“`html

US Attacks Iran Nuclear Locations, Leading to Crude Oil Spike

The United States executed airstrikes on three Iranian nuclear sites on Sunday, deploying seven B-2 stealth bombers that dropped bunker-buster bombs designed to penetrate deep underground facilities. This military operation follows previous attacks from Israel and comes amid stalled nuclear negotiations with Iran. Although concerns of Iranian retaliation were voiced by officials like Vice President JD Vance and Secretary of State Marco Rubio, the attack was deemed successful.

Market Reaction

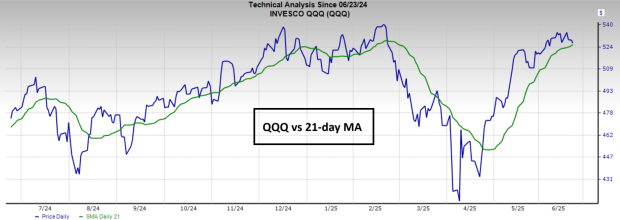

In the immediate aftermath, U.S. equity index futures dropped, while crude oil futures surged over 5% at the open before stabilizing. This reflects a notable shift in market sentiment, indicating that investors believe an aggressive Iranian response is unlikely. The underlying resilience of the stock market has been evident, quickly rebounding after initial negative reactions to geopolitical news.

Key Statistics

B-2 stealth bombers, each valued at over $2 billion, made a 30-hour flight from the U.S. to Iran, executing a high-stakes mission without being detected. Oil prices displayed unprecedented volatility, demonstrating both market sensitivity to geopolitical events and investor confidence in the ongoing bullish trend.

“`