Maximizing Returns: A Covered Call Strategy for PBF Energy Inc Shareholders

Investors in PBF Energy Inc (Symbol: PBF) have the opportunity to enhance their income beyond the stock’s current 4% annualized dividend yield. By selling a covered call option with a $42 strike price set to expire in January 2027, shareholders can collect a premium of $3.30. This strategy can potentially provide an additional 5.8% return, resulting in a total annualized return of 9.8% if the stock remains below the strike price. However, any gains above $42 would be forfeited if the stock is called away. Currently, PBF shares would need to increase by 53.1% for this scenario to occur, enabling shareholders to achieve a remarkable total return of 65.1% before dividends, should the stock be called away.

Understanding dividend trends can be tricky, as they often depend on a company’s profitability. For investors evaluating PBF Energy Inc, the dividend history chart below is vital for assessing whether the latest dividend is sustainable and if a 4% annualized yield is a realistic expectation.

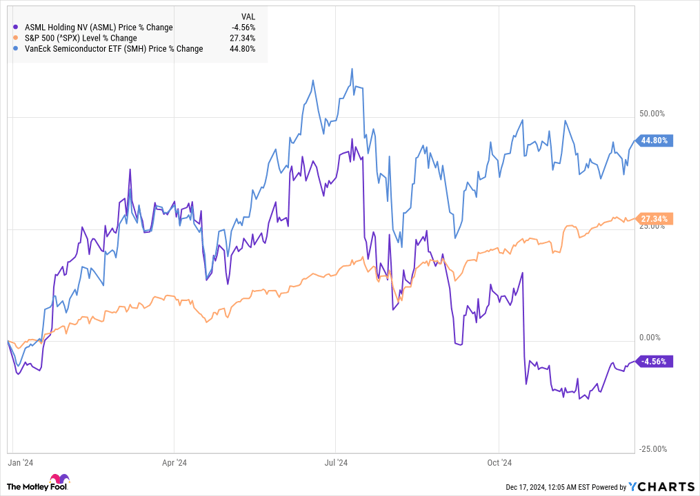

Below is a chart illustrating PBF’s trading history over the past twelve months, with the $42 strike price noted in red:

The trading chart and PBF’s historical volatility provide a helpful reference when determining if the January 2027 covered call at the $42 strike presents an adequate reward for the risk of potentially missing out on further gains. Based on the last 251 trading days and the current price of $27.55, we calculate PBF Energy Inc’s trailing twelve-month volatility to be 39%. For additional options strategies and expirations available, you can visit the PBF Stock Options page on StockOptionsChannel.com.

In mid-afternoon trading on Tuesday, put volume among S&P 500 stocks reached 1.37 million contracts, while call volume stood at 2.68 million, resulting in a put:call ratio of 0.51. This figure indicates considerable call volume in comparison to puts, reflecting a preference among traders for call options on this day, especially when contrasted with the long-term median put:call ratio of 0.65.

Explore the top 15 call and put options that are generating buzz among traders today.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Additional Resources:

- Funds Holding IBTP

- Funds Holding ZGEN

- Institutional Holders of LOOP

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.