Analyzing Nvidia and Qualcomm: The Semiconductor Showdown in AI

In my view, semiconductors are the backbone of artificial intelligence (AI). They power everything from storage and memory to quantum computing and machine learning, supporting a wide range of generative AI applications.

Those who have monitored chipmakers in recent years know that Nvidia (NASDAQ: NVDA) stands out as a leading player in the AI industry. Despite seeing its shares surge by 752% over the past two years, renowned investor Masayoshi Son of SoftBank recently claimed that Nvidia is undervalued.

Son believes that the total addressable market (TAM) for generative AI is anticipated to grow significantly in the coming years. This growth bodes well for Nvidia, which has a strong lineup of graphics processing units (GPUs). With its competitive edge, Nvidia might capture much of the emerging market share Son envisions. If this scenario materializes, the potential for Nvidia stock certainly appears promising.

Even though Son’s assessment may hold water, it doesn’t mean we should overlook other promising firms in the semiconductor sector. In particular, I want to discuss Qualcomm (NASDAQ: QCOM) as a potential alternative investment to Nvidia, which may currently offer even better prospects.

Qualcomm’s Growing Role in the AI Market

Qualcomm, unlike Nvidia, focuses primarily on different sectors within the semiconductor industry. While Nvidia concentrates its efforts on GPUs for generative AI, Qualcomm’s Snapdragon architecture primarily aims to power mobile devices and Internet of Things (IoT) products.

In its fiscal year ending September 29, Qualcomm reported revenues of $38.9 billion, reflecting just a 9% increase year over year. While this growth may not seem remarkable, it’s essential to consider that Qualcomm has been working through a turnaround phase, pressing forward with cost-cutting measures while revitalizing growth in its core handset business.

Signs of improvement are becoming evident. Although revenue grew modestly in the first half of fiscal 2024, Qualcomm’s financial health strengthened in the latter half, with sales increasing by 11% in the third quarter and an impressive 19% in the fourth quarter.

Moreover, Qualcomm’s net income and earnings per share (EPS) demonstrated a robust 40% growth year over year in fiscal 2024. This kind of profitability is impressive, especially when considering Nvidia’s market dominance.

A Strong Buyback Program Signals Confidence

As part of its latest earnings report, Qualcomm announced a $15 billion stock buyback program. This strategy appears to be an effective way to utilize the company’s excess cash flow, rewarding shareholders in the process.

Qualcomm vs. Peers: A Valuation Perspective

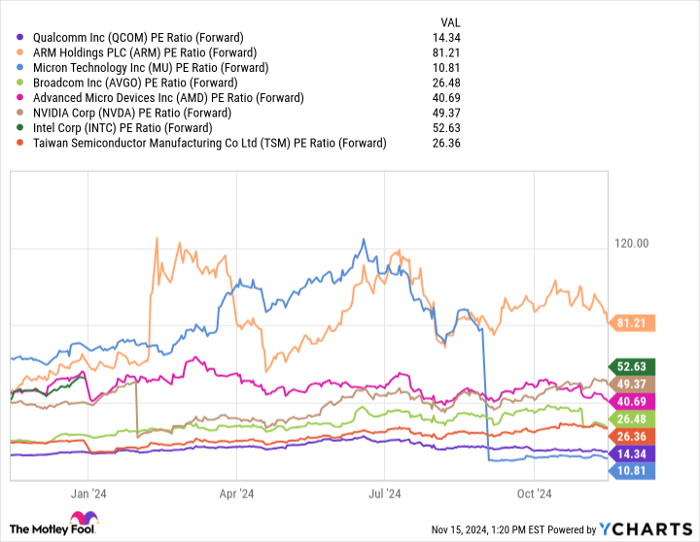

To evaluate Qualcomm’s position among its semiconductor counterparts, I analyzed its forward price-to-earnings (P/E) ratio against other major players. Currently at a forward P/E of only 14.3, Qualcomm seems to be trading at a significant discount relative to many industry peers.

QCOM PE Ratio (Forward) data by YCharts

These valuation patterns suggest Qualcomm could be undervalued compared to other semiconductor stocks. Coupling this with the new $15 billion share repurchase program, it seems Qualcomm’s management is aware of this undervaluation and is taking steps to address it.

While Son’s insights on Nvidia’s growth might be accurate, I believe Qualcomm presents a more attractive investment option at this time due to its appealing valuation compared to its competitors. In my view, Qualcomm stock is a wise choice for investors with a long-term outlook.

A Second Chance for Lucrative Investments

Have you ever felt you missed an opportunity to invest in a successful stock? You might want to pay attention now.

Our team occasionally releases a “Double Down” stock recommendation for firms poised for significant growth. If you think you’ve missed your chance, it could be the ideal moment to invest before the window closes. Consider these impressive returns:

- Nvidia: Invest $1,000 back in 2009, and you’d have $363,386!

- Apple: Invest $1,000 in 2008, and it would grow to $43,183!

- Netflix: A $1,000 investment in 2004 would now be worth $456,807!

We are currently issuing “Double Down” alerts for three outstanding companies, and opportunities like this don’t come along every day.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.