It was a stark day for the markets as technology stocks, consumer goods, and small caps plunged in response to the Federal Reserve’s tempered outlook on potential interest rate cuts in early 2024.

Following the Fed’s announcement that a rate cut in March was unlikely, U.S. equity markets closed considerably lower. The S&P 500 plummeted 1.6%, the tech-heavy Nasdaq dropped 2.2%, and the Russell 2000 index of small cap stocks slid 2.5%.

Exchange-traded funds that mirror the performances of these indexes mirrored the downwards trend: the SPDR S&P 500 ETF SPY took a 1.6% hit, the Invesco QQQ Trust QQQ lost 2%, and the iShares Russell 2000 ETF IWM shed 2.5%.

Thursday’s indicators, including those from rate and money markets, indicated diminished prospects for an interest rate cut in March. Even the CME Group’s FedWatch tool painted a bleak picture, showing a reduced probability of a quarter-point rate cut at the Fed’s March meeting – down to 44.5% from 52.8% immediately pre-Fed meeting and drastically lower than the 73.4% probability a month prior.

In spite of the Fed’s statement being only a slightly hawkish shift, analysts at Datatrek believe the markets perceive this as a misstep by the Fed. They remarked, “Given that futures actually increased the odds of rate cuts this year, despite Powell’s comments and U.S. equities sold off by over 1.5%, it seems clear that markets believe the Fed is about to make a policy mistake.”

James Knightley, chief international economist at ING, suggested that the Fed’s reluctance was borne out of a fear of repeating past misjudgments. “We suspect that the Fed recognizes its credibility was damaged by its ‘inflation is transitory’ assertion in 2021 only to have to rapidly reverse course with significant rate hikes through 2022 and 2023,” he said.

“The last thing the Fed wants to do is get it wrong again at a key turning point, loosen too soon, too quickly and reignite inflation pressures,” Knightley added.

Impact on The Stocks

The decision to delay the rate cut will prolong the period of elevated borrowing costs, posing a threat to companies with substantial capital market borrowing, such as major tech firms, and those reliant on borrowing from traditional sources of credit, particularly small businesses.

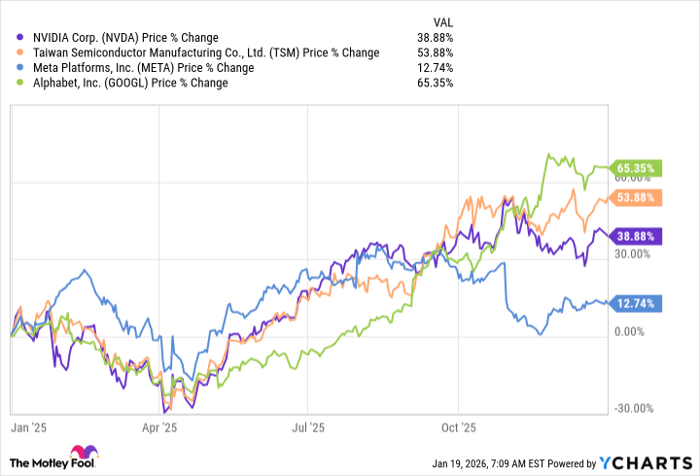

In the wake of the Fed’s announcement, major tech companies witnessed a downturn. Alphabet GOOGL shares nosedived by 7.5% as investors expressed disappointment with its fourth-quarter results.

The iShares U.S. Technology ETF IYW plunged by 2.5% on Wednesday, but showed signs of recovery, rallying by around 0.8% in morning trade on Thursday.

Consumer discretionary stocks also suffered the consequences. The series of rate hikes in 2022 and 2023 has stretched consumer credit to its limit, prompting concerns among analysts about an impending consumer slowdown.

Lululemon Athletica LULU tumbled by 5.7%, while Nike NKE declined by 3.2%. The Consumer Discretionary Select Sector SPDR Fund XLY, an ETF encompassing both Lululemon and Nike, dropped by 1.8% on Wednesday, but managed to bounce back by 0.7% on Thursday.

Real estate stocks also took a hit amid fears that mortgage rates would inch higher due to the delayed interest rate cuts. Boston Properties BXP suffered a 5% decline.

Image created with photos from Shutterstock and Unsplash.