“`html

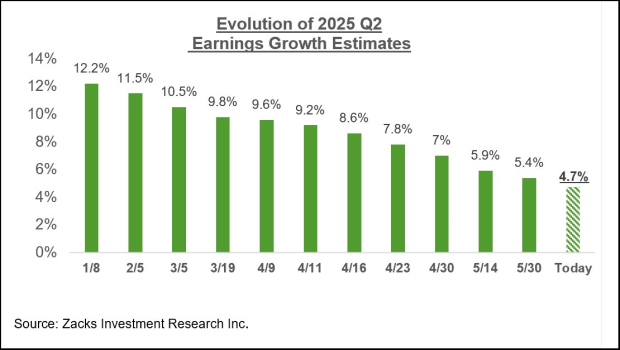

The Nasdaq and S&P 500 have maintained their positions throughout June, following a significant rally since April. Analysts anticipate that further movement may depend on the upcoming second-quarter earnings season, starting mid-July. Key factors supporting the current bullish trend include progress in trade negotiations, controlled inflation, and growth in corporate earnings.

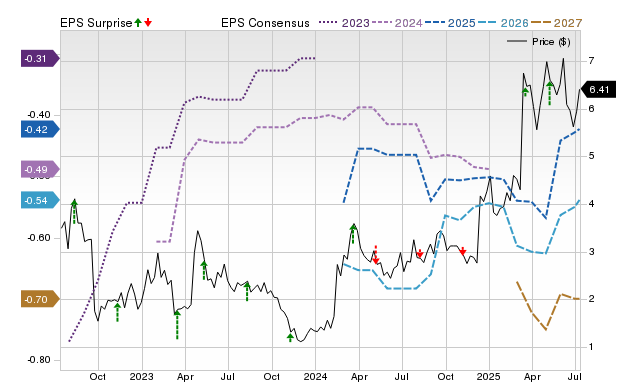

Marubeni Corporation (MARUY), a Japanese trading and investment conglomerate, presents a potential investment opportunity, having gained 250% over the past decade, outperforming both the Zacks Conglomerates sector and the S&P 500. Currently, Marubeni’s stock is trading at a 35% discount compared to its sector and features a return on equity (ROE) of 13.5%, significantly above its industry’s average of 3.13%. Additionally, it provides a dividend yield of 2.71%.

“`