Can AbbVie Outperform the Nasdaq? A Look at Its Strong Dividends

Investing in exchange-traded funds (ETFs) that follow the Nasdaq Composite is a straightforward way to match its returns. However, those seeking better performance might want to consider adding AbbVie (NYSE: ABBV) to their portfolio. This pharmaceutical company could potentially surpass the Nasdaq, largely due to its strong dividend program.

The Strength of Dividends

AbbVie is recognized as a Dividend King, having increased its dividend payouts for over 50 years. This includes a streak of 52 years, counting its time under the umbrella of its former parent, Abbott Laboratories. Since its separation in 2013, AbbVie has raised its dividend by an impressive 288%, making it appealing to long-term investors.

Maintaining a reliable dividend amid various economic challenges, such as geopolitical struggles or health crises, speaks volumes about a company’s stability. AbbVie has proven it can increase these payouts over time, demonstrating the traits of a robust investment. While dividends alone can’t replace an income, reinvesting them can significantly boost returns.

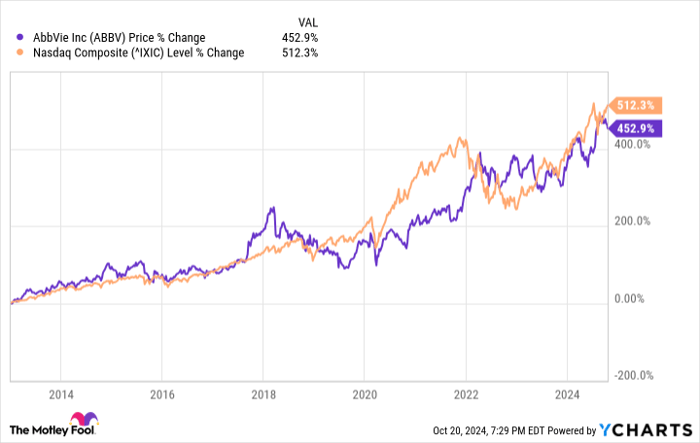

The combination of time, dividends, and compounding can yield impressive results. For example, while AbbVie’s stock performance has lagged behind the Nasdaq since 2013, the total returns—factoring in reinvested dividends—paint a different picture. AbbVie’s total returns have outpaced the Nasdaq by a notable margin.

ABBV data by YCharts.

ABBV Total Return Level data by YCharts.

Challenges Ahead

Critics might question whether AbbVie can sustain its performance against the Nasdaq, especially given that tech giants are soaring due to advancements in artificial intelligence (AI). Moreover, AbbVie has lost its top-selling drug, Humira, which raises concerns about its future competitiveness in a market dominated by companies like the Magnificent Seven.

While AI advancements seem groundbreaking, it isn’t guaranteed that all tech companies will thrive. For instance, will the current hype around Nvidia hold up? How will Alphabet and Apple navigate regulatory pressures? Tesla‘s stock performance has been variable, leaving investors uncertain about its trajectory.

Despite the allure of tech stocks, AbbVie might offer something different. Its business model focuses on essential health products. In tough economic times, consumers are likely to prioritize medication over luxury items like the latest Tesla or iPhone.

Furthermore, even though AbbVie no longer counts on Humira, it has introduced two new immunology treatments, Skyrizi and Rinvoq, expected to exceed combined sales of $27 billion by 2027, surpassing Humira’s peak of $22.1 billion. These therapies are projected to grow well into the 2030s, ensuring that AbbVie remains competitive and capable of continuing its dividend streak for many years.

Investing in AbbVie: A Consideration

If you’re thinking about investing $1,000 in AbbVie, keep this in mind:

The Motley Fool Stock Advisor team has identified what they consider the 10 best stocks to buy now, and AbbVie is not among them. Those stocks could generate substantial returns in the near future.

For context, when Nvidia was featured on this list on April 15, 2005, an initial $1,000 investment would be worth $880,670 today!

Stock Advisor serves as a helpful guide for investors, offering strategies for successful portfolio building, regular analyst updates, and new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Abbott Laboratories, Alphabet, Apple, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.