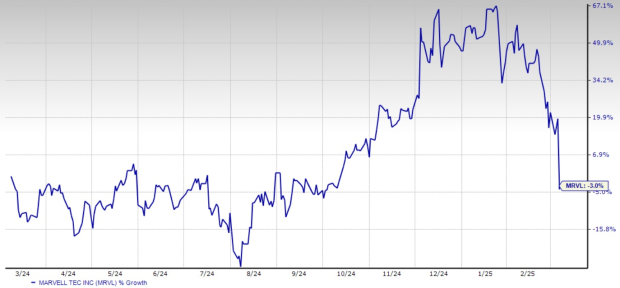

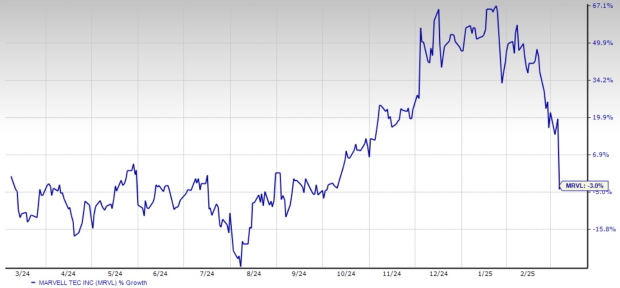

Marvell Technology Stock Drops 20% But Long-Term Outlook Remains Positive

Marvell Technology, Inc.’s MRVL shares fell nearly 20% after the company’s fourth-quarter fiscal 2025 earnings report. Investors reacted negatively to a disappointing sales outlook for the first quarter of fiscal 2026.

The market’s response reflects concern over slowing growth. However, this reaction might be overblown as Marvell’s long-term investment case is still strong, particularly due to its leadership in custom AI silicon, data center networking solutions, and high-speed interconnects.

Is this a buying opportunity for investors? Despite immediate challenges, Marvell’s fundamentals remain solid, presenting a compelling case for long-term investment.

One-Year Price Return Performance

Image Source: Zacks Investment Research

Q4 Results Exceed Expectations, Q1 Sales Guidance Disappoints

On March 5, Marvell released its solid results for the fourth quarter of fiscal 2025, with revenues growing 27% compared to the previous year and 20% sequentially to $1.82 billion. This figure surpassed the Zacks Consensus Estimate by 0.7%. The company’s non-GAAP earnings per share (EPS) reached 60 cents, exceeding consensus estimates by 1.7% and reflecting a 30% year-over-year increase and 40% sequential growth.

Marvell Technology, Inc. Price, Consensus and EPS Surprise

Marvell Technology, Inc. price-consensus-eps-surprise-chart | Marvell Technology, Inc. Quote

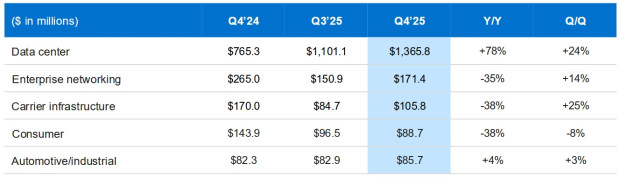

The data center revenues soared by 78% year-over-year to $1.37 billion, representing 75% of Marvell’s overall sales. This growth was driven by strong demand for custom AI silicon, electro-optics products, and Teralynx Ethernet switches. Nevertheless, the first-quarter fiscal 2026 sales forecast of $1.875 billion (+/- 5%) barely meets market expectations, leading to the stock’s significant decline.

Revenue Summary by End Market

Image Source: Marvell Technology, Inc.

The drop in MRVL stock due to weak sales guidance indicates investor fears related to AI demand and high valuations. This negative reaction also impacted other semiconductor and AI stocks, with major players like Broadcom Inc. (AVGO), NVIDIA Corporation (NVDA), and Advanced Micro Devices, Inc. (AMD) falling 6.3%, 5.7%, and 2.8% respectively.

Long-Term Growth Driven by AI in Data Centers

Although the first-quarter guidance is lackluster, Marvell’s long-term prospects are strong. The company is poised to benefit from hyperscalers’ growing demand for custom silicon for AI applications. In fiscal 2025, Marvell surpassed its AI revenue target of $1.5 billion, and it anticipates “very significant” growth beyond $2.5 billion in AI revenue for fiscal 2026.

Marvell’s focus on custom AI silicon and electro-optics products positions it as a key player in high-performance computing. Partnerships with major hyperscalers will support ongoing growth, with management optimistic that revenues from its custom XPU (accelerated computing) solutions will continue to increase into fiscal 2027 and beyond.

Opportunities in High-Speed Networking

As AI workloads increase, there is a greater need for advanced networking solutions in data centers. Marvell is addressing this demand with high-speed optical interconnects, including 800G PAM, 400ZR DCI, and an industry-first 1.6T PAM DSP (digital signal processor), which improves optical module power consumption by 20%.

Moreover, the shift from copper to optical connectivity within AI infrastructure presents a substantial opportunity. Marvell’s Co-Packaged Optics (CPO) technology and the development of the first 2nm silicon IP for cloud and AI workloads reinforce its competitive position in future networking.

Valuation Discount Presents Buying Opportunity

Following the decline after the earnings report, Marvell is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 25.98x. This is noticeably lower than its one-year median of 59.25x and also less than the Zacks Electronics – Semiconductors industry average of 27.12x. This valuation makes Marvell an attractive option for investors looking to gain exposure to AI and high-performance computing at a favorable price.

Conclusion: Consider Buying Marvell Stock

While Marvell’s weak first-quarter guidance led to a significant stock sell-off, its long-term fundamentals remain robust. The company’s role in AI-powered data center infrastructure, custom silicon, and high-speed networking provides confidence in revenue visibility for the future.

With the stock down nearly 20%, long-term investors may find this an excellent buying opportunity. As AI adoption continues to grow, Marvell’s growth potential remains strong, establishing it as a compelling investment at current levels. MRVL currently holds a Zacks Rank #2 (Buy).

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss out on our top 10 tickers for 2025. Curated by Zacks Director of Research Sheraz Mian, this selection has proven to be consistently successful. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks yielded +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has analyzed 4,400 companies covered by the Zacks Rank to identify the best 10 to buy and hold in 2025. You can still be among the first to see these newly released stocks with high potential.

see New Top 10 Stocks >>

Interested in the latest recommendations? Download 7 Best Stocks for the Next 30 Days for free. Click to receive this report.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis report

Broadcom Inc. (AVGO) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.