Why Value Stocks Are Gaining Momentum Amid Market Turmoil

Hello, Reader.

Tom Yeung here with today’s Smart Money.

If you ask the average retail trader about their current feelings towards the market, expect to hear a list of four-letter expletives.

Since the beginning of the year, the percentage of respondents to a survey by the American Association of Individual Investors (AAII) who are bearish on the market has jumped from 34% to about 60%.

The sentiment has also shifted among average Americans, with approximately half of those surveyed believing the economy is worsening, up from one-third in January.

Such feelings are understandable. Shares of notable companies like Nvidia Corp. (NVDA) are trading 23% below their January highs, and Tesla Inc. (TSLA) is down 40%.

Each day seems to bring new uncertainty about which country may impose tariffs next, or which government agency might face cuts.

However, the broader stock market tells a contrasting story.

The S&P 500 index is currently just 6% below its all-time high reached in mid-February. Many emerging markets may drop more than that in a single day. Interestingly, over a third of the S&P 500 companies have seen price increases during this time.

The reason behind this divergence is simple:

The selloff of high-priced, well-known tech stocks is being balanced by a shift toward lesser-known value stocks.

Today, let’s explore how market uncertainty is transforming investment strategies, bringing previously overlooked trades into focus, and how this shift toward value investing is proving beneficial.

I’ll also touch on a significant trend currently unfolding in the markets.

