Market Volatility: Nasdaq 100 Signals Potential Turnaround

The stock market is currently experiencing significant disruptions.

This week, both the S&P 500 and Nasdaq dipped below their 200-day moving averages, which could indicate an impending market trend reversal.

Concerns about the current administration’s policy changes, including federal spending cuts, tariffs, and deportations, are fueling fears of a recession in the U.S. economy.

These concerns are valid. The likelihood of a recession and a bear market is increasing. Therefore, exercising caution is appropriate given these risks.

However, we believe the potential for economic recovery and a stock market rebound remains more favorable. Stocks may be on the verge of a bounce.

Self-Inflicted Challenges in the Stock Market

Only a few months ago, the economic outlook was robust.

Unemployment was low, job creation was strong, consumer spending was resilient, and real wage growth remained positive. Inflation was decreasing, interest rates were falling, and corporate earnings continued to rise.

Even though many positive indicators still hold true, investors worry that President Trump’s policy adjustments could reverse those economic gains.

Such reversals would stem from self-inflicted challenges. The good news is that self-inflicted wounds can often be stopped.

For instance, tariffs and broad federal budget cuts can be halted. It appears the current administration is beginning to roll back, or at least slow down, some of these policies.

President Trump has twice postponed tariffs impacting Mexico and Canada and has granted exemptions to sectors such as the automobile industry. He also indicated that future government job cuts will be carried out with a “scalpel,” rather than a “hatchet,” suggesting a more surgical approach.

Signs suggest a shift in the White House’s approach, moving to less radical changes. This trend could alleviate Wall Street’s recession fears over the coming months.

For these reasons, we contend that the chances of economic recovery here are significantly more favorable than a meltdown.

That said, we also recognize that we are not more astute than the market itself; we must heed its signals regarding future economic and stock movements. Our technical analysis indicates substantial market insights may emerge in the next two weeks.

Critical Focus: The Nasdaq 100

Currently, we are closely monitoring the Nasdaq 100.

This index holds particular significance, even more than the S&P 500, as it includes the world’s top 100 tech companies. Given the prominence of technology in today’s economy, these companies wield considerable influence.

This week, as previously mentioned, the Nasdaq 100 closed below its 200-day moving average for the first time in over a year, indicating a potential major market trend shift.

This has only occurred 11 times since 1990, signaling a possible market turning point.

In every one of those instances, the stock market was positioned for either a significant rebound or breakdown—determined entirely by the performance of stocks over the following two weeks.

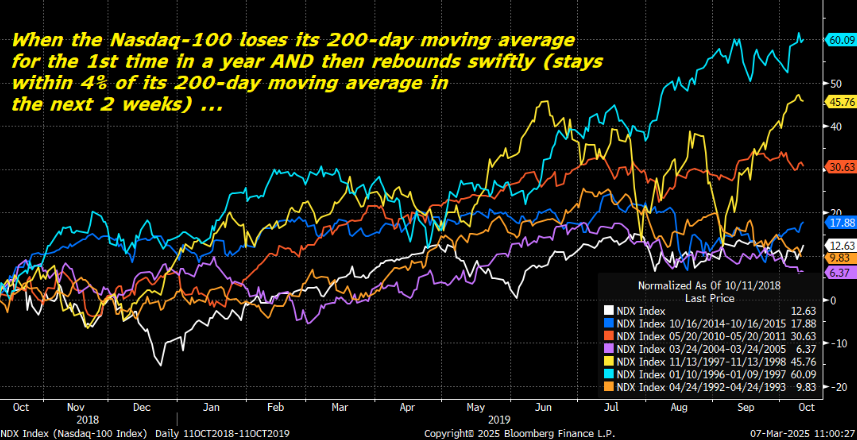

If the Nasdaq 100 demonstrates strong resilience and remains within 4% of its 200-day moving average during this time, historical trends suggest a rebound is likely within 12 months, often with average gains exceeding 25%.

Such occurrences have taken place in early 1992, early 1996, late 1997, early 2004, mid-2010, late 2014, and late 2018.

