“`html

Disney’s Streaming Surge: Profitability Beckons

Disney DIS achieved a notable milestone in its first quarter of fiscal 2025, as its streaming division transitioned to profitability. The Direct-to-Consumer operating income hit $293 million, a remarkable recovery from a $138 million loss in the same quarter last year. Overall, Disney’s financial performance was strong, reporting revenues of $24.7 billion, a 5% increase, alongside adjusted earnings per share soaring 44% to $1.76. This success underscores the effectiveness of the company’s strategic choices, even with fluctuations in subscriber numbers.

The improvement in the streaming segment showcases Disney’s shift from prioritizing subscriber growth to focusing on profitability. While Disney+ saw a slight decline of 0.7 million subscriptions, totaling 124.6 million, the average monthly revenue per paid subscriber rose by 4% to $7.99, affirming the company’s pricing strategy. Conversely, Hulu displayed strong performance, with subscriptions climbing 3% to reach 53.6 million, indicating successful cross-platform synergies.

Analyzing Disney’s Strategic Moves

Disney’s strategic initiatives, including adding an ESPN tile on Disney+ and enhancing its platforms, highlight its dedication to improving user experience amidst stiff competition from firms such as Netflix NFLX, Amazon AMZN-owned Amazon Prime Video, and Apple AAPL-owned Apple TV+. Management projects an increase in Direct-to-Consumer operating income by around $875 million in fiscal 2025, reflecting confidence in sustained profitability in the streaming segment.

The Entertainment sector also performed well, with operating income rising by $0.8 billion to $1.7 billion, driven by enhanced streaming economics and successful theatrical releases, like Moana 2. Disney’s content strategy has resonated with audiences, evidenced by its successful features and increasing engagement on its streaming platforms.

However, Disney’s stock has gained 11.5% over the past year, while the Zacks Consumer Discretionary sector grew by 13.9%, suggesting that much of the optimism might already be reflected in the stock price.

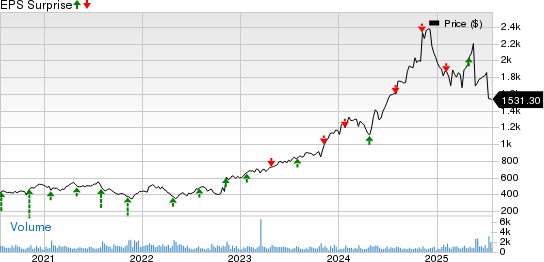

Performance in the Last Year

Image Source: Zacks Investment Research

Challenges Ahead for Disney

Despite strong results, challenges await in 2025. The company anticipates another slight decline in Disney+ subscribers for the second quarter, while the Sports division expects a negative impact of about $150 million from rising college sports costs and the exit from the Venu Sports joint venture. Furthermore, the recent integration of Hulu+ Live TV with fuboTV Inc. adds complexities and execution risks.

Moreover, the deconsolidation of Star India and a joint venture with Reliance Industries introduce uncertainties regarding international growth. These structural shifts could take time for stakeholders to fully evaluate their effects on Disney’s global strategies and financial outlook.

Consideration of the company’s substantial debt, currently at $45.3 billion against a cash position of $5.48 billion, is necessary. Additionally, its price-to-sales ratio stands at 2.17X, higher than the Zacks Media Conglomerates industry’s average of 0.93X.

Disney’s Price-to-Sales Ratio Over Three Years

Image Source: Zacks Investment Research

Investment Outlook for Disney

While Disney’s investment narrative is appealing over the long term, current market conditions and ongoing changes suggest that more favorable entry points may arise in 2025. The company’s extensive content library, strong brand recognition, and improving streaming prospects position it well for future growth, yet potential execution risks should not be overlooked.

Disney anticipates high-single-digit adjusted EPS growth for fiscal 2025, alongside expected cash from operations around $15 billion. These figures lay a solid foundation for long-term value creation. Nonetheless, as the streaming industry evolves and competitive pressures increase, opportunities for more appealing entry points may surface.

According to the Zacks Consensus Estimate, fiscal 2025 revenues are projected at $94.78 billion, reflecting a year-over-year growth of 3.74%. Earnings are expected to grow 8.85% to $5.41 per share, suggesting steady, though modest growth in the upcoming period.

Image Source: Zacks Investment Research

For the latest on earnings estimates and surprises, visit Zacks Earnings Calendar.

Key Considerations for Investors

Investors looking at Disney stock should closely monitor various aspects of the company’s performance in 2025. Key focuses should include trends in streaming subscriber retention and acquisition, which will help determine the effectiveness of Disney’s pricing strategy and content offerings. Metrics related to content engagement and monetization will also be crucial in evaluating Disney’s programming investments.

Additionally, the developments surrounding the integration of Hulu+ Live TV with fuboTV will be critical in assessing execution capabilities. Observing how structural changes in international markets develop, especially post-Star India transaction, is vital. Existing shareholders might choose to hold their positions due to Disney’s strong fundamentals, while potential investors could wait for more favorable entry points as the company continues its transformation. Although Disney remains a sound long-term investment, prudent timing and price considerations could enhance returns in today’s market.

Looking Forward

Disney’s strategic positioning in the entertainment industry is robust, with numerous growth opportunities across its business segments. By prioritizing profitability over mere subscriber increases, along with a solid content pipeline“`html

Investors Eye Investment Potential in Disney as Company Navigates Challenges

Investors looking to enter Disney’s stock may find better opportunities in 2025. The company faces immediate hurdles, but its ongoing transformation can lead to significant improvements over time.

Patience and Timing Could Pay Off

To successfully invest in Disney’s stock, patience is crucial. Investors should wait for optimal moments that present a favorable risk-reward ratio. As Disney’s strategic plans unfold and the effects of recent organizational changes are revealed, potential gains may become clearer. Currently, Disney holds a Zacