Warren Buffett’s Strategy: Evaluating Lantheus with RSI Insights

Legendary investor Warren Buffett famously advises caution when the market is greedy and encourages boldness when there is fear. A valuable tool for measuring market sentiment is the Relative Strength Index (RSI), a technical analysis indicator that gauges momentum on a scale from zero to 100. A stock is deemed oversold when its RSI drops below 30.

Lantheus Holdings Inc Enters Oversold Territory

On Wednesday, shares of Lantheus Holdings Inc. (Symbol: LNTH) fell into oversold status, achieving an RSI of 26.9 after trading as low as $79.24 per share. In contrast, the current RSI for the S&P 500 ETF (SPY) stands at 53.7. This low RSI reading could signal that the recent heavy selling of LNTH shares is nearing exhaustion, prompting bullish investors to consider potential buying opportunities.

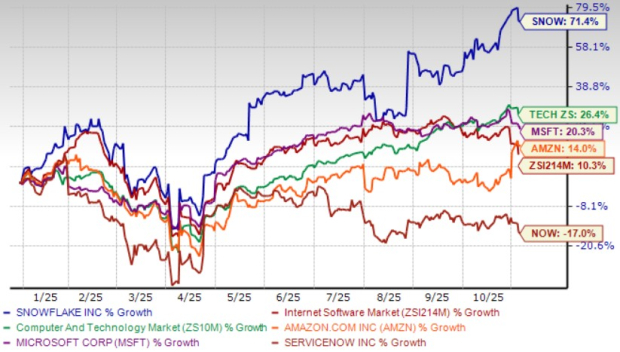

52-Week Performance Overview

The chart below illustrates LNTH’s performance over the past year:

Within the past 52 weeks, LNTH has experienced a low point of $74.28 per share and reached a high of $126.89. The last transaction occurred at $80.49.

![]() Discover 9 other oversold stocks to monitor.

Discover 9 other oversold stocks to monitor.

Additional Resources:

- Institutional Holders of BOSS

- NSEC YTD Return

- SHYG Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.