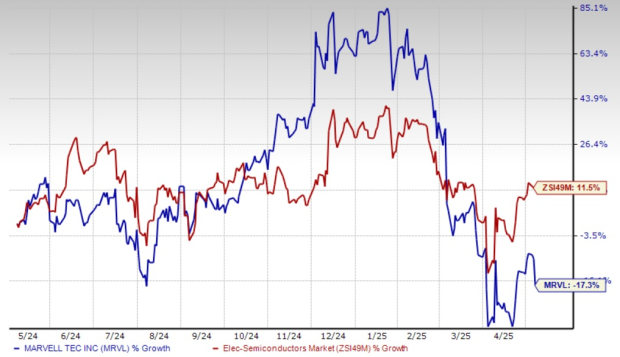

Marvell Technology, Inc. Faces Share Price Volatility Amid Market Concerns MRVL shares have been highly volatile, declining by 17.3% over the past year. This performance trails the Zacks Electronics – Semiconductors industry’s growth of 11.5%.

Marvell Technology One-Year Price Performance Chart

Image Source: Zacks Investment Research

The recent dip in Marvell’s share price raises an important question: Should investors hold or sell?

Factors Contributing to MRVL’s Share Price Decline

Marvell Technology’s downturn stems from broader market weaknesses, particularly the sell-off in tech stocks due to trade tensions. Recent U.S. government actions towards China have stirred concerns, especially since approximately 43% of Marvell’s projected fiscal 2025 revenues come from China.

Additionally, geopolitical tensions, fears of sanctions, and tariff threats have fueled skepticism among investors. Nonetheless, MRVL’s strong fundamentals suggest that these concerns might be exaggerated.

Positive Impact of Data Center and Networking Demand

Marvell Technology is seeing growth as hyperscalers increase their use of custom silicon for artificial intelligence (AI) workloads. In fiscal 2025, MRVL’s AI-related revenues surpassed the $1.5 billion target, and the company anticipates exceeding $2.5 billion in AI revenue for fiscal 2026.

Its innovations in AI silicon and electro-optics have positioned Marvell as a key player in high-performance computing. With strong partnerships among major hyperscalers, management expects a continued upward trajectory for revenues from its accelerated computing solutions through fiscal 2027 and beyond.

Moreover, as the adoption of AI workloads grows, data centers increasingly require advanced networking solutions. MRVL is responding with high-speed optical interconnects like the 800G PAM and industry-first 1.6T PAM DSP, which reduce optical module power usage by 20%.

The transition from copper to optical connections in AI infrastructure presents substantial growth potential. MRVL’s contributions through Co-Packaged Optics and its groundbreaking 2nm silicon IP for cloud and AI solidify its standing in next-generation networking.

Based on these developments, the Zacks Consensus Estimate for Marvell Technology’s revenues in 2026 stands at $8.3 billion, signaling a year-over-year growth rate of 43.8%. The consensus for earnings is projected at $2.76 per share, reflecting a robust 75.8% increase year-over-year.

Marvell has successfully beaten the Zacks Consensus Estimate in each of the last four quarters, averaging a 4.3% surprise. (Find the latest EPS estimates and surprises on Zacks earnings Calendar.)

Marvell Technology, Inc. Price, Consensus, and EPS Surprise Graph

Marvell Technology, Inc. price-consensus-eps-surprise-chart | Marvell Technology, Inc. Quote

Collaborative Efforts to Enhance Growth

Marvell Technology has established strong partnerships with industry giants, including NVIDIA NVDA, Juniper Networks JNPR, and Coherent Corp. COHR, to develop high-speed networking technologies for AI.

The collaboration between Marvell and NVIDIA aims to integrate MRVL’s optical interconnect solutions with NVDA’s AI computing technologies. Utilizing the NVIDIA HGX H100 platform, they created the NVIDIA Israel-1, designed to enhance AI applications’ efficiency.

Marvell has also teamed up with Juniper Networks and Coherent Corp. to craft 800ZR networking solutions, combining their efforts to develop advanced AI-capable networking infrastructures.

MRVL’s Valuation Overview

The recent drop in Stock price has resulted in a forward 12-month price-to-sales (P/S) ratio of 5.59X, considerably below its one-year median of 10.16X and the Zacks Electronics – Semiconductors industry average of 6.81X. This valuation discount makes MRVL attractive for investors seeking exposure to AI and high-performance computing at a reasonable price.

Marvell 12-Month (P/S) Valuation Graph

Image Source: Zacks Investment Research

Conclusion: Holding MRVL Stock is Advisable

Despite facing short-term challenges from U.S.-China relations and rising costs due to tariffs, Marvell Technology boasts strong fundamentals and a solid presence in the data center and networking markets.

As AI adoption accelerates, Marvell’s growth outlook remains positive, making the Stock a compelling option at its current valuation. Currently, MRVL holds a Zacks Rank #3 (Hold).

This article originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.