Strategies for ACV Auctions Investors: Put Options Insights

Investors considering ACV Auctions Inc (Symbol: ACVA) may find the current market price of $13.98 per share a little steep. Instead of buying shares outright, they could explore alternative strategies like selling put options. A particularly intriguing option is the August put at a $10 strike, currently trading with a bid of $0.65. This could yield a 6.5% return relative to the $10 investment, or an impressive annualized return of 15.3%—a metric we refer to as the YieldBoost.

Selling a put does come with specific considerations. Unlike owning shares, selling a put does not confer the benefits of ACVA’s price appreciation unless the contract is exercised. The buyer of this put option will only exercise it at the $10 strike if it proves more profitable than selling at the existing market price. If ACV Auctions sees its shares drop by 28.5% and the option is executed, the effective cost basis would be $9.35 per share after accounting for the premium. Thus, the primary financial takeaway for the put seller remains the premium income, allowing for that 15.3% annualized return.

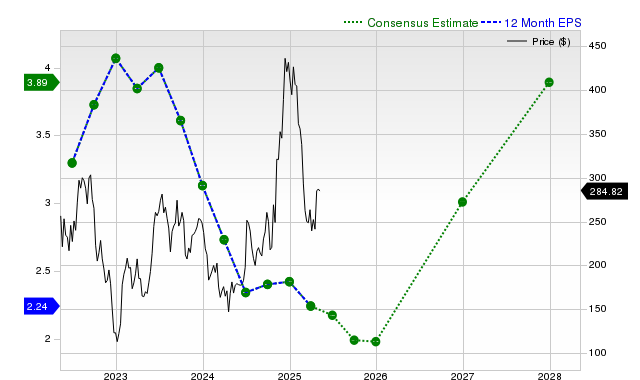

The following chart provides a visual representation of ACV Auctions Inc’s price history over the last twelve months, highlighting where the $10 strike sits relative to past performance:

This chart, alongside ACV’s historical volatility, serves as a useful tool for determining if the August $10 put option at a 15.3% annualized return offers an adequate reward relative to its risks. Currently, the trailing twelve-month volatility of ACV Auctions is calculated at 46%, based on the last 250 trading days combined with the recent price of $13.98. For further insights on available put options with differing expirations, you can visit the ACVA options page on StockOptionsChannel.com.

In mid-afternoon trading on Thursday, the put volume among S&P 500 companies reached 1.17 million contracts, compared to 1.52 million calls. This resulted in a put:call ratio of 0.77, which stands out as relatively high against the long-term average of 0.65. Such data indicates a marked increase in put buyers today relative to call buyers—a noteworthy trend in options trading dynamics this session.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

Also See:

- GBS shares outstanding history

- WEL market cap history

- Institutional Holders of MOO

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.