Maximize Income with Playtika’s Covered Call Strategy

Shareholders of Playtika Holding Corp (Symbol: PLTK) seeking to increase their income beyond the stock’s current 4.7% annualized dividend yield have an option: sell a January 2026 covered call at the $12.50 strike price. This move could yield a premium of 45 cents per share, translating to an additional 4.8% return based on the current stock price. If combined with the dividend, this brings the potential total annual return to 9.5%, assuming the stock is not called away. It’s important to note that shares would need to climb 47.9% for this option to become profitable for the buyer, meaning shareholders could still achieve a remarkable 53.3% return if their stock is called, along with any dividends received until that point.

Generally, dividend amounts can be unpredictable, reflecting the company’s profitability fluctuations. For Playtika Holding Corp, a look at the dividend history chart below may provide insight into whether maintaining a 4.7% annualized dividend yield is realistic.

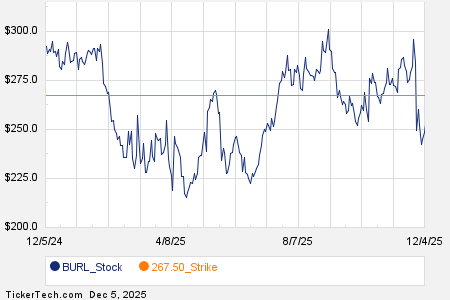

Next, we present a chart showing PLTK’s trailing twelve-month trading history. The highlighted $12.50 strike is indicated in red:

This chart, alongside the stock’s historical volatility, aids in assessing whether selling the January 2026 covered call at the $12.50 strike is a sound choice. Keep in mind that most options eventually expire worthless. Currently, the calculated trailing twelve-month volatility for Playtika Holding Corp stands at 36%, based on the last 251 trading days and the latest price of $8.44. For further options strategies and available expirations, please check the PLTK Stock Options page on StockOptionsChannel.com.

As of mid-afternoon trading on Tuesday, the put volume among S&P 500 companies reached 841,155 contracts, while call volume hit 1.76 million, resulting in a put:call ratio of 0.48. This figure indicates significantly higher call volume compared to puts, suggesting that buyers are leaning more towards calls in today’s options trading.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

- Electric Utilities Dividend Stocks

- PGY Stock Predictions

- SWBI YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.