Skillsoft Corp. (SKIL) reported a 6% year-over-year decline in revenue for Q3 2026, driven largely by an 18% drop in Global Knowledge (GK) revenues. Despite the revenue dip, the company achieved an adjusted EBITDA of $28 million, with a margin of 22%, down from 23.3% in the previous year.

Efforts to mitigate losses included a 4.1% reduction in total operating expenses, totaling $101 million. This was achieved through cuts in content and software expenses (2.4% decrease), selling and marketing expenses (7.1% decrease), and general and administrative expenses (11.9% decrease). The Talent Development Solutions segment remained profitable, while GK suffered a negative EBITDA of $3.3 million.

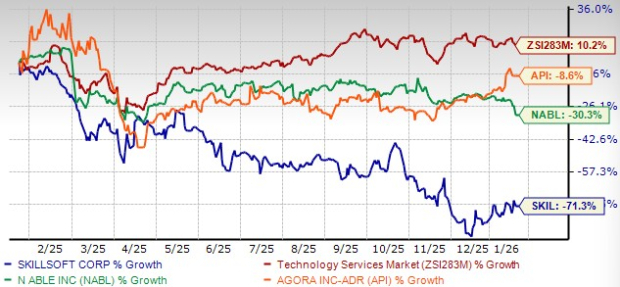

Over the past year, SKIL’s stock has decreased by 71.3%, contrasting with industry growth of 10.2%. The company trades at a 12-month forward price-to-earnings ratio of 1.99, significantly lower than the industry average of 25.21.