The Fundamental Rules to Wealth

Success in the stock market is a labyrinth, yet one route, in particular, stands out as the key to prosperity over the ages: invest in high-quality businesses, procure them at a fairer cost, and clutch these esteemed positions as long as their greatness endures.

Today, the spotlight is on Mastercard Incorporated (NYSE:MA), a paragon of an exceptional business, currently trading at a favorable valuation.

A Glimpse into the Origins

Mastercard is a juggernaut in global payment and technology, with roots extending back to the mid-20th century. In a bold gambit, a consortium of banks birthed the Interbank Card Association (ICA) in 1966 to fabricate a rival to BankAmericard (now Visa). Their ambition was to craft a universal credit card embraced by multiple banks.

In 1969, the ICA unfurled “Master Charge: The Interbank Card” to spar with BankAmericard, eventually rechristened as Mastercard in 1979 to echo its global ambit. Mastercard rapidly sowed its eminence globally, forging alliances with myriad banks and financial institutions, knitting a truly worldwide network.

Mastercard’s earnings stem largely from transaction-related fees and services it dispenses, augmented by:

Transaction Fees on its network, Cross-Border Fees, Assessment Fees on member banks, Licensing Fees for the use of its logo and network, Data and Analytics Services, Innovation and Technology Services, Partnerships and Collaborations, and Interest on Deposits. Mastercard operates as a payment network, without directly lending money to cardholders. It luxuriates in the benefit of debt but avoids the service obligation.

Staggeringly, much of the world still shuns credit cards, with the brunt of the developing world bereft of traditional banking services or credit facilities. Cash transactions reign supreme, underscoring the untapped potential Mastercard could plumb in the future.

The scorching evolution of contacts and digital payment technologies positions Mastercard at the vanguard of penetrating emerging markets, laying the groundwork to provide secure, slick solutions for regions shackled to cash transactions for eons.

As the global expanse of e-commerce mushrooms, Mastercard ascends at the portal of opportunities to engineer seamless online transactions. The spurt in online commerce proffers a vast theater for Mastercard to play a pivotal role in enhancing payment experiences, guaranteeing both security and convenience for global consumers.

Mastercard’s foray into blockchain technology and cryptocurrencies kindles scintillating prospects. Venturing into these bold frontiers places the company at the cutting edge of financial technology, ready to adapt to the evolving needs of the digital epoch.

Ergo, Mastercard’s strategic alignment, blended with its ardor for embracing technological advances, not only acknowledges the current payment panorama but also underscores its readiness to sculpt and conquer future markets, delineating a dynamic course for growth and global financial inclusion.

Sporting a swaggering market capitalization of $395 billion, Mastercard sits regally as the 17th largest company within the S&P 500 index. Despite its fledgling years as a publicly traded entity, Mastercard has etched an indelible track record of triumph.

A Storied History of Triumph

On May 25, 2006, the unveiling of Mastercard on the stock exchanges at $39 per share was nothing short of a gala affair. The stock swiftly outpaced the broader market, accentuating gains exceeding 100% during 2006 and 2007. It weathered the Financial Crisis with a drop of over 33% in 2008, yet boasts an extraordinary compound annual growth rate (CAGR) of 30.17%, strikingly outperforming the S&P 500’s 9.85%. This equates to an investment in Mastercard burgeoning to a value twenty times greater than that achieved with the S&P.

Inspecting Mastercard’s monthly returns against those of the S&P, the stock has exhibited superior performance 60.66% of the time, as assessed by calendar month returns. Investors exercising patience and clutching their shares for prolonged periods witnessed even rosier outcomes. Over a rolling 12-month period, Mastercard outdid the index 75.5% of the time, surging to 82.95% over a rolling 36-month vista. Notably, the margin of outperformance has been impeccable at a stirring 100% over a rolling 60-month stretch.

While a past replete with remarkable returns is certainly laudable, the seminal question looms: Is Mastercard poised to continue its exceptional legacy? Let’s unravel this enigma.

The Quality Quandary

Evaluating Mastercard’s Business Quality and Financial Health

When assessing the quality of a business, it’s essential to delve into key financial metrics that serve as benchmarks for operational strength. These metrics, including the return on capital employed, total revenue, gross margin, and the free cash flow conversion ratio, paint a comprehensive picture of the business’s vitality and profitability.

