Investors React to Trump’s Tariff Plans as Bitcoin Gains Momentum

As I draft this update on Wednesday afternoon, all three major stock indexes are experiencing notable gains following a positive influx of news earlier today.

Trump’s Evolving Stance on Tariffs

Let’s start with former President Donald Trump:

- He indicated “no intention” to dismiss Federal Reserve Chairman Jerome Powell.

- Furthermore, he suggested a shift toward a less aggressive posture concerning trade with China, stating that tariff rates are currently “very high” but will “come down substantially.” He assured that while the rates won’t drop to zero, significant reductions are likely.

Expanding on this second point, The Wall Street Journal published an exclusive article suggesting the possibility of reducing tariffs by over 50%.

According to the WSJ:

“President Trump hasn’t made a final determination. The discussions remain fluid and several options are on the table,” officials reported.

One senior White House official mentioned that the tariffs on China could be lowered to between 50% and 65%.

This potential reduction could involve a tiered tariff system, gradually implemented rather than an immediate rollback.

Further detail from the WSJ: “The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year, suggesting 35% levies on items not deemed a threat to national security, and at least 100% for strategically important goods.”

The proposal suggests phasing in these levies over a span of five years.

In a keynote address at the Institute of International Finance, Treasury Secretary Scott Bessent emphasized the need to restore equilibrium in the global financial landscape. He remarked on the potential for “a big deal” between the U.S. and China, following prior comments indicating that the current tariff structure is not sustainable.

Ultimately, aside from actual trade agreements, this is what Wall Street and U.S. corporations seek: a return to a stable and predictable environment conducive to strategic capital allocation.

While stock prices have eased from their earlier session highs, the day remains favorable as I write. Even in the event of a pullback, the current trade discussions offer encouraging insights.

The Dollar’s Decline and Rising Economic Uncertainty

As we approach 2025, the U.S. dollar continues under pressure, despite today’s uptick due to favorable trade news. Since mid-January, the dollar has depreciated by 9%.

Source: TradingView

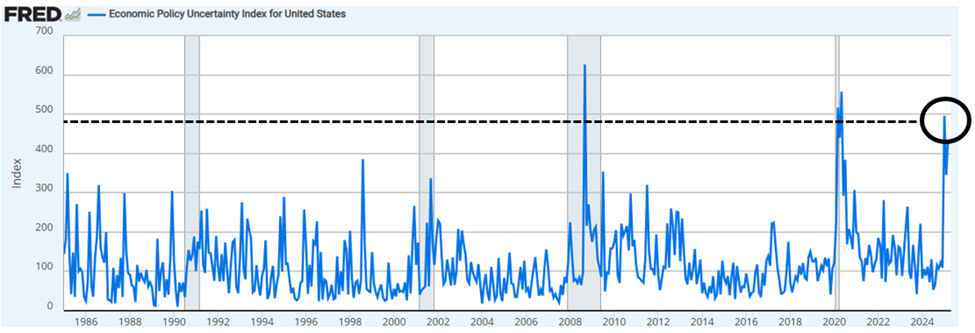

Simultaneously, economic uncertainty has surged. The Economic Policy Uncertainty Index from the Federal Reserve shows that today’s readings are the highest recorded since the 2008 Global Financial Crisis and the 2020 Covid downturn.

Source: Fed data

Global government debt is also climbing. The Institute of International Finance notes that the worldwide debt-to-GDP ratio reached a record 328% in 2024, with total global debt surging to $318 trillion.

When combined, a weakening dollar, rising economic uncertainty, and escalating global debt create a scenario ripe for alternative assets.

Bitcoin Surges as a Potential Hedge

In this context, Bitcoin is beginning to emerge as a viable hedge. Bitcoin has recently reclaimed the $93,000 mark.

