Stock Market Soars: Is Now the Time to Invest?

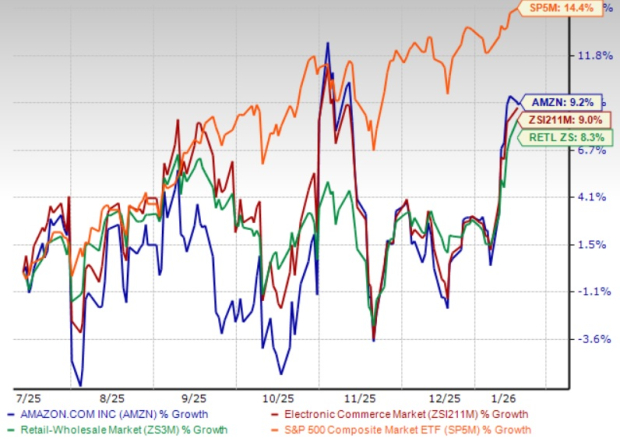

Last year proved to be excellent for investors, as the S&P 500 (SNPINDEX: ^GSPC) kicked off the new year with strong momentum, marking a bull market and achieving a double-digit gain by the end of 2024. This success follows a remarkable 24% increase in the previous year.

While stocks across various industries saw growth, investors particularly focused on companies involved in the booming field of artificial intelligence (AI). Consequently, AI stocks like Nvidia and Palantir Technologies achieved the largest gains in the Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 during 2024.

Where should you invest $1,000 now? Our team of analysts has uncovered what they believe are the 10 best stocks to buy today. Discover the 10 stocks »

As we enter a new year, optimism remains high for the stock market, with continuing positive momentum. AI’s growth potential is just beginning, and recent interest rate cuts may soon benefit both companies and households.

Considering these factors, there has never been a better time to invest in the S&P 500. But what is the best way to go about it? Let’s explore further.

Image source: Getty Images.

Understanding the S&P 500

To start, let’s look at the S&P 500. This benchmark has been around since the late 1950s and consists of 500 companies. Members are added or removed periodically to reflect the leading companies in the economy. To be included, a company must have a minimum market value of $18 billion, as the index tracks large-cap stocks only.

Joining the index is a significant achievement for any company, signaling its status among top American firms. Investing in the S&P 500 means backing the country’s most successful businesses, and historically, it has paid off; the index has yielded an average annual return of 10% since its inception.

The most efficient method to invest in this high-performing index is through a fund that tracks it. My top picks are the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY). Both of these exchange-traded funds (ETFs) mirror the index’s composition and, thus, offer equivalent returns. They are almost identical, so either option would enhance your portfolio.

Benefits of Diverse Investment

Like the S&P 500, the Vanguard and SPDR funds are primarily focused on technology but also span across 10 other industries. This diversification allows you to gain exposure to trending stocks while spreading risk across various sectors. Purchasing these shares is as straightforward as buying stocks since they trade on the market daily.

However, it’s important to note that these funds come with a management fee, known as an expense ratio. Typically, you should aim for ETFs with expense ratios under 1%. The Vanguard’s ratio stands at 0.03%, while the SPDR’s is 0.09%. Keeping these ratios low ensures that more of your investment returns remain intact over time.

Investment Strategies

When it comes to investing in these funds, you have a couple of strategies to consider. One option is to make a lump-sum purchase and hold it for the long haul. This approach has a proven track record; historically, the index has yielded double-digit gains.

Alternatively, you could take advantage of compounding by making an initial investment today and continuing to invest a set amount monthly for an extended period. This strategy can significantly enhance your total investment. For instance, if you invest $1,000 now and add $100 monthly over 35 years, assuming a 10% annualized return (the historical average), you would contribute $43,000, yielding over $310,300 in returns.

Your choice between a one-time investment or a gradual approach will hinge on your investment timeline and strategy. Given the S&P 500’s robust history, either method is a wise way to engage with this thriving index as we kick off January.

Should You Invest $1,000 in Vanguard S&P 500 ETF Today?

Before deciding to buy into the Vanguard S&P 500 ETF, consider the following:

The Motley Fool Stock Advisor analysts have identified the 10 best stocks to invest in now, and the Vanguard S&P 500 ETF is not among them. The recommended stocks have potential for considerable returns in the coming years.

Take Nvidia, for instance, which made this list on April 15, 2005. If you invested $1,000 then, it would be worth around $847,637 today!

Stock Advisor offers investors a clear roadmap for success, featuring guidance on portfolio building, regular updates, and two new stock picks each month. Since 2002, the service has significantly outperformed the S&P 500, delivering more than quadruple its return.*

Explore the 10 stocks »

*Stock Advisor returns as of December 30, 2024.

Adria Cimino has no stake in any stock mentioned. The Motley Fool recommends Nvidia, Palantir Technologies, and Vanguard S&P 500 ETF.

The views expressed are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.