The Rise of Value Investing

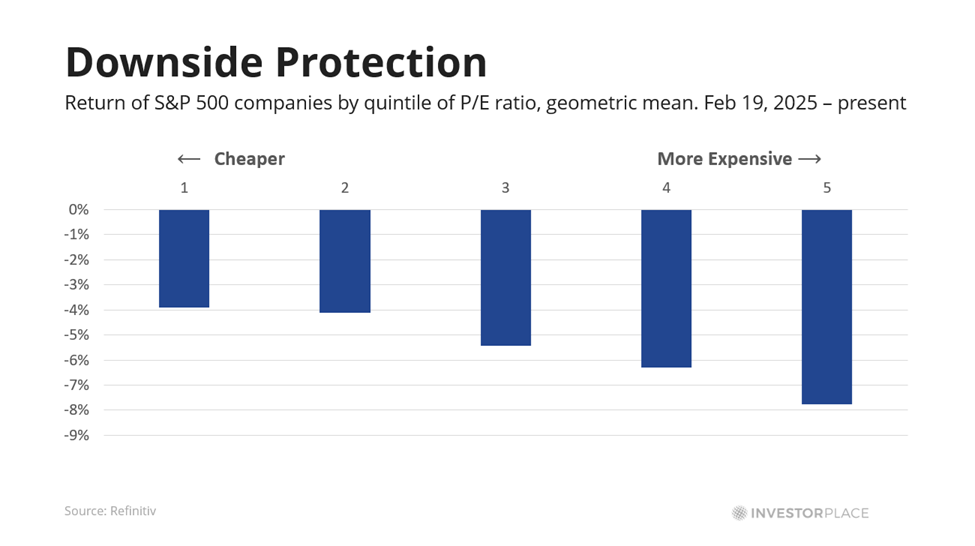

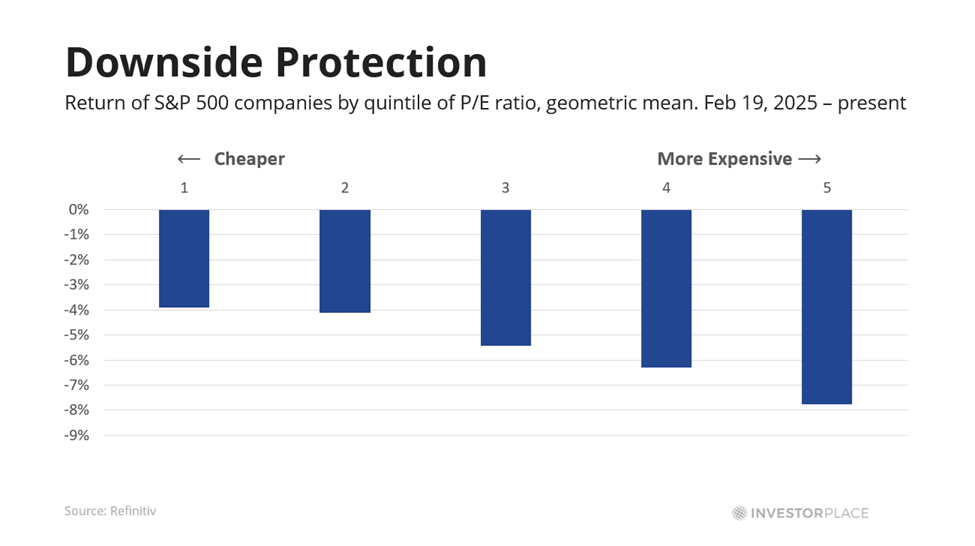

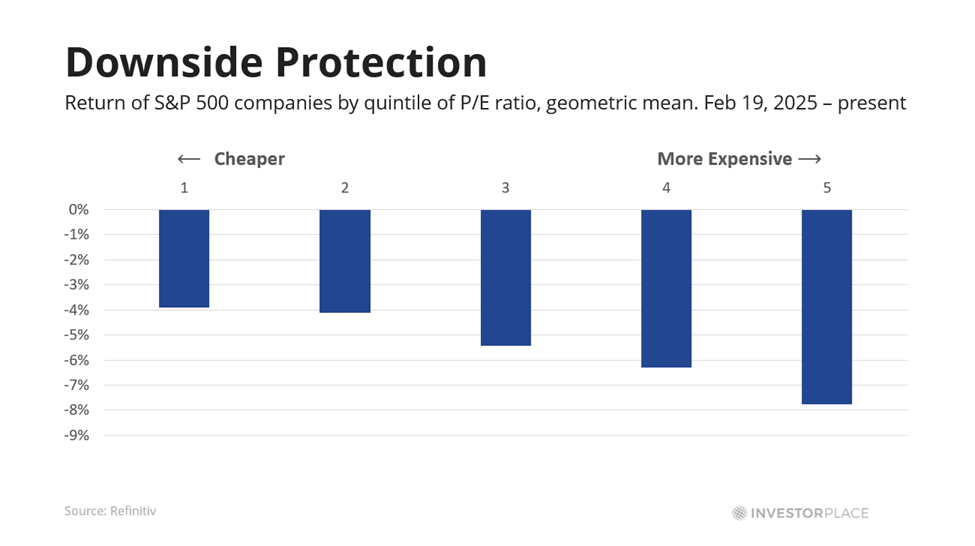

Since the S&P 500 peaked on February 19, shares of cheaper companies have outperformed their costlier counterparts. This trend is evident even with basic financial metrics.

In the past month, shares of the lowest quintile of S&P 500 firms, measured by current price-to-earnings (P/E) ratio, have declined by just 4%. In comparison, the shares in the upper quintile based on P/E have seen an 8% decrease.

The sector performance displays an even sharper contrast.

For instance, shares in biopharmaceutical companies have gained 3%, energy companies have risen 4%, and water utilities have surged by 12%. In contrast, IT services dropped 19% during the same period.

The key takeaway is that amid market turbulence, previously regarded “conservative” trades are regaining appeal.

For example, shares of Bristol-Myers Squibb Co. (BMY)—a recommendation from my paid service Fry’s Investment Report—have increased by 7% since February 19, despite no substantial news from the company. Analysts have largely kept their forecasts for 2026 earnings per share steady at $6.16.

Notably, the rise of gold prices has been especially pronounced. Since February 19, gold has increased by 4%, with shares of related mining companies rising even more sharply.

Investors are now reassessing how they view consistent cash flows. Companies in stable sectors such as pharmaceuticals and mining are being seen as reliable avenues for wealth preservation and growth rather than as risks to avoid.

This resurgence in value investing reflects a return to more traditional market dynamics reminiscent of the 2010s following the financial crisis or the mid-2000s during China’s economic rise. Companies with solid cash flows are thriving, while riskier speculative investments struggle.

In this climate, traditional value investors like Warren Buffett are likely to thrive, while speculative investors like Cathie Wood may find it challenging.

Earlier this year, in a Smart Money piece, Eric forecasted that 2025 would witness the “Revenge of Value”—where the highly priced “Magnificent Seven” stocks would underperform, while value stocks, precious metals, and pharmaceutical firms would flourish.

As a result, over the past few months, Eric has advised his Fry’s Investment Report members and other readers to exit positions in the Magnificent Seven and explore lower-priced tech alternatives, while also maintaining investments in gold and other commodities.

These strategic moves are already yielding positive outcomes.

While many investors may express frustration, we remain focused on one key five-letter word in investing: v-a-l-u-e.

The Emerging Tech Divide

While the potential for tariffs or even a trade war creates ongoing unease, an even larger narrative is unfolding in the market.

Since 2020, Eric has tracked a trend he describes as the “Technochasm.” This term refers to the widening gap created by technological advances within the market.

On one side, there are companies (and investors) harnessing rapid innovation; on the other, entities lagging behind and at risk of being left out.

The emergence of artificial intelligence has intensified this divide, creating a broader chasm.

However, Eric, along with his InvestorPlace colleagues Louis Navellier and Luke Lango, identify a significant opportunity in this disruption. They are working on this through their collaborative research initiative, AI Revolution Portfolio. (To learn more about this service, click here.)

Previously, when Eric first highlighted the Technochasm, he guided his readers to invest in high-performing stocks, achieving returns of 1,350% in just 11 months from mining company Freeport-McMoRan Inc. (FCX).

Because of this, Eric, Louis, and Luke recently held an important broadcast to explain how this monumental capital shift could lead to a new generation of tech millionaires—while potentially leaving many others behind.

If you’re interested in learning more about this opportunity—and the six pivotal stocks at its core—click here to access the free replay.

Regards,

Tom Yeung

Markets Analyst, InvestorPlace