Gilead Sciences Faces Downgrade as Financial Forecasts Show Decline

Fintel has reported that on November 8, 2024, Maxim Group changed their outlook for Gilead Sciences (LSE:0QYQ) from Buy to Hold.

Analyst Predictions Indicate Potential Decline

As of October 22, 2024, the average target price for Gilead Sciences stands at 89.53 GBX per share. This figure ranges from a low of 70.13 GBX to a high of 129.97 GBX. Compared to its last closing price of 97.45 GBX, this average represents a potential decline of 8.13%.

Annual Revenue Expectations Dip Slightly

Gilead Sciences is projected to generate annual revenue of 27,782MM, reflecting a slight decrease of 1.83%. The anticipated non-GAAP earnings per share (EPS) is 7.33.

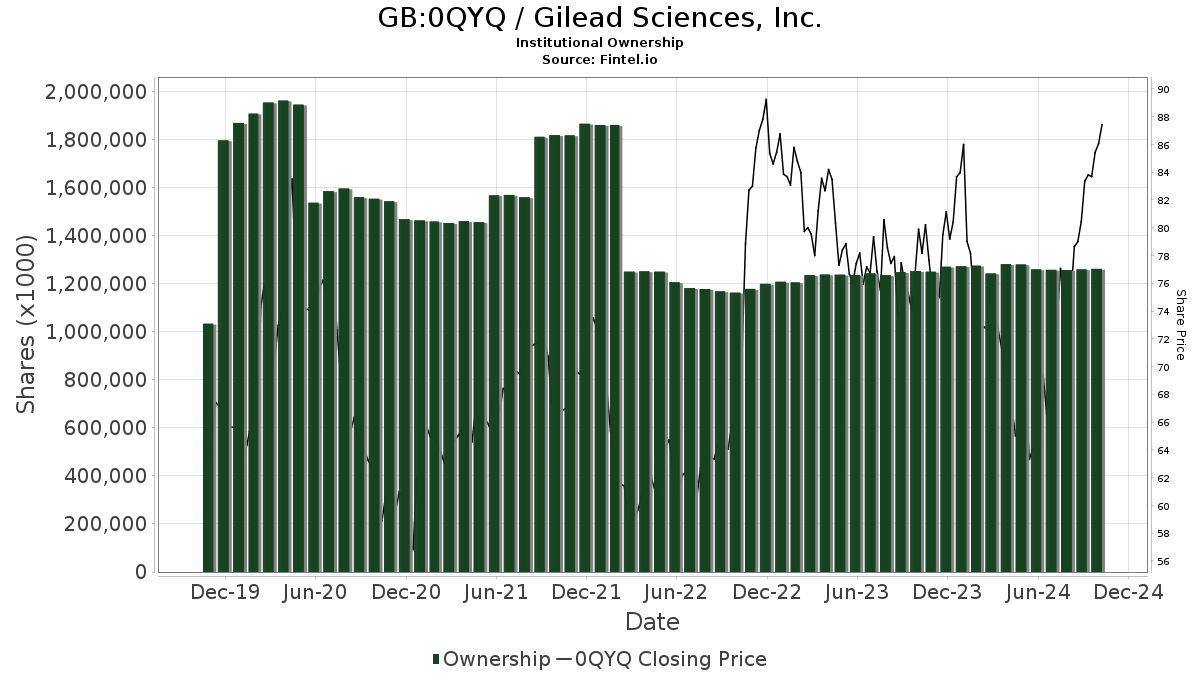

Shifts in Fund Sentiment

Currently, 2,850 funds or institutions report holdings in Gilead Sciences. This marks a decrease of 19 fund owners, or 0.66%, from the previous quarter. The average portfolio weight for all funds invested in 0QYQ increased by 5.16% to 0.40%, while total shares owned by institutions rose by 2.17%, reaching 1,262,285K shares over the last three months.

Institutional Shareholder Movements

Capital World Investors owns 76,250K shares, constituting 6.12% of the company. This is a decrease from their previous holding of 84,497K shares, representing a drop of 10.82%. Their portfolio allocation in 0QYQ also fell by 16.72% during the last quarter.

Capital Research Global Investors holds 60,428K shares, equating to 4.85% ownership, reduced from 61,246K shares, a decline of 1.35%. Their portfolio allocation in 0QYQ decreased by 10.38% over the last three months.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) possesses 39,368K shares for 3.16% ownership. This is a minor increase from 39,174K shares, though they reduced their portfolio allocation in 0QYQ by 8.46% last quarter.

Dodge & Cox holds 33,122K shares, amounting to 2.66% ownership, down from their previous count of 33,167K shares, a decline of 0.14%. Their portfolio allocation in 0QYQ also saw a decrease of 3.23%.

The Vanguard 500 Index Fund Investor Shares (VFINX) reported ownership of 31,976K shares, or 2.57%, having increased slightly from 31,400K shares, which represents a growth of 1.80%. However, their allocation in 0QYQ was reduced by 9.71% in the last quarter.

Fintel offers in-depth investment research tools for individual investors, financial advisors, and small hedge funds.

Our platform provides a wide scope of data including fundamentals, analyst assessments, ownership statistics, fund sentiment, insider trading, options behavior, and much more, all designed for improved investment strategies.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.