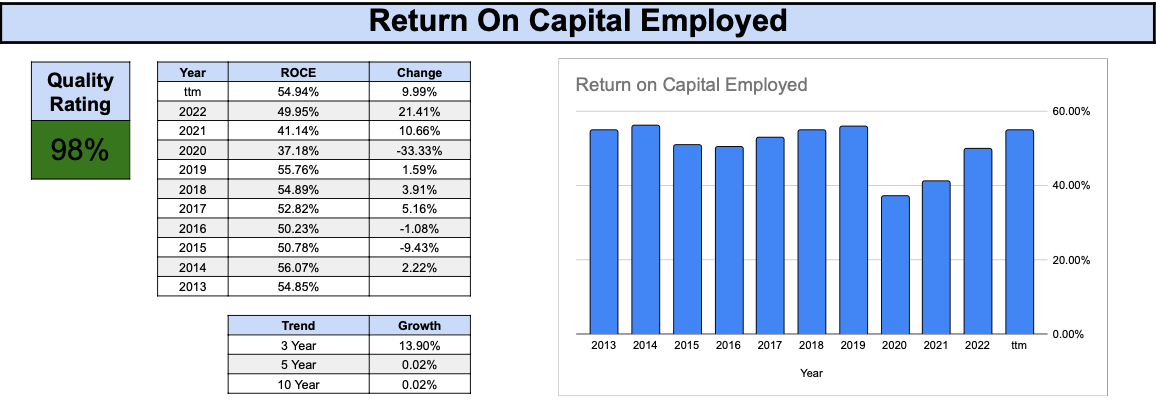

Return on Capital Employed

Mastercard’s historical Return on Capital Employed (ROCE) has been commendable, averaging an impressive 50% over the last decade. Despite a temporary dip in 2020, subsequent years have shown a promising return to its long-term averages, marking an overall 98% quality rating for its historical ROCE.

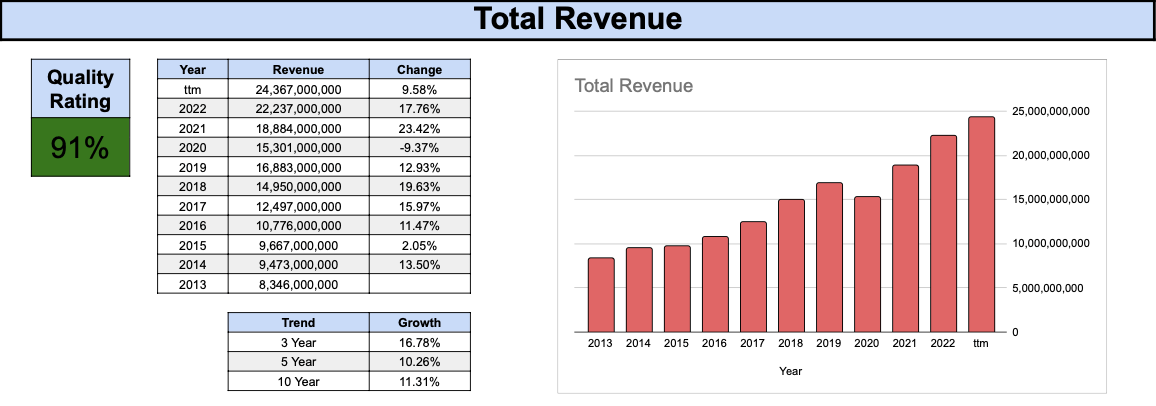

Total Revenue Growth

Over the last decade, Mastercard has achieved an extraordinary 192% growth in revenue, translating to an impressive annualized growth rate of approximately 11.31%. With the exception of a singular instance in 2020, the company has consistently demonstrated sustained growth in total revenue, earning a notable quality rating of 91% for its robust revenue history.

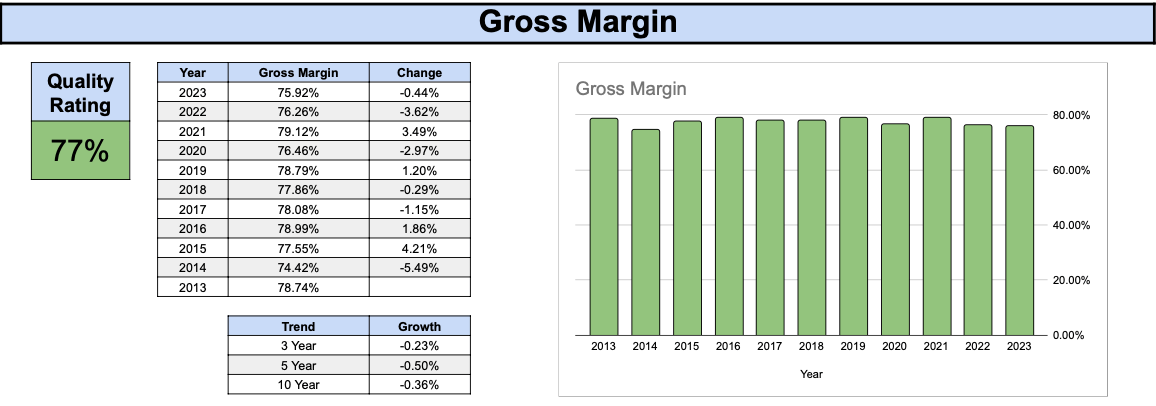

Gross Margin Stability

The company has maintained a robust and stable gross margin, residing in the high 70% range over the last decade. However, there has been a slow and steady decline, resulting in a quality rating of 77% primarily due to the downward trend observed.

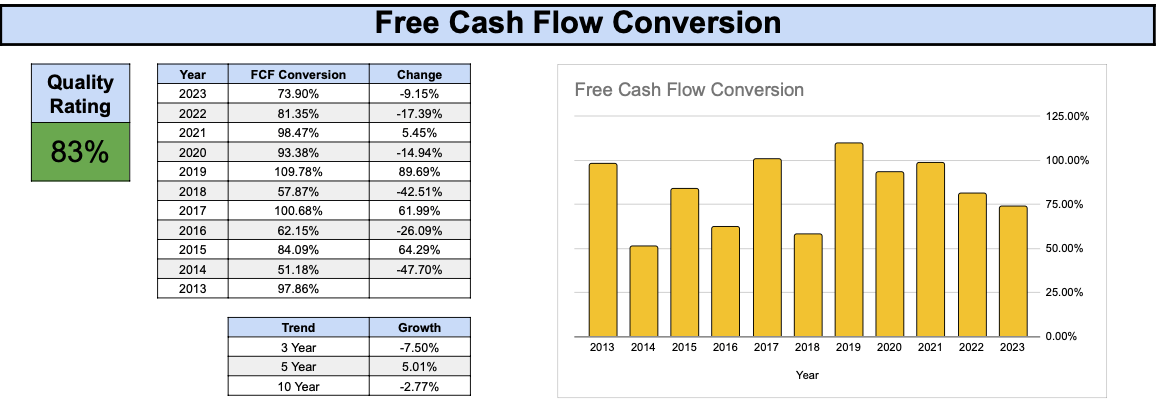

Free Cash Flow Conversion Ratio

Mastercard has shown proficiency in converting profits into free cash flow, with the ratio mostly held above the 50% mark. Despite recent fluctuations and a downward trend, the company still earns a respectable quality rating of 83% in this category.

Combing the quality ratings for all four metrics, Mastercard earns a composite quality score of 87.25%, positioning the company as a high-quality enterprise that boasts enduring financial excellence.

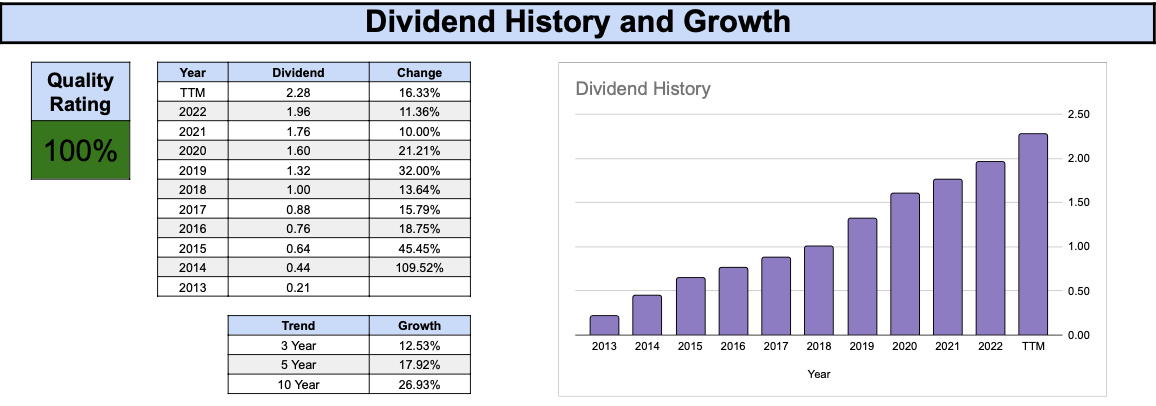

Dividend History

Mastercard initiated its dividend growth journey in 2012 and has since maintained an impressive 12-year history of consistent and above-average dividend growth. With dividends consistently increasing at an annual growth rate in the double digits, shareholders can anticipate continued above-average dividend growth.

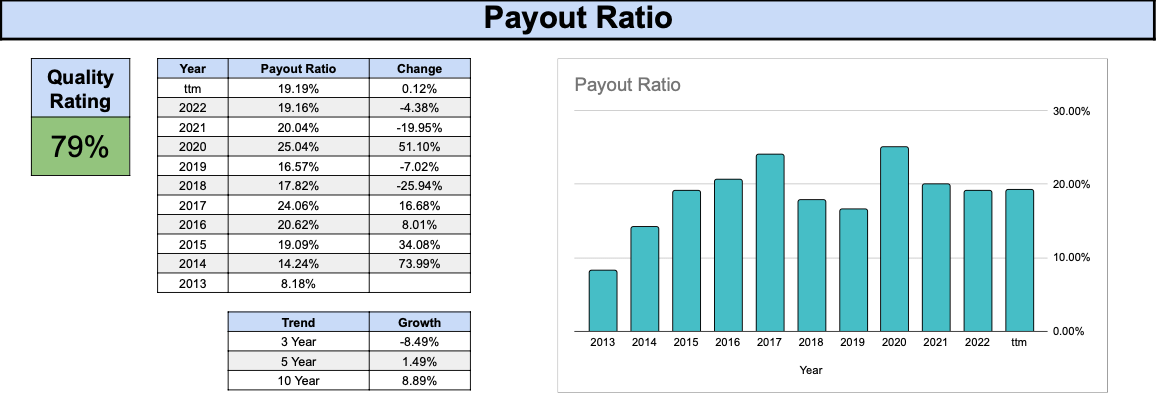

Throughout the last decade, Mastercard has sustained a healthy payout ratio around 20%, allowing ample room for prospective dividend growth and strategic business reinvestment.

Valuation

When evaluating a stock’s attractiveness, considering dividend yield theory and price-to-earnings multiple valuations is crucial. Mastercard’s robust financial health and impressive dividend history position the company favorably for sustained growth and strategic flexibility.

Decoding Mastercard’s Valuation: Are Shares Truly in the Green?

When it comes to assessing the value of a stock, the dividend yield and price-to-earnings (P/E) ratio are two crucial metrics that can offer vital insights. In the case of Mastercard, these metrics provide a fascinating glimpse into the stock’s valuation, hinting at potential undervaluation or overvaluation. Let’s delve into the numbers and the stories they reveal.

The Dividend Yield Perspective

Mastercard’s dividend yield stands at the forefront of our valuation journey. The historical dividend yield, depicted by the blue line in the chart on the left, has shown considerable stability, meandering within a tight 0.4% to 0.8% range, with an overarching trend around 0.6%. This data, when compared against the 5-year rolling average dividend yield (red line), hints at a significant divergence in recent times.

At present, the 5-year trailing average dividend yield closely aligns with the current dividend yield, suggesting a fair valuation for Mastercard that hovers around $416, as per the dividend yield theory. This gives investors a definitive snapshot of the fair price based on historical dividend performance.

The Price-to-Earnings Ratio Unveiling

Shifting gears to the price-to-earnings multiple, a fascinating narrative unfolds. The P/E ratio for Mastercard has seen a steady upward trajectory, punctuated by a peak near 60 in 2020 due to lower earnings that year, leading to a diminished fair valuation. However, recent years have seen earnings outpace share price growth, nudging the P/E ratio below the trailing average. With a current P/E ratio slightly below the trailing average, Mastercard seems marginally undervalued, with a fair price estimated at around $428, as per the trailing P/E multiple.

Convergence and Conclusion

Combining both valuation methodologies unveils an average fair price for Mastercard at $422, mirroring the current market price of $422.30. Although this valuation leaves little margin of safety, it suggests that Mastercard might warrant consideration for purchase based on its potential future growth prospects. However, investors must exercise caution and conduct their own rigorous due diligence.

Final Thoughts

Amidst this valiant voyage through numbers, it’s pertinent to mention that I hold a long position in Mastercard, intending to keep my shares for the long haul. However, I strongly advise conducting comprehensive due diligence to form a well-informed opinion about Mastercard’s potential as a high-quality business and whether the current valuation aligns with individual investment criteria.

These insights were originally penned for Quality At A Fair Price on Substack.