US Stock Markets Rally Amid Optimism for Trade Relations

The S&P 500 Index ($SPX) (SPY) closed up +1.67% on Wednesday, alongside the Dow Jones Industrials Index ($DOWI) (DIA) which increased by +1.07%, and the Nasdaq 100 Index ($IUXX) (QQQ) that surged by +2.28%. Additionally, June E-mini S&P futures (ESM25) saw an uptick of +1.70%, while June E-mini Nasdaq futures (NQM25) rose by +2.35%.

On Wednesday, stock indexes experienced a rally for the second consecutive session. The S&P 500 reached a two-week high, whereas the Nasdaq 100 achieved a one-week high. Investor hopes for improved US-China trade relations were buoyed by President Trump’s remarks indicating a desire to be “very nice” in upcoming talks, hinting at potential tariff reductions if a deal is struck with China. Furthermore, confidence in the dollar grew when President Trump stated he would not be dismissing Fed Chair Powell, which offset concerns about foreign investors liquidating dollar assets, including stocks and Treasuries.

However, stocks did retract from their peak levels following Treasury Secretary Bessent’s comments, which muted optimism for an imminent trade agreement. He noted that the US had not unilaterally offered to cut tariffs on China, dampening investor sentiment.

Encouraging economic reports also supported stock growth; Wednesday’s data revealed better-than-expected US new home sales and a positive manufacturing PMI. Notably, the Fed’s Beige Book indicated that US economic activity remained largely unchanged leading up to April 14, with employment showing slight increases and modest to moderate price growth.

In the mortgage market, US MBA mortgage applications dropped by -12.7% during the week ending April 18. The purchase mortgage sub-index fell by -6.6%, while the refinancing sub-index decreased significantly by -20.0%. The average 30-year fixed mortgage rate ticked up by +9 basis points to 6.90%, compared to 6.81% the prior week.

The US April S&P manufacturing PMI unexpectedly increased by +0.5 to 50.7, surpassing expectations of a drop to 49.0. Additionally, March new home sales surged by +7.4% month-over-month to a six-month high of 724,000, higher than the anticipated 685,000.

Conversely, comments from Fed Governor Kugler injected negativity into the market. She indicated that tariffs could be inflationary and leverage a more significant economic impact than previously expected. Kugler also expressed support for holding interest rates steady until inflation pressures are mitigated.

In the cryptocurrency market, Bitcoin (^BTCUSD) rose more than +2% to a seven-week high as a weakening dollar, which dropped to a three-year low, increased demand for cryptocurrencies as a store of value amidst global trade tensions.

Currently, the markets are pricing in an 8% chance of a -25 basis point rate cut following the FOMC meeting scheduled for May 6-7.

This week’s market focus shifts to Q1 corporate earnings results and any updates on US trade policies. The Fed Beige Book is expected to be released later today, with Thursday bringing reports on March capital goods new orders nondefense ex-aircraft and parts (projected to rise +0.1% month-over-month) and March existing home sales expected to decline by -2.8% month-over-month to 4.14 million. On Friday, market participants will look for the revised University of Michigan April consumer sentiment index, with no changes expected from the previous reading of 50.8.

The Q1 earnings reporting season is now underway. According to data from Bloomberg Intelligence, the market consensus estimates Q1 year-over-year earnings growth for S&P 500 companies at +6.7%, a decrease from earlier expectations of +11.1% in November. For full-year 2025, corporate profits for the S&P 500 are projected to rise by +9.4%, a downward revision from the +12.5% forecast in early January.

Internationally, stock markets closed with mixed results. The Euro Stoxx 50 climbed to a two-and-a-half-week high, finishing up +2.77%. China’s Shanghai Composite decreased by -0.10%, while Japan’s Nikkei Stock 225 rose to a three-week high, finishing +1.89% higher.

Interest Rates

June 10-year T-notes (ZNM25) closed lower on Wednesday, down -3.5 ticks, with the 10-year T-note yield dropping by -1.2 basis points to 4.381%. Despite an initial upward movement following President Trump’s reaffirmation of Fed Chair Powell’s position, T-notes faced selling pressure due to stronger-than-expected reports on new home sales and manufacturing PMI, which indicated rising inflation expectations. On Wednesday, the 10-year breakeven inflation rate increased to a one-and-a-half-week high of 2.307%.

Decent demand supported T-note prices during the Treasury’s $70 billion auction of 5-year T-notes, achieving a bid-to-cover ratio of 2.41, surpassing the 10-auction average of 2.39.

