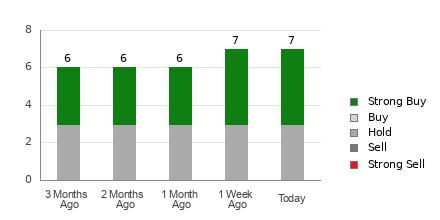

FTAI Aviation Ltd (Symbol: FTAI) shareholders can enhance their income by selling a January 2027 covered call at the $190 strike, collecting a premium of $15.70, which equates to an annualized return of 8%, bringing the total potential annualized return to 9% if the stock remains below that strike price. The stock would need to rise 55.2% to $190 for shareholders to lose any upside beyond this point, which would still yield a total return of 68% including dividends if called.

On Wednesday, the put volume among S&P 500 components reached 876,843 contracts, while call volume surged to 1.66 million, resulting in a put:call ratio of 0.53. This indicates a strong preference for call options relative to puts compared to the long-term median put:call ratio of 0.65.