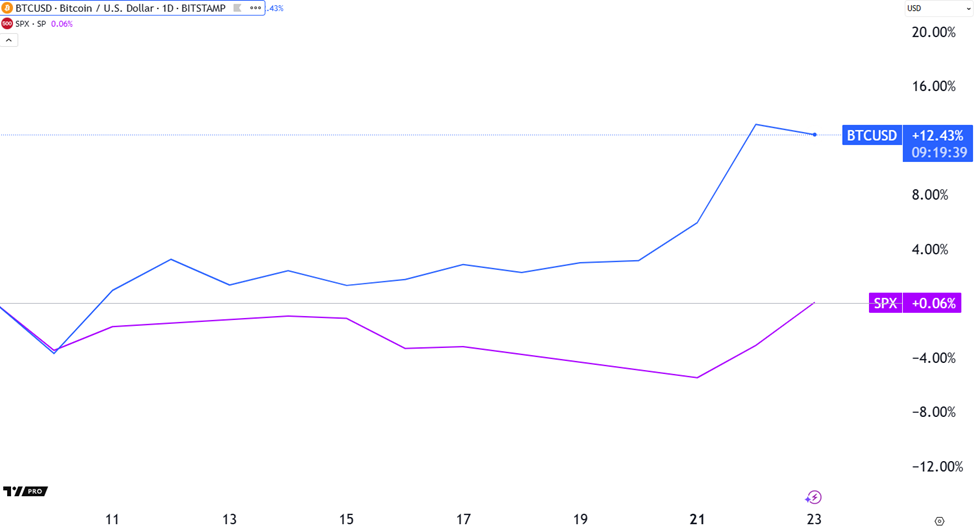

While it’s tempting to point to today’s market optimism as the main driver, the motivations for Bitcoin’s rise seem broader.

However, it’s essential to acknowledge that it may be premature to declare that Bitcoin has hit its bottom. It is still early to assess whether investor sentiment has genuinely shifted, recognizing Bitcoin as a credible safeguard of economic value.

Nonetheless, we are making progress in that direction. A closer examination reveals that since April 9, Bitcoin’s performance diverges from traditional markets; while the S&P 500 remains flat today, Bitcoin has risen by 12%.

Bitcoin Gains Strength Amid Global Economic Uncertainty

Source: TradingView

Understanding Bitcoin’s Rise in a Weakening Economic Climate

A weakening U.S. dollar is fostering uncertainty in fiat currencies, driving some investors to seek alternatives for long-term value storage. Despite its volatility, Bitcoin is increasingly viewed as a hard asset. Its capped supply of 21 million coins, lack of central authority, and resistance to depreciation makes it appealing to many.

This move towards Bitcoin reflects broader worries about the global debt situation. Countries around the world are grappling with soaring debt, a trend that undermines the value of fiat currencies. Furthermore, Bitcoin serves as a sort of “exit ramp” for investors wanting to step away from such a system reliant on excessive borrowing.

Historically, during times of heightened trade tensions, such as the U.S.-China conflict in 2019, Bitcoin’s value increased due to capital flight from countries experiencing instability. Investors from China and other emerging markets sought non-sovereign stores of value. Bitcoin’s borderless nature and independence from the U.S. dollar give it added attraction in uncertain times.

Together, these factors elucidate why there has been a renewed interest in Bitcoin. The gains observed are not merely a reaction to instability; they stem directly from it.

Technical Analysis Suggests a Bullish Outlook for Bitcoin

Prominent trader Jeff Clark has analyzed the current trading patterns of Bitcoin. With more than 40 years of trading experience, he employs various indicators and charting techniques to navigate the markets.

In his recent assessment, Clark noted that Bitcoin’s price surged above $105,000 in early February, followed by a downtrend characterized by lower highs and lower lows. However, as the price approached $75,000 earlier this month, bullish momentum indicators started signaling potential recovery.

The past three weeks have seen Bitcoin stable within a tight trading range near $85,000. This pattern often suggests a buildup of energy for a significant market move. Following Monday’s rally, it appears that Bitcoin may be poised for an upward trajectory.

Investment Opportunities in Bitcoin Mining

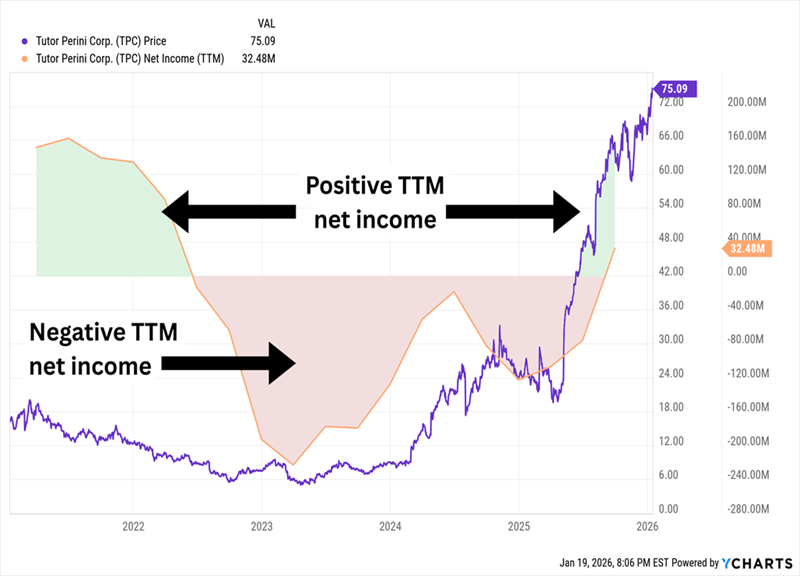

During periods of rising Bitcoin prices, mining companies typically benefit as well. However, Clark observed unusual market behavior recently: while Bitcoin has been fluctuating between $76,000 and $86,000, mining stocks have slipped to historic lows relative to Bitcoin’s price.

