Kontoor Brands Inc (KTB) shareholders can enhance their income by selling a covered call with a December expiration at the $75 strike price, earning a premium of $3.10 per share. This translates to an anticipated additional return of 10.9% annualized, bringing the total potential yield to 14% if the stock remains below $75. If the stock rises above this price, shareholders would realize an overall return of 18.1%, factoring in dividends.

Currently, KTB’s trading price stands at $66.27, indicating a necessary 13.4% increase for the stock to be called away. The company’s trailing twelve-month volatility is calculated at 43%, providing context for the risk associated with the covered call strategy.

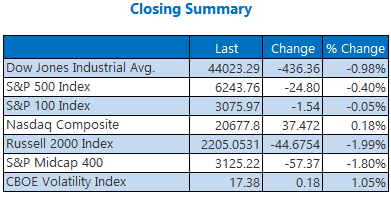

In broader market activity on Tuesday, S&P 500 put volume reached 989,342 contracts, while call volume hit 2.30 million, resulting in a put:call ratio of 0.43, indicating a preference for calls among traders relative to puts.