“`html

Finding Monthly Dividends: Strategies for High Returns

For contrarian investors, nothing beats the benefits of monthly dividends. They align perfectly with monthly bills, making retirement planning straightforward.

However, securing sufficient yield is crucial to transitioning away from traditional employment. With savings fixed at their current levels, we must pursue higher dividends to maximize our earnings.

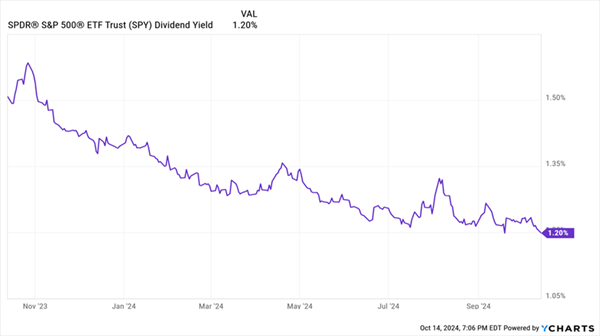

The S&P 500 isn’t sufficient for those goals. The SPY fund offers quarterly payments—too infrequent for our needs—and a yield of just 1.2%, which is disappointing.

“The Market” Is Paying Just Pennies

Even many yield-focused funds currently show an unimpressive 2.8% yield. This brings into question what qualifies as a “high dividend fund” these days.

Since When is 2.8% a High Dividend?

Consider the options of five monthly payers offering dividends between 6.2% to 13.7%. For a $500,000 retirement fund, this translates to annual dividends ranging from $31,000 to $68,500.

LTC Properties (LTC)

Dividend Yield: 6.2%

This sector covers various industries, making monthly dividend stocks a familiar territory for many investors. One such option is LTC Properties (LTC), a real estate investment trust (REIT) focused on long-term care.

LTC owns over 190 facilities, primarily consisting of assisted living and skilled nursing properties. The pandemic affected long-term care significantly, but most operators have rebounded. Yet, LTC still has ground to cover from its pre-COVID stock levels.

LTC Is Still Well Off Pre-COVID Levels

The 2024 and 2025 adjusted funds from operations (AFFO) are expected to remain consistently flat or even decline from 2023. Although LTC’s shares trade at a fair 13 times AFFO, the company’s lack of growth is concerning, albeit it hasn’t reduced its monthly dividend during the pandemic.

Wedbush analysts recently commented that LTC might explore a new RIDEA structure under the REIT Investment Diversification and Empowerment Act, which could introduce new growth avenues. However, any changes aren’t anticipated until 2025.

AGNC Investment Corp. (AGNC)

Dividend Yield: 13.7%

AGNC Investment Corp. (AGNC) operates differently from many REITs. Instead of dealing with physical properties, it manages “paper” real estate, specifically mortgages, and is a significant player with an $8 billion market cap in the mortgage REIT sector.

Mortgage REITs profit by purchasing mortgage loans and earning interest, relying on the difference between short-term borrowing and long-term lending rates.

AGNC invests in residential mortgage-backed securities (MBS) from government agencies such as Fannie Mae and Freddie Mac. Leveraging plays a crucial role in its investment strategy, leading to heightened risk when interest rates rise, but potentially magnifying gains in a declining rate environment.

In April, I noted that AGNC was positioned to benefit from potential Federal Reserve rate cuts, which have since resulted in a notable stock recovery—over 20% total return since its lows earlier this year.

“Spreads should tighten if the Fed finally starts easing, which should provide some lift under mREITs in general, and better operators like AGNC specifically.”

AGNC shows minimal credit risk and stands ready to capitalize on any additional rate cuts from the Fed. Current valuations indicate the stock trades at 1.25 times tangible book value, which raises some concerns over price.

Prospect Capital (PSEC)

Dividend Yield: 13.6%

The next option in the high-yield space is Prospect Capital (PSEC), one of the largest business development companies (BDCs).

BDCs, like REITs, are required to provide dividends and help finance small to medium businesses often overlooked by banks. Prospect Capital has a portfolio spanning 117 investments across 35 industries, with 81% categorized as secured debt.

“`

Exploring High-Yield Investment Opportunities: PSEC, DNP, and PTY

Prospect Capital (PSEC)

Dividend Yield: High Double-Digit Dividend

Prospect Capital focuses on real estate, particularly multifamily properties, and subordinated structured notes. The company features a highly diversified portfolio, showcased in their latest investor presentation:

Source: Prospect Capital Q2 Investor Presentation

PSEC presents an attractive double-digit dividend with solid net investment income (NII) coverage for a time. Notably, non-accrual loans represent a mere 0.3%, and the stock trades at only 60% of its net asset value (NAV), making it the lowest-priced option among the business development companies (BDCs) I monitor.

However, the issue lies in PSEC’s consistent low valuation, attributed to ongoing underperformance since 2021. The dividend faced multiple cuts over the years, the last occurring in 2017, and it has remained unchanged since. Bloomberg has highlighted Prospect’s financial struggles, echoing my previous warnings to investors about the risks of betting against this stock.

While the low price could lead to greater gains if sentiment shifts positively, the burden is placed squarely on Prospect to prove its worth.

DNP Select Income (DNP)

Distribution Rate: 8.1%

Closed-end funds (CEFs), which differ from mutual funds and ETFs, offer unique advantages, including the ability to use leverage to boost returns. These funds may also trade below their net asset value (NAV), providing opportunities for savvy investors. The DNP Select Income Fund (DNP) is a utility-focused CEF that invests in both traditional electric and water utilities—such as Sempra Energy (SRE) and CenterPoint Energy (CNP)—and telecommunications infrastructure companies like American Tower (AMT).

Diversifying with Utilities

Source: Duff & Phelps

DNP’s portfolio includes not just equities; 16% is allocated to bonds and cash. In addition, it employs a moderate debt leverage strategy of 25%, which allows it to sustain its appealing 8% yield. However, the fund regularly trades at a premium, averaging 16% above NAV, and even peaked at a 31% premium earlier this year. Purchasing it becomes lucrative during periods when the premium diminishes.

PIMCO Corporate & Opportunity Fund (PTY)

Distribution Rate: 9.9%

The PIMCO Corporate & Income Opportunity Fund (PTY) diversifies its investments across various types of debt, focusing significantly on junk bonds, which comprise about 35% of its assets. The remainder includes non-agency mortgage securities, developed-market bonds, and emerging-market debt.

A Clear Performance Advantage

Despite being a multisector fund, PTY outshines many competing products, indicated by its Morningstar five-star rating and ranking within the top 1% across various performance metrics. Nevertheless, shares are currently trading at a staggering 24% above their NAV, which raises concerns for potential investors.

Building Sustainable Monthly Income Streams

Purchasing a fund at 24% over its NAV is akin to paying significantly above market price for a car or home. Why compromise your financial strategy by investing in overpriced funds when reasonably priced monthly payers are available?

My “8%+ Monthly Payer Portfolio” is filled with solid investments that offer impressive yields while allowing for steady growth over time. This approach ensures a sustainable retirement income derived primarily from dividends.

Consider this: with a million-dollar portfolio, an 8% yield provides $80,000 annually. Even a $500,000 investment would yield about $40,000 each year, translating to roughly $3,330 in monthly income.

Is your current portfolio capable of generating such income? If not, it may be time to re-evaluate your investments. Click here to discover more about these generous monthly dividend payers.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.