In European markets, government bond yields edged higher. The 10-year German bund yield rose by +5.4 basis points to 2.497%, while the UK gilt yield finished up +0.7 basis points at 4.552%, rebounding from a two-week low of 4.469%.

The Eurozone’s April S&P manufacturing PMI unexpectedly improved by +0.1 to a two-and-a-quarter-year high of 48.7, outperforming expectations of a decline to 47.4. However, the April S&P composite PMI slipped by -0.8 to 50.1, slightly under market expectations of 50.2.

ECB Governing Council member and Bundesbank President Nagel warned that Europe remains in a “stagnating situation” partly due to the impact of US tariffs, with a risk of recession looming for Germany. Additionally, ECB Governing Council member Villeroy de Galhau stated that there are currently no inflationary pressures within Europe, justifying the ECB’s decisions to cut interest rates earlier and more aggressively compared to other central banks.

Market expectations indicate an 86% probability for a -25 basis point rate cut by the ECB during the policy meeting scheduled for June 5.

US Stock Movers

On Wednesday, the “Magnificent Seven” stocks recorded substantial gains, bolstering the broader market. Tesla (TSLA) closed up over +5%, while Meta Platforms (META) and Amazon.com (AMZN) both increased by more than +4%. Nvidia (NVDA) closed with a gain of over +3%, and Apple (AAPL) along with Alphabet (GOOGL) rose by more than +2%. Microsoft (MSFT) noted a gain of over +1%.

Chip stocks surged on the back of easing US-China trade tensions, with President Trump indicating tariffs might be reduced if a deal is achieved. Noteworthy gains included Marvell Technology (MRVL) rising over +6% and Lam Research (LRCX) closing up more than +5%. Additional semiconductor stocks such as Advanced Micro Devices (AMD), ARM Holdings Plc (ARM), Microchip Technology (MCHP), and GlobalFoundries (GFS) all saw increases of over +4%. Other significant performers included Micron Technology (MU), ON Semiconductor (ON), KLA Corp (KLAC), Applied Materials (AMAT), and NXP Semiconductors NV.

Stocks Rise Amid Positive Earnings Reports and Bitcoin Gains

On Wednesday, several technology stocks, including NXP Semiconductors (NXPI) and Texas Instruments (TXN), closed up by over +3%. The surge in cryptocurrency-related stocks accompanied a more than +2% increase in Bitcoin’s price, which reached a seven-week high. Riot Platforms (RIOT) saw a substantial increase, closing up +6%, while Coinbase Global (COIN) ended the day over +3% higher. Additionally, MicroStrategy (MSTR) and MARA Holdings (MARA) both closed up more than +1%.

Performance Highlights

Amphenol Corp (APH) led the S&P 500 with a significant +8% gain after reporting first-quarter net sales of $4.80 billion, surpassing the consensus estimate of $4.25 billion.

Boeing (BA) also posted impressive results, closing up more than +6% after revealing first-quarter revenue of $19.50 billion, exceeding the consensus of $19.37 billion.

Boston Scientific (BSX) saw its stock rise over +4% after it raised its full-year net sales guidance to +15% to +17%, up from an earlier forecast of +12.5% to +14.5%.

Similarly, Vertiv Holdings (VRT) jumped more than +9% after increasing its full-year net sales forecast to between $9.33 billion and $9.58 billion, well above the consensus estimate of $9.20 billion.

