Market Movements: Mixed Results as Chip Stocks Surge

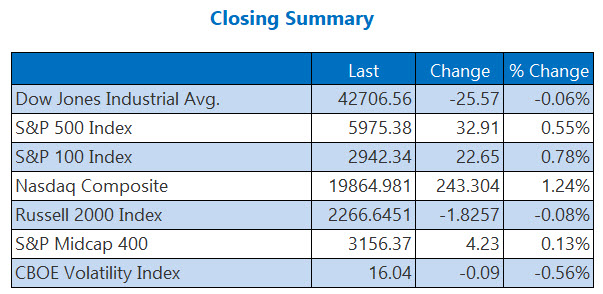

On Monday, the stock market displayed mixed results. The Dow Jones Industrial Average dipped into negative territory, while the Nasdaq Composite index gained significantly due to Nvidia’s (NVDA) impressive rally and strength in the chip sector. The S&P 500 also ended the day with a gain. Optimism was sparked by reported adjustments to President-elect Trump’s tariff plan, benefiting technology and automotive stocks. Investors now turn their attention to a shortened trading week, with the NYSE and Nasdaq set to close on Thursday in tribute to the late U.S. President Jimmy Carter.

Here’s what else you need to know from today’s market:

- 3 chip stocks riding the sector surge.

- One retail stock appears ripe for a rebound.

- Plus, keep an eye on the latest Disney deal; bullish notes surrounding an airline giant; and two downgrades weighing down TMUS.

Key Updates for Today

- LG Electronics is set to collaborate with Microsoft (MSFT) to enhance its artificial intelligence (AI) capabilities, aiming to improve consumer electronics. (Bloomberg)

- Canadian Prime Minister Justin Trudeau has announced his resignation from his role as Liberal Party leader, but will remain in position until a successor is chosen. (CNBC)

- Disney deal leads to a breakout for FUBO.

- An airline stock receives two new bullish ratings.

- A double downgrade hits T-Mobile stock hard.

Note: There were no significant earnings reports today.

Oil and Gold Prices Decline

Oil prices fell on Monday, despite strong demand from the Middle East and ongoing stimulus discussions in China. The price of February-dated West Texas Intermediate (WTI) crude oil dropped by 40 cents, totaling $73.56 per barrel.

Meanwhile, gold also experienced a downturn due to rising U.S. Treasury yields, influenced by a weakening dollar. Gold for January delivery decreased by 0.4%, closing at approximately $2,645.50 an ounce.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.