“`html

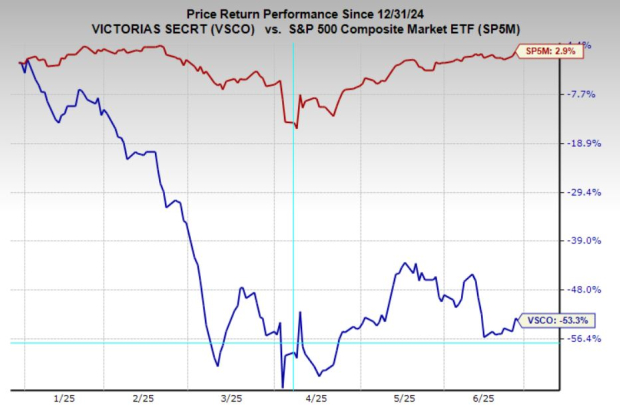

Victoria’s Secret (VSCO) is facing significant challenges as recent analyst downgrades reflect a sharp decline in earnings estimates and overall confidence in the company’s performance. Year-to-date, the stock has dropped considerably, and it currently holds a Zacks Rank #5 (Strong Sell), indicating deteriorating fundamentals.

Over the last two months, earnings estimates for the current quarter have plummeted by 62%, with full-year estimates falling by 12.2% and 13.1% for this year and next, respectively. Annual sales have also decreased from $6.7 billion in 2022 to $6.2 billion in the trailing twelve months, with flat sales anticipated through at least next year.

Given the stagnant revenue, shrinking margins, and intense competition from more agile brands, it is advisable for investors to avoid Victoria’s Secret stock until there are signs of a turnaround or improvement in its outlook.

“`