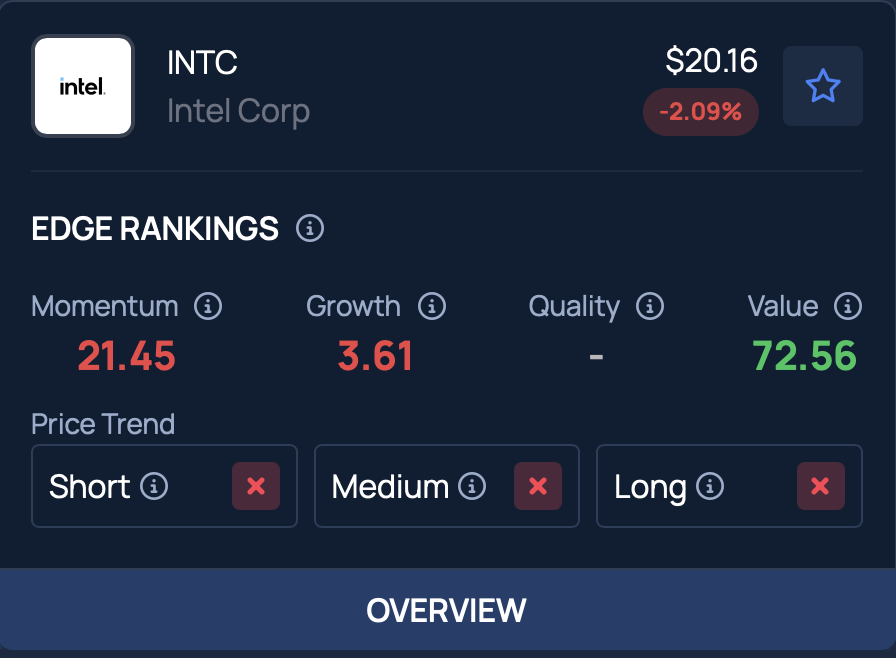

Intel (INTC) closed up over +6% following a Bloomberg report that the company plans to reduce its workforce by more than 20% to enhance operational efficiency.

In other news, Phillip Morris (PM) closed up more than +3% after reporting a first-quarter adjusted EPS of $1.69, exceeding the consensus of $1.61. The company also raised its full-year adjusted EPS forecast to between $7.36 and $7.49, up from $7.04 to $7.17, better than the consensus estimate of $7.23.

Declining Stocks

On the downside, Lennox International (LII) closed down more than -8% after reporting first-quarter earnings that fell short of analysts’ expectations, stating that price increases would mitigate lower volume.

Baker Hughes (BKR) led the Nasdaq 100 losers, closing down over -6% after reporting first-quarter revenue of $6.43 billion, which was below the consensus of $6.49 billion. The company projected second-quarter revenue between $6.30 billion and $7.00 billion, with the midpoint falling short of the consensus estimate of $6.86 billion.

Otis Worldwide (OTIS) also experienced a more than -6% decline, closing after announcing first-quarter net sales of $3.35 billion, just below the consensus of $3.37 billion.

Gold mining stocks were impacted as well, with AngloGold Ashanti Plc (AU) closing down more than -5% in response to a sharp decline of over -3% in gold prices. Newmont (NEM) also saw a decrease of more than -2%.

Bristol-Myers Squibb (BMY) closed down over -2% after its schizophrenia treatment, Cobenfy, failed to meet its primary goal in clinical testing. Likewise, Chubb Ltd (CB) reported first-quarter net premiums of $12.65 billion, falling short of the consensus estimate of $13.03 billion, leading to a more than -2% drop in its shares.

CME Group (CME) was down more than -1% after disclosing first-quarter revenue of $1.60 billion, which did not meet the consensus of $1.65 billion.

Upcoming Earnings Reports (4/24/2025)

- Allegion plc (ALLE)

- Alphabet Inc (GOOGL)

- Ameriprise Financial Inc (AMP)

- Bristol-Myers Squibb Co (BMY)

- CBRE Group Inc (CBRE)

- CenterPoint Energy Inc (CNP)

- CMS Energy Corp (CMS)

- Comcast Corp (CMCSA)

- Digital Realty Trust Inc (DLR)

- Dover Corp (DOV)

- Dow Inc (DOW)

- Eastman Chemical Co (EMN)

- Erie Indemnity Co (ERIE)

- Fiserv Inc (FI)

- Freeport-McMoRan Inc (FCX)

- Gilead Sciences Inc (GILD)

- Hartford Insurance Group Inc/The (HIG)

- Hasbro Inc (HAS)

- Healthpeak Properties Inc (DOC)

- Intel Corp (INTC)

- Interpublic Group of Cos Inc/The (IPG)

- Keurig Dr Pepper Inc (KDP)

- L3Harris Technologies Inc (LHX)

- LKQ Corp (LKQ)

- Merck & Co Inc (MRK)

- Nasdaq Inc (NDAQ)

- PepsiCo Inc (PEP)

- PG&E Corp (PCG)

- Pool Corp (POOL)

- Principal Financial Group Inc (PFG)

- Procter & Gamble Co/The (PG)

- Republic Services Inc (RSG)

- Southwest Airlines Co (LUV)

- Textron Inc (TXT)

- T-Mobile US Inc (TMUS)

- Tractor Supply Co (TSCO)

- Union Pacific Corp (UNP)

- Valero Energy Corp (VLO)

- VeriSign Inc (VRSN)

- West Pharmaceutical Services Inc (WST)

- Weyerhaeuser Co (WY)

- Willis Towers Watson PLC (WTW)

- Xcel Energy Inc (XEL)

On the date of publication,

Rich Asplund

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.