Market Turns Positive: Focus on AI Chip Stocks Marvell and Micron

As global trade tensions ease, market sentiment has shifted positively, leading investors to pay closer attention to emerging AI chip manufacturers like Marvell Technology MRVL and Micron Technology MU.

While both companies are key players in the semiconductor sector, they serve different markets. Marvell specializes in custom networking chips tailored for AI infrastructure, mainly catering to hyperscalers and cloud providers. Conversely, Micron focuses on memory and storage solutions, delivering AI chips through its high-bandwidth memory (HBM) and advanced dynamic random-access memory (DRAM) products.

Performance Overview of MRVL and MU

In line with the market recovery, Marvell’s stock has increased by 12% this month, while Micron’s shares surged over 20%. However, Marvell’s stock remains down 40% for 2025 due to weaker-than-expected guidance and the delay of its Investor Day event. In contrast, Micron shares are up about 12% year-to-date, driven by robust demand for AI memory.

Over the past five years, Marvell’s stock has outperformed the broader market, rising over 130%. Micron’s increase of 106% aligns closely with the Nasdaq, slightly exceeding the benchmark S&P 500.

Image Source: Zacks Investment Research

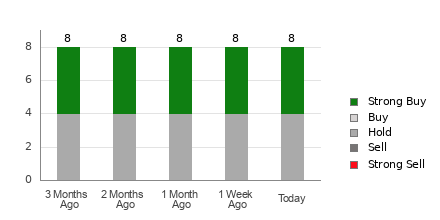

Growth Projections for Marvell and Micron

Looking ahead, Marvell is expected to see total sales rise by 43% in fiscal 2025 to $8.28 billion, up from $5.77 billion last year. Furthermore, FY26 sales are projected to grow another 18% to $9.78 billion. Marvell’s annual earnings are anticipated to increase by 75% in FY25 to $2.75 per share, compared to EPS of $1.57 in 2024. EPS for FY26 is forecasted to jump an additional 27% to $3.50.

Image Source: Zacks Investment Research

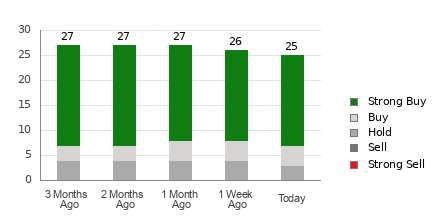

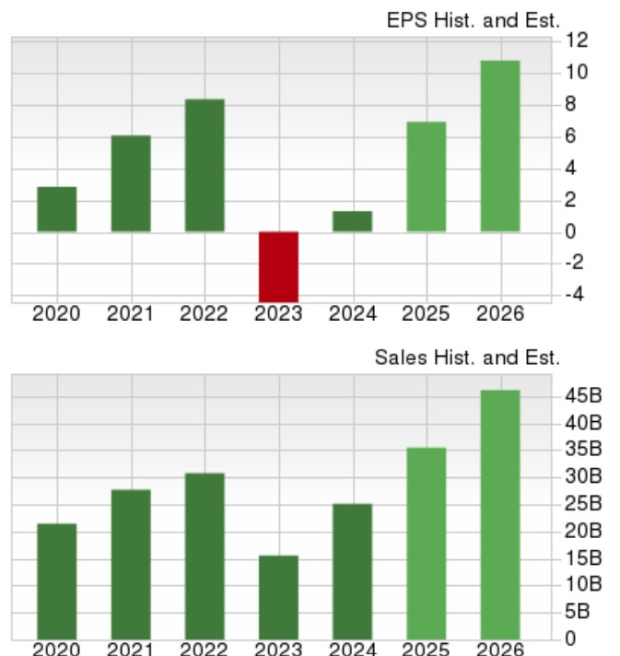

Micron, on the other hand, is forecasted to see FY25 sales climb 41% to $35.49 billion, up from $25.11 billion in 2024. Additionally, FY26 sales are expected to rise another 30% to $46.11 billion. Micron’s annual earnings are projected to rebound dramatically, reaching $6.93 per share from EPS of $1.30 last year, with FY26 EPS anticipated to soar 56% to $10.79.

Image Source: Zacks Investment Research

Valuation Comparison: MRVL and MU

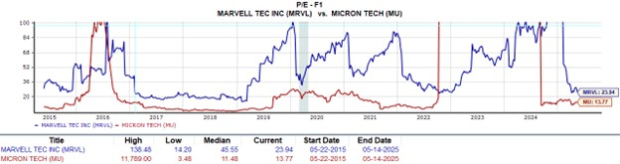

For long-term investors, both Marvell and Micron offer attractive valuations based on price-to-earnings ratios. Marvell trades at a multiple of 23.9X forward earnings, close to the S&P 500 average, and represents a 47% discount to its decade-long average of 45.5X.

Micron shares are currently trading at a forward earnings multiple of 13.7X, nearing its decade median of 11.4X and significantly below the highs seen in this period.

Image Source: Zacks Investment Research

Conclusion

Both Marvell and Micron Technology stand out as compelling options in the chip sector. Currently, both hold a Zacks Rank #3 (Hold) as they need to confirm their promising growth projections. Marvell will report its Q1 results on May 29, while Micron will announce its fiscal third-quarter results on June 25.

Recent analyses suggest that analysts favor Micron for its memory solution demand. Nevertheless, Marvell’s custom networking chips and AI infrastructure offerings remain critical in the changing technology landscape.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.