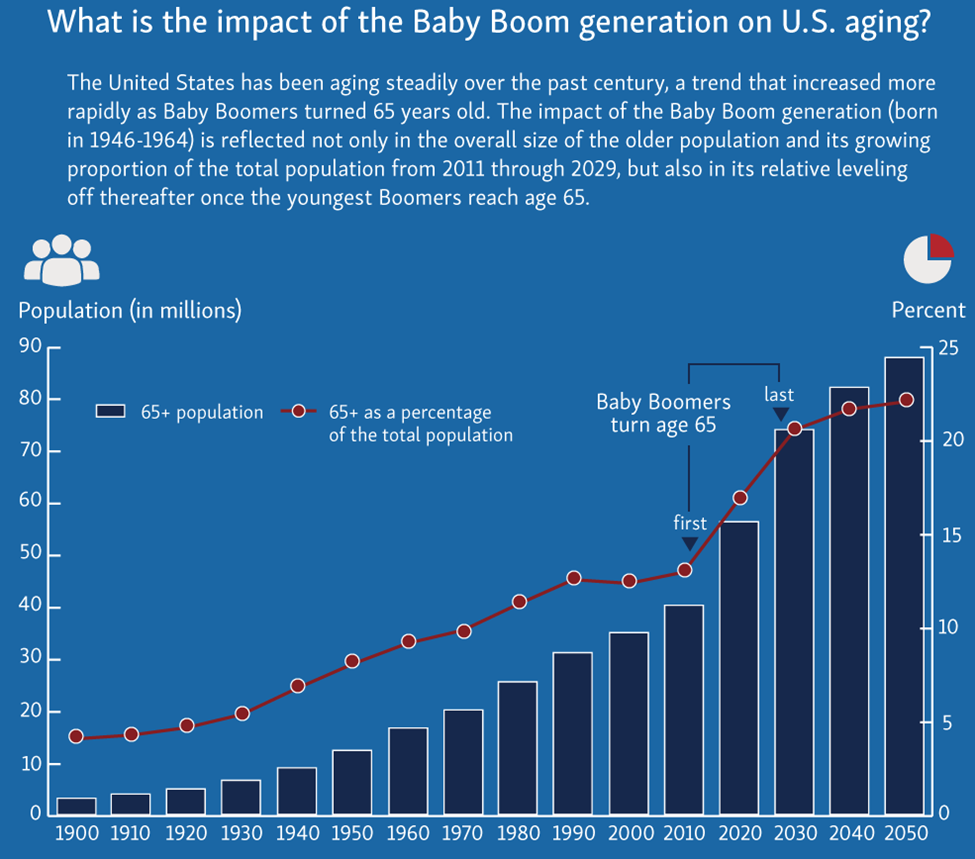

Micron Technology: Evaluating Selling Puts as a Strategy

For investors considering a purchase of Micron Technology Inc. (Symbol: MU) shares at the current market price of $96.44, an alternative strategy worth exploring is selling put options. In particular, the January 2026 put contract with a $77.50 strike price stands out, boasting a bid of $8.05. By selling this put, investors can collect a premium that represents a 10.4% return based on the $77.50 commitment. This translates to a notable annualized return of 12.3%, which is referred to as the YieldBoost by Stock Options Channel.

It’s important to note that selling a put does not give investors exposure to Micron’s potential share appreciation. The put seller only acquires shares if the contract is exercised, which requires the share price to fall below the strike price. Specifically, the put would be exercised only if Micron’s shares drop by 20.1%, thereby resulting in an effective cost basis of $69.45 per share after accounting for the premium collected. Consequently, the main benefit for the put seller remains the premium yield, assuming Micron’s shares do not decline significantly.

Interestingly, the annualized return of 12.3% from the put contract outstrips Micron’s 0.5% annualized dividend yield by 11.8%, given the current market price. Furthermore, purchasing the stock directly to collect dividends introduces more downside risk because the stock price would have to fall 20.14% to hit the $77.50 strike price.

While discussing dividends, it is essential to recognize that these payouts can be unpredictable, fluctuating with each company’s profitability. Review of Micron Technology’s dividend history is critical for assessing whether the recent dividend rate is likely to continue, which helps in evaluating the prospect of a 0.5% annualized dividend yield.

The chart below illustrates the trailing twelve-month trading history for Micron Technology Inc., highlighting the position of the $77.50 strike price in relation to past performance:

With insights from the above chart and an analysis of Micron’s historical volatility, investors can better assess whether selling the January 2026 put at the $77.50 strike for a 12.3% annualized return offers a favorable risk-reward ratio. The trailing twelve-month volatility for Micron, calculated based on the last 250 trading days and the current price of $96.44, stands at 57%. For additional put option ideas across different expirations, visit the MU Stock Options page at StockOptionsChannel.com.

In mid-afternoon trading on Thursday, the volume for puts among S&P 500 components reached 1.17 million contracts, with call volume at 1.52 million. This resulted in a put:call ratio of 0.77, which is unusually high when compared to the long-term median ratio of 0.65. This suggests an increased presence of put buyers in today’s options trading relative to call buyers. Discover which 15 call and put options traders are being discussed today.

![]() Top YieldBoost Puts of the Nasdaq 100 »

Top YieldBoost Puts of the Nasdaq 100 »

Also See:

- PFPT Videos

- FVCB Average Annual Return

- UHS Market Cap History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.