risks. Swaps currently imply a 49% chance for a -25 basis point rate cut by the ECB at the April 17 policy meeting.

Stock Movers in the U.S. Market

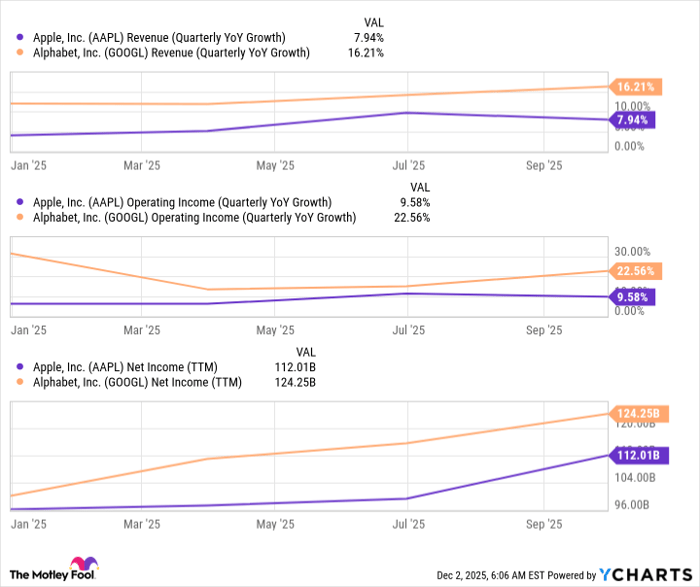

The downturn among the Magnificent Seven stocks is impacting the wider market. Tesla (TSLA) has decreased by more than -5%, and Alphabet (GOOGL) is down over -4%. Additionally, Nvidia (NVDA) and Apple (AAPL) each fell by more than -2%, while Amazon.com (AMZN), Microsoft (MSFT), and Meta Platforms (META) are down more than -1%.

Travel stocks and cruise line operators are experiencing losses due to economic concerns. United Airlines Holdings (UAL) leads the S&P 500 as it declines more than -7%, followed closely by Carnival (CCL) down more than -6%. Delta Air Lines (DAL) and Norwegian Cruise Line Holdings (NCLH) each fell by over -5%, while Royal Caribbean Cruises Ltd (RCL) is down more than -4%.

Stocks sensitive to cryptocurrency are also falling, as Bitcoin holds steady at a one-week low. Consequently, shares of Coinbase Global (COIN), MicroStrategy (MSTR), MARA Holdings (MARA), and Riot Platforms (RIOT) are down more than -4%.

Rocket Companies (RKT) has taken a more significant hit, dropping over -10% after announcing its acquisition of Redfin in an all-stock transaction valued at $1.75 billion.

Emerson Electric (EMR) is down more than -3% due to a downgrade from Barclays, which reduced its rating to underweight from equal weight with a price target of $110.

Sherwin-Williams Co (SHW) has declined more than -1% after Jeffries downgraded its recommendation to hold from buy.

Host Hotels & Resorts (HST) is also down over -1% following a downgrade from Compass Point Research & Trading LLC, which shifted its rating to neutral from buy.

Conversely, defensive food and beverage stocks saw gains amidst the market’s broader weakness. Molson Coors Beverage (TAP), Conagra Brands (CAG), and Campbell Soup Company (CPB) rose more than +2%. Additionally, PepsiCo (PEP), Hormel Foods (HRL), Kraft Heinz (KHC), Mondelez International (MDLZ), and Keurig Dr Pepper (KDP) each increased over +1%.

Leading the S&P 500 gainers, Paycom Software (PAYC) rose more than +4% after KeyBanc Capital Markets upgraded it to overweight from sector weight, setting a price target of $245. Similarly, Cognizant Technology Solutions (CTSH) advanced over +1% following a Wall Street Journal report on Mantle Ridge’s $1 billion stake in the company. CME Group (CME) also increased by +1% after Raymond James upgraded it to outperform from market perform with a price target of $287.

Williams-Sonoma (WSM) saw a gain of over +1% after S&P Dow Jones Indices announced it will replace Teleflex in the S&P 500 before trading on March 24.

Earnings Reports (3/10/2025)

Upcoming earnings reports include Oracle Corp (ORCL), Seaport Entertainment Group Inc (SEG), Standardaero Inc (SARO), and Vail Resorts Inc (MTN).

On the date of publication, Rich Asplund did not hold any positions in the securities mentioned in this article. All information and data within this article are strictly for informational purposes. For additional details, please refer to the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.