Nonetheless, the end result isn’t guaranteed to be positive…

A Pivotal Moment for the Stock Market

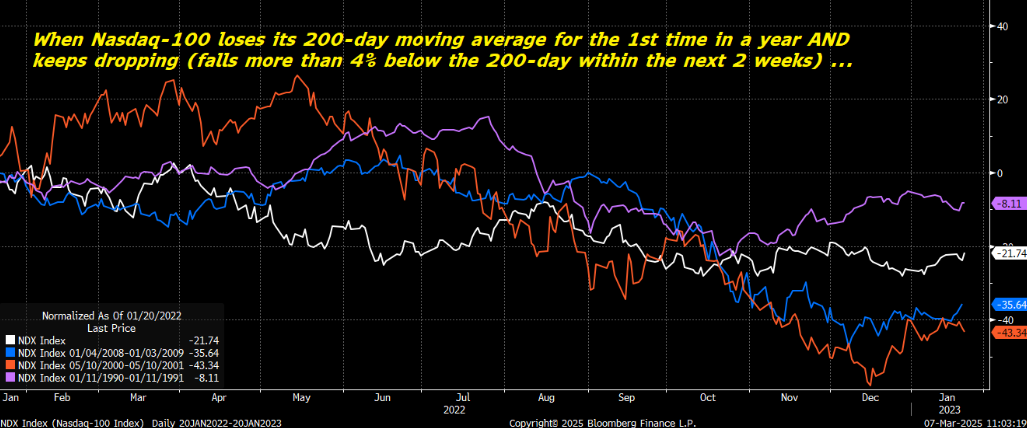

Historically, if the Nasdaq 100 does not maintain strong defensive measures and falls more than 4% below its 200-day moving average over the subsequent two weeks, stocks tend to enter a bear market.

Notably, this pattern has been observed in early 1990 (leading up to the recession of the 1990s), mid-2000 (prior to the dot-com crash), early 2008 (before the 2008 financial crisis), and early 2022 (leading to the inflation crisis).

Market at Critical Juncture: Stocks Could Either Rally or Plummet

According to technical analysis, the stock market finds itself at a pivotal moment. The next two weeks will be critical in determining whether stocks will experience a significant rally or face a downturn in the coming year.

If the Nasdaq 100 (NDX) can maintain strong support, remaining within 4% of its 200-day moving average during this period, we can expect positive momentum in the markets. Currently, the NDX stands approximately 2% below this moving average.

On the contrary, should the NDX break down from this level, a market decline is likely. Given these factors, I believe it is a favorable time to consider buying stocks.

Outlook on Economic Recovery

We assess the likelihood of an economic recovery as significantly outweighing the potential for a recession. Moreover, we believe that the Nasdaq 100 has a greater chance of remaining within 4% of its 200-day moving average than of significantly falling below it.

Consequently, we believe it is more probable that stocks will rise over the next year, presenting an opportune moment for investors to take action.

So, why delay your investments?

If our optimistic outlook is incorrect, we will have a clear indication within two weeks, allowing us to modify our positions as necessary—potentially including hedging strategies for protection.

However, for the time being, we suggest adopting an aggressive investment stance.

It’s time to buy the dip.

Investing in AI Stocks

Buying AI stocks is key—specifically targeting those capable of transforming the economy. The emergence of new AI technologies is expected to lead to widespread job displacement, which is already underway.

Companies such as Meta, Amazon, Salesforce, Microsoft, Intuit, Duolingo, Workday, Intel, Dell, Best Buy, Chevron, AMD, Klarna, Cisco, and Activision Blizzard have either recently announced or are currently implementing layoffs partially attributed to AI developments.

This technological advancement poses a risk to jobs. As AI systems become increasingly sophisticated, the danger to employment will intensify.

Thus, investing in AI stocks is not merely a strategy for potential profit but also a means to protect one’s wealth against the impending challenges of the evolving job landscape.

To further explore the implications of AI on the economy, markets, and individual finances, I have created a new presentation. This presentation acts as a comprehensive guide to navigating the upcoming AI-driven era—rich with valuable insights tailored for investors.

Be sure to watch that new video now.

On the date of publication, Luke Lango did not possess (either directly or indirectly) any positions in the companies mentioned in this article.

P.S. Stay informed with Luke’s latest market insights by checking our Daily Notes! Access the most recent updates on your Innovation Investor or Early Stage Investor subscriber site.