This situation suggests that either Bitcoin’s price must decrease, or mining stocks need to recover – or a mix of both. Clark anticipates that as Bitcoin’s value increases, the growth potential for mining companies will be greater.

Recent performance backs this prediction; between Tuesday and Wednesday, miners Marathon Digital Holdings (MARA), CleanSpark (CLSK), and Riot Platforms (RIOT) raised their prices by 18.5%, 21.4%, and 22.6%, respectively.

In Conclusion

Market volatility is presenting unique opportunities, particularly concerning trading technologies. One such tool is TradeSmith’s An-E, an AI-driven trading algorithm capable of forecasting stock prices based on quantitative analysis. As volatility continues to define market conditions, the adoption of advanced predictive tools may become essential in navigating these changes.

Investors should remain vigilant as market dynamics evolve. Whether through Bitcoin itself or related mining stocks, opportunities for profit exist amid uncertainty. Making informed decisions will be crucial in the forthcoming trading landscape.

Strategic Trading Insights Amid Market Volatility

Recent updates highlight how traders are navigating the volatile markets post-Liberation Day. As the market seeks stability, opportunities arise for those adept at spotting fluctuations.

Market Trends and Trading Opportunities

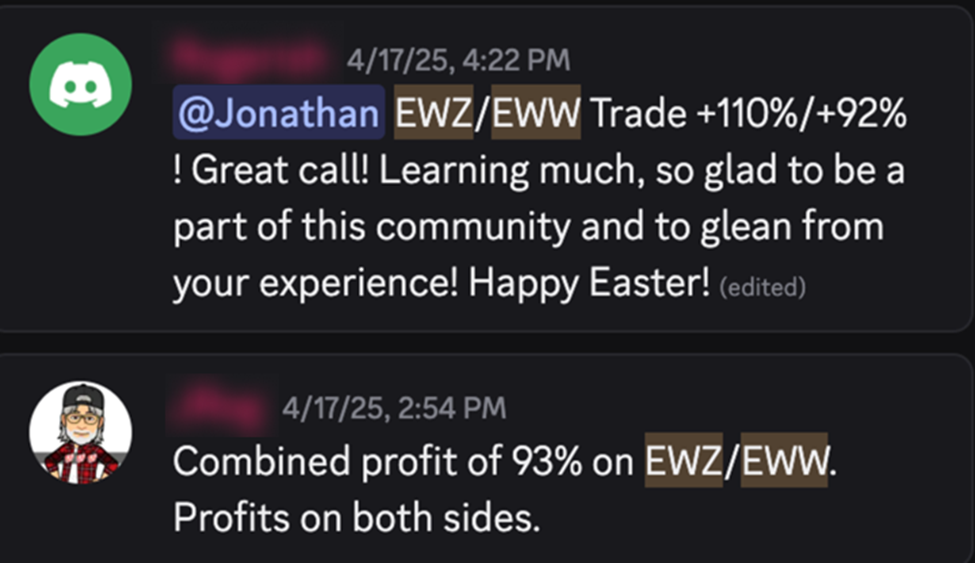

In a volatile environment, nimble traders can leverage price variations. Recently, a noteworthy gain was achieved by identifying a growing divergence between Mexican and Brazilian stocks. This insight resulted in a significant triple-digit profit, demonstrating the value of monitoring market disparities.

Market analyst Jonathan emphasizes that divergences are prevalent across various sectors. A critical example he notes is the gold-to-oil ratio, currently at an extreme of 274.74. Additionally, he highlights substantial gaps between crude oil and refined product prices.

Daily Broadcasts for Insight

Join Jonathan for Daily Trading Insights

Jonathan invites traders to tune into his daily broadcasts, “Masters in Trading Live,” held at 11:00 am on market open days. These sessions offer insights into navigating volatile markets and identifying profitable trades.

Participants can choose to engage in trading or simply observe and learn from the discussions. The educational aspect of these broadcasts aims to equip traders with tools and strategies to enhance their profitability.

Community Feedback

Feedback from Jonathan’s followers indicates a positive reception of the insights shared during these broadcasts. His commitment to transparency and education helps empower traders to make informed decisions.

Conclusion

In his closing remarks, Jonathan emphasizes the importance of recognizing market divergences, as they present substantial profit potential. With significant price dislocations and widening spreads currently observed, there’s ample opportunity for traders prepared to act.

For consistent updates on specific trading setups and strategies, traders are encouraged to join Jonathan for his “Masters in Trading Live” sessions.

Best regards,

Jeff Remsburg