Major Indices Plummet as Fed Independence Faces New Threats

The S&P 500 Index ($SPX) (SPY) closed down -2.36% on Monday, following suit were the Dow Jones Industrial Index ($DOWI) (DIA) down -2.48% and the Nasdaq 100 Index ($IUXX) (QQQ) down -2.46%. June E-mini S&P futures (ESM25) and June E-mini Nasdaq futures (NQM25) also fell, down -2.42% and -2.47% respectively.

On Monday, stock indexes tumbled, with the S&P 500, the Dow Jones, and the Nasdaq reaching 1-1/2 week lows. The sell-off came amid growing uncertainties regarding the Federal Reserve’s independence as President Trump contemplated firing Fed Chair Powell. Recently, selling intensified following comments made by National Economic Council Director Hassett, indicating that Trump has been considering Powell’s removal due to his interest rate decisions. This anxiety contributed to the dollar’s decline to a three-year low while gold prices surged to a new record high. The uncertainty regarding Powell’s position eroded confidence in the dollar, leading to potential sell-offs by foreign investors in dollar assets, which include stocks and Treasuries.

Negative US economic news added to the market’s woes as March leading indicators dropped -0.7% month-over-month, worse than the anticipated -0.5% decline, marking the largest drop in 17 months.

In contrast to the stock market, Bitcoin (^BTCUSD) rose over +3% to a 3-1/2 week high. This gain is attributed to the dollar’s slump, increasing demand for cryptocurrencies amid concerns about the Fed’s independence. The market now discounts a 16% chance of a -25 basis point rate cut after the May 6-7 FOMC meeting.

Upcoming Economic Data and Earnings Reports

This week’s market attention will center on Q1 corporate earnings reports and potential shifts in US trade policies. On Wednesday, March new home sales are forecast to rise by +0.7% month-over-month to 681,000 units, alongside the release of the Fed Beige Book. Then, on Thursday, new orders for capital goods (excluding defense and aircraft) are expected to grow by +0.1% month-over-month. Existing home sales are predicted to decline -2.8% month-over-month to 4.14 million. Lastly, Friday will see the revised University of Michigan April consumer sentiment index, which is expected to remain unchanged at 50.8.

The Q1 earnings season is currently underway. According to Bloomberg Intelligence, consensus estimates predict a +6.7% year-over-year earnings growth for S&P 500 companies, down from an earlier estimate of +11.1% in November. For the full year 2025, corporate profits are expected to increase by +9.4%, a revision from the +12.5% forecast made in January.

International Markets React Mixed

Overseas, stock markets on Monday exhibited mixed results. The Euro Stoxx 50 remained closed due to Easter Monday. However, China’s Shanghai Composite gained +0.45%, reaching a two-week high, while Japan’s Nikkei 225 dropped -1.30%.

In trade policy news, President Trump recently announced several tariff-related decisions. On April 4, he temporarily exempted consumer electronics from reciprocal tariffs but retained a 20% tariff on electronics from China. Following this, on April 9, he declared a 90-day halt on higher reciprocal tariffs affecting 56 nations while upholding the new 10% baseline tariff on most nations. The EU also announced on April 10 a 90-day delay on implementing 25% tariffs on $21 billion worth of US goods, while tensions with China escalated after the US barred Nvidia from selling chips to China and China retaliated by raising tariffs on US goods to 125% from 84%.

Interest Rates and Treasury Performance

In the bond market, June 10-year T-notes (ZNM25) closed down -11.5 ticks, while the 10-year T-note yield rose by +8.4 basis points to 4.409%. Concerns over President Trump potentially seeking to remove Fed Chair Powell influenced a bearish sentiment in T-notes, leading to diminished confidence in the dollar and prompting foreign selling of dollar assets, including Treasuries. This week, the Treasury is set to auction $213 billion in T-notes and floating-rate notes, starting with $69 billion in 2-year T-notes on Tuesday. Some safe-haven buying of Treasuries was noted after the stock downturn.

European government bonds did not trade on Monday, with markets closed. The previous Thursday saw the 10-year German bund yield decline to a 1-1/2 week low of 2.452%, finishing down -3.7 basis points at 2.472%. Similarly, the yields on the 10-year UK gilt dropped to a 1-1/2 week low at 4.547% before closing down -3.7 basis points at 4.566%.

ECB Governing Council member Muller cautioned that US trade tariffs and increased public spending in Germany might heighten inflation pressures. Market swaps are pricing in a 92% probability of a -25 basis point rate cut at the ECB’s upcoming June 5 meeting.

