Exploring Put Options for Trimble Inc Amid Market Price Uncertainty

Investors looking to buy shares of Trimble Inc (Symbol: TRMB) at the current market price of $70.31 may want to consider an alternative strategy—selling puts. A notable option is the August put at the $70 strike, which currently bids at $4.90. By selling this contract, investors can collect a 7% return on their $70 commitment, translating to an impressive 17.4% annualized rate of return—referred to as the YieldBoost at Stock Options Channel.

It’s important to note that selling a put does not afford an investor the same upside as owning shares outright. A put seller only ends up owning shares if the contract is exercised. This typically occurs when exercising the put is more beneficial than selling at the prevailing market price. Unless Trimble’s shares decline by 0.4%—triggering the exercise of the put—the put seller’s only advantage lies in pocketing the premium from the contract, yielding that 17.4% annualized return.

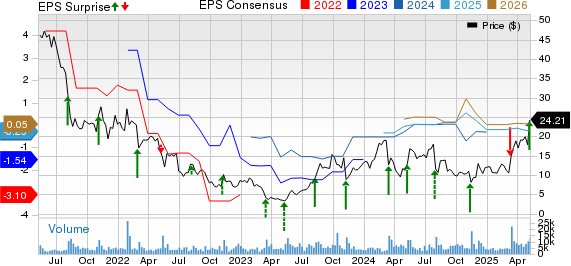

Below is a chart that illustrates Trimble Inc’s trading history over the past twelve months, highlighting the $70 strike in green:

Using the chart and Trimble’s historical volatility in conjunction with fundamental analysis can help determine whether selling the August put at the $70 strike for a 17.4% annualized return offers an attractive risk-reward balance. Currently, Trimble’s trailing twelve-month volatility, calculated using the last 250 trading day closing prices along with today’s price of $70.31, stands at 29%. For more put option ideas across various expirations for TRMB, visit the TRMB Stock Options page at StockOptionsChannel.com.

In mid-afternoon trading on Friday, put volume among S&P 500 components reached 1.33 million contracts, matching call volume at 1.33 million. This resulted in a put:call ratio of 0.70, which is above the long-term median ratio of 0.65. This indicates a higher number of put buyers than typical in today’s options trading activity.

![]() Top YieldBoost Puts of the S&P 500 »

Top YieldBoost Puts of the S&P 500 »

also see:

– Top Ten Hedge Funds Holding FEX

– REVE shares outstanding history

– Funds Holding BNDW

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.