Investing doesn’t have to be complicated. While detailed analysis can be useful, simply investing in the S&P 500 can be quite effective. This index tracks the largest 500 companies in the U.S., reflecting the overall health of the U.S. economy. Since it includes the top companies from key sectors, the S&P 500 tends to mirror economic trends.

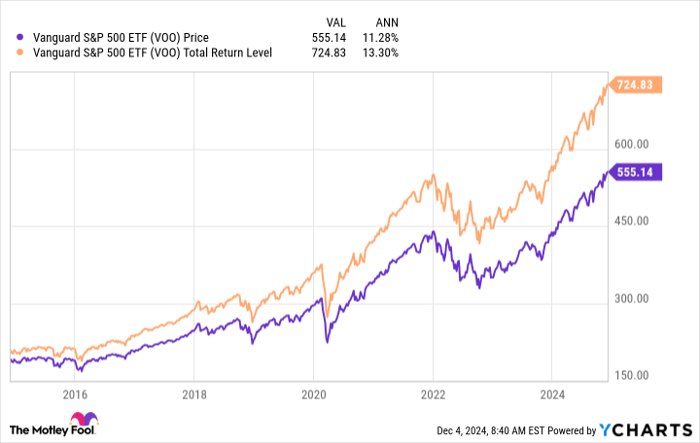

If you’re considering an investment in the S&P 500 this December, the Vanguard S&P 500 ETF (NYSEMKT: VOO) is a strong option.

VOO data by YCharts.

Choosing Between Standard and Equal-Weight ETFs

Most S&P 500 ETFs use a market-cap weighting, meaning larger companies make up a bigger portion of the fund. Here are the top 10 holdings in the Vanguard S&P 500 ETF:

| Company | Percentage of the ETF |

|---|---|

| Apple | 7.11% |

| Nvidia | 6.76% |

| Microsoft | 6.26% |

| Amazon | 3.61% |

| Meta Platforms | 2.57% |

| Alphabet (Class A) | 2.08% |

| Alphabet (Class C) | 1.72% |

| Berkshire Hathaway (Class B) | 1.71% |

| Broadcom | 1.64% |

| Tesla | 1.44% |

Source: Vanguard. Percentages as of Oct. 31, 2024.

Market capitalizations can change, so the holdings’ percentages are adjusted quarterly. On Dec. 4, Apple’s market cap was around $3.7 trillion, while News Corp represented the smallest holding with about $17.5 billion.

Equal-weight S&P 500 ETFs, which allocate similar weight to each company, have recently gained popularity.

This December and into next year, a standard, market-cap-weighted ETF seems like a wise choice. Its top holdings include powerful companies with significant upward momentum.

Looking at sectors such as artificial intelligence (AI), cloud computing, cybersecurity, semiconductors, and electric vehicles, the ETF’s leading companies (which make up nearly 35% of the fund) could maintain their strong performance as seen recently.

Why Choose Vanguard Over Other ETFs?

In addition to the Vanguard ETF, there are other notable S&P 500 ETFs, including the SPDR S&P 500 ETF Trust and the iShares Core S&P 500 ETF. All three funds track the S&P 500; what’s different are their management costs. The Vanguard S&P 500 ETF and iShares have low expense ratios of 0.03%. In contrast, the SPDR S&P 500 ETF Trust charges 0.0945%.

How significant are these fees? For instance, if you invest $500 each month into all three ETFs at an average annual return of 10% over 25 years, your fees would total about $2,600 with Vanguard or iShares, but around $8,300 with SPDR.

I recommend the Vanguard ETF over iShares because it tends to have higher trading volume. This makes buying and selling shares smoother without causing major price swings.

Consistent Investing Yields Results

Regardless of the S&P 500 ETF you select, a smart approach is to dollar-cost average. This means determining how much you can invest regularly in the S&P 500 and sticking to that plan, regardless of market fluctuations. For example, if you decide to invest $300 monthly, you could structure it as $75 weekly or $150 bi-weekly, based on what fits best with your finances.

What ultimately matters is maintaining your investment schedule. Regular contributions to the S&P 500 have consistently proven effective for long-term wealth building.

Is Now the Right Time to Invest in Vanguard S&P 500 ETF?

Before committing to the Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor team recently listed what they consider the 10 best stocks to invest in right now, and the Vanguard S&P 500 ETF isn’t among them. These top picks have the potential to deliver outstanding returns over the coming years.

For instance, take Nvidia, which was recommended on April 15, 2005. If you had invested $1,000 at that time, it would be worth about $889,004!*

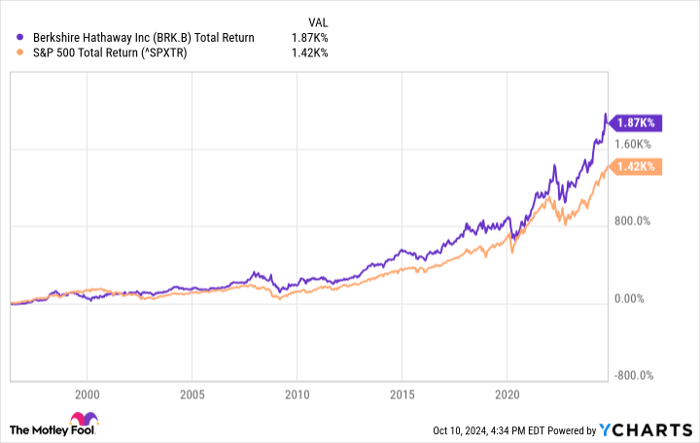

Stock Advisor offers an easy-to-follow plan for investors, providing portfolio-building guidance, regular updates, and two monthly stock recommendations. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.*

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a board member. Randi Zuckerberg, a former Facebook director and sister of Meta Platforms CEO Mark Zuckerberg, holds a board position as well. Stefon Walters has stakes in Apple, Microsoft, and the Vanguard S&P 500 ETF. The Motley Fool recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and the Vanguard S&P 500 ETF. The Motley Fool also recommends Broadcom and holds specific options on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.