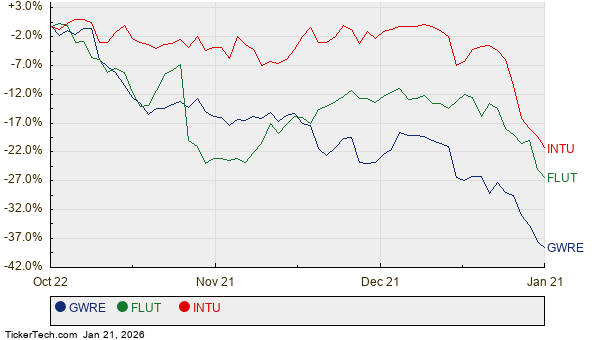

Stock Movers and Market Impact

The “Magnificent Seven” stocks faced significant pressure, impacting the broader market negatively on Monday. Tesla (TSLA) dropped more than -5%, while Nvidia (NVDA) fell over -4%. Other notable declines included Amazon.com (AMZN) and Meta Platforms (META) each down more than -3%, with Alphabet (GOOGL) and Microsoft (MSFT) down over -2%, and Apple (AAPL) down -1%.

Chip stocks also contributed to the market’s downturn, with Marvell Technology (MRVL) closing down more than -4% and ARM Holdings Plc (ARM) down more than -3%. Additional declines were noted for Advanced Micro Devices (AMD), Broadcom (AVGO), Micron Technology (MU), ASML Holding NV (ASML), and others.

Health insurance stocks continued their decline, led by UnitedHealth Group’s recent cut to its full-year earnings outlook. United Health Services (UHS) plummeted over -10%, and Humana (HUM) and Molina Healthcare (MOH) each fell more than -6%. Furthermore, UnitedHealth Group (UNH) lost over -5%, and HCA Healthcare (HCA) also experienced substantial drops.

Market Update: Major Stocks Decline with Notable Exceptions

Several major stocks experienced significant declines on Monday. Elevance Health (ELV) and Centene (CNC) both saw their shares fall by more than -4%. Meanwhile, CVS Health (CVS) and Cardinal Health (CAH) ended the day down more than -3%.

Energy stocks also fell in response to the drop in the price of WTI crude, which sank more than -2%. As a result, APA Corp (APA) and Diamondback Energy (FANG) posted notable declines of over -4%. In addition, Devon Energy (DVN), Chevron (CVX), and Baker Hughes (BKR) all closed down more than -3%, while Halliburton (HAL) and Phillips 66 (PSX) declined more than -2%.

Salesforce (CRM) dropped more than -4% after D.A. Davidson downgraded the company’s stock to underperform from neutral, setting a price target of $200.

On the other hand, Discover Financial Services (DFS) rose by over +3%, leading gains in the S&P 500 after U.S. regulators approved Capital One Financial’s acquisition of Discover.

Gold-mining stocks saw an uptick, with AngloGold Ashanti Plc (AU) rising more than +2% as gold prices soared to a new all-time high.

Fidelity National Information (FIS) gained more than +2% following an upgrade from TD Cowen, which moved the stock rating from hold to buy with a price target of $92.

Netflix (NFLX) increased by more than +1% after posting Q2 revenues of $11.04 billion, exceeding consensus expectations of $10.88 billion.

Upcoming Earnings Reports (4/22/2025)

Several companies are scheduled to report earnings, including 3M Co (MMM), Baker Hughes Co (BKR), Capital One Financial Corp (COF), Chubb Ltd (CB), Danaher Corp (DHR), Elevance Health Inc (ELV), Enphase Energy Inc (ENPH), EQT Corp (EQT), Equifax Inc (EFX), General Electric Co (GE), Genuine Parts Co (GPC), Halliburton Co (HAL), Intuitive Surgical Inc (ISRG), Invesco Ltd (IVZ), Kimberly-Clark Corp (KMB), Lockheed Martin Corp (LMT), Moody’s Corp (MCO), MSCI Inc (MSCI), Northern Trust Corp (NTRS), Northrop Grumman Corp (NOC), NVR Inc (NVR), Packaging Corp of America (PKG), Pentair PLC (PNR), PulteGroup Inc (PHM), Quest Diagnostics Inc (DGX), RTX Corp (RTX), Steel Dynamics Inc (STLD), Synchrony Financial (SYF), Tesla Inc (TSLA), and Verizon Communications Inc (VZ).

On the date of publication, Rich Asplund did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are provided solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.