Marriott Expands Branded Residences Across EMEA Region

In the past two years, Marriott International, Inc. (MAR) has signed 26 agreements to expand its branded residential portfolio in prime locations across Europe, the Middle East, and Africa (EMEA).

Growth of Marriott’s Residential Portfolio

Marriott is accelerating the growth of its residential portfolio in the EMEA region. The company now has 70 projects in total, including 43 in its signed pipeline and 27 already open.

The portfolio features 16 luxury and premium brands, allowing developers to benefit from Marriott’s strong brand recognition. This initiative not only enhances lead generation but also increases sales velocity and value for developers.

Owners of these residences enjoy Marriott’s high-quality services and exclusive benefits through the ONVIA recognition platform, which connects them to distinctive offerings within the Marriott Bonvoy portfolio.

Out of the 16 brands, 13 currently have either open properties or signed agreements in the EMEA region.

Upcoming Openings in 2024

By the end of 2024, Marriott plans to open several projects, including The Residences at the St. Regis Al Mouj Muscat Resort in Oman and The Ritz-Carlton Residences, Baku in Azerbaijan. The Residences at the St. Regis Belgrade will also debut in Southeast Europe. Additionally, the Ritz-Carlton Reserve, Nujuma, will introduce this luxury brand to the EMEA region.

The Ritz-Carlton Residences, Diriyah, and The St. Regis Residences at Financial Center Road, Dubai, along with W Residences Manchester, demonstrated promising sales potential upon their launches.

Marriott’s standalone property, The St. Regis Residences in Casares, Costa del Sol, is set to open in fall 2024, marking Marriott’s first branded residence in Spain. In Dubai, The Ritz-Carlton Residences at Creekside will feature 200 residences spread across seven buildings and 12 mansions.

A partnership with Highgate will also lead to the rebranding of several properties in Algarve, Portugal, expected to open mid-2025. This includes The Residences at The Westin Salgados Beach Resort and Marriott Residences Salgados Resort.

Performance of MAR Stock

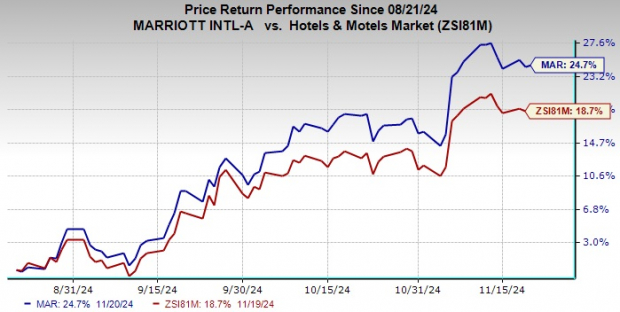

In the last three months, shares of this leading hospitality company have risen by 24.7%. This growth outpaces the 18.7% rise in the Zacks Hotels and Motels industry. Marriott’s expansion strategy and the increasing demand for global travel drive its positive outlook.

Image Source: Zacks Investment Research

Recently, Marriott reported a surge in group bookings, fueled by growing business and leisure travel. As travel demand remains strong globally, Marriott is poised for continued success in the market.

Marriott’s Zacks Rank and Top Stock Picks

Marriott currently holds a Zacks Rank #3 (Hold).

Here are some stocks from the Consumer Discretionary sector with better rankings:

Sportradar Group AG (SRAD) has a Zacks Rank #1 (Strong Buy) and a trailing four-quarter earnings surprise of 83.3%. The stock gained 61.4% in the last six months, with estimates indicating a 29.5% growth in sales and 8.3% in earnings per share (EPS) for 2024.

Interface, Inc. (TILE) also has a Zacks Rank of 1 and has seen a 73.3% trailing earnings surprise. Its stock has increased by 61.3% over the past six months, with projected sales and EPS growth of 4.7% and 37%, respectively, for 2024.

Flexsteel Industries, Inc. (FLXS) maintains a Zacks Rank of 1 as well, despite a trailing four-quarter negative earnings surprise of 12.7%. The stock’s six-month gain stands at 60.4%, with expectations of 4.9% sales growth and 54% EPS growth for fiscal 2025.

Expert Stock Recommendations

Our research team has identified five stocks with a high probability of doubling in value soon. Director of Research Sheraz Mian emphasizes one innovative financial firm with over 50 million customers and a diverse range of products, signaling strong future growth.

This standout stock follows successful picks from Zacks, like Nano-X Imaging, which rose by +129.6% in just over nine months.

Discover Our Top Stock and Four Additional Picks

Get the Latest Recommendations from Zacks Investment Research

Free Analysis Report: Marriott International, Inc. (MAR)

Free Analysis Report: Flexsteel Industries, Inc. (FLXS)

Free Analysis Report: Interface, Inc. (TILE)

Free Analysis Report: Sportradar Group AG (SRAD)

Read the Full Article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.