Fintel reports that on May 22, 2024, Maxim Group initiated coverage of A-Mark Precious Metals (NasdaqGS:AMRK) with a Buy recommendation.

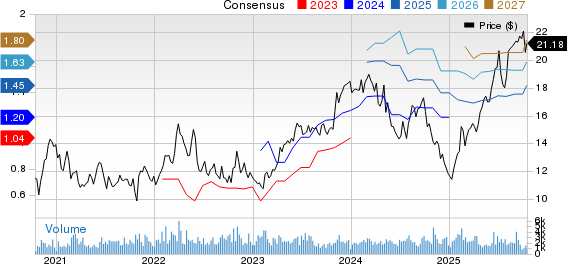

Analyst Price Forecast Suggests 3.56% Upside

As of May 8, 2024, the average one-year price target for A-Mark Precious Metals is 40.04. The forecasts range from a low of 33.33 to a high of $46.20. The average price target represents an increase of 3.56% from its latest reported closing price of 38.66.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for A-Mark Precious Metals is 9,470MM, a decrease of 8.00%. The projected annual non-GAAP EPS is 5.23.

What is the Fund Sentiment?

There are 336 funds or institutions reporting positions in A-Mark Precious Metals. This is an decrease of 15 owner(s) or 4.27% in the last quarter. Average portfolio weight of all funds dedicated to AMRK is 0.15%, an increase of 5.80%. Total shares owned by institutions increased in the last three months by 3.67% to 17,579K shares.  The put/call ratio of AMRK is 0.45, indicating a bullish outlook.

The put/call ratio of AMRK is 0.45, indicating a bullish outlook.

What are Other Shareholders Doing?

American Century Companies holds 1,812K shares representing 7.92% ownership of the company. In its prior filing, the firm reported owning 1,804K shares , representing an increase of 0.45%. The firm decreased its portfolio allocation in AMRK by 6.84% over the last quarter.

ASVIX – Small Cap Value Fund Investor Class holds 1,455K shares representing 6.36% ownership of the company. In its prior filing, the firm reported owning 1,365K shares , representing an increase of 6.19%. The firm decreased its portfolio allocation in AMRK by 3.22% over the last quarter.

Praetorian PR holds 1,228K shares representing 5.36% ownership of the company. In its prior filing, the firm reported owning 1,015K shares , representing an increase of 17.35%. The firm decreased its portfolio allocation in AMRK by 21.79% over the last quarter.

Invesco holds 815K shares representing 3.56% ownership of the company. In its prior filing, the firm reported owning 532K shares , representing an increase of 34.79%. The firm decreased its portfolio allocation in AMRK by 87.14% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 600K shares representing 2.62% ownership of the company. No change in the last quarter.

A-Mark Precious Metals Background Information

(This description is provided by the company.)

Founded in 1965, A-Mark Precious Metals, Inc. (NASDAQ: AMRK) is a leading full-service precious metals trading company and wholesaler of gold, silver, platinum and palladium bullion and related products. The company’s global customer base includes sovereign and private mints, manufacturers and fabricators, refiners, dealers, financial institutions, industrial users, investors, collectors, and e-commerce and other retail customers. The company conducts its operations through three complementary segments: Wholesale trading & Ancillary Services, Secured Lending, and Direct Sales. A-Mark operates several business units in its Wholesale trading & Ancillary Services segment, including Industrial, Coin and Bar, trading and Finance, Storage, Logistics, and the Mint (as more fully described below). Its Industrial unit services manufacturers and fabricators of products utilizing precious metals, while its Coin and Bar unit deals in over 200 different products for distribution to dealers and other qualified purchasers. As a U.S. Mint-authorized purchaser of gold, silver and platinum coins, A-Mark purchases bullion products directly from the U.S. Mint for sale to customers. A-Mark also has distributorships with other sovereign mints, including Australia, Austria, Canada, China, Mexico, South Africa and the United Kingdom. Through its Transcontinental Depository Services subsidiary, A-Mark provides customers with a variety of managed storage options for precious metals worldwide. Through its A-M Global Logistics subsidiary, A-Mark provides customers an array of complementary services, including receiving, handling, inventorying, processing, packaging and shipping of precious metals and custom coins on a secure basis. A-Mark also holds a majority stake in a joint venture that owns the minting operations known as SilverTowne Mint (Mint), which designs and produces minted silver products which provide greater product selection to customers, price stability within the supply chain as well as more secured access to silver during volatile market environments. The company operates its Secured Lending segment through its wholly-owned subsidiaries, Collateral Finance Corporation (CFC) and AM Capital Funding, LLC (AMCF). Founded in 2005, CFC is a licensed finance lender that originates and acquires loans secured by bullion and numismatic coins. Its customers include coin and precious metal dealers, investors, and collectors. AMCF was formed in 2018 for the purpose of securitizing eligible secured loans of CFC. A-Mark operates its Direct Sales segment primarily through its wholly-owned subsidiary Goldline Inc. (Goldline), a direct retailer of precious metals for the investor community. Goldline markets A-Mark’s precious metal products through various channels, including radio, television, and the Internet. A-Mark is headquartered in El Segundo, California, with offices and facilities in Los Angeles, California, Vienna, Austria, Las Vegas, Nevada, and Winchester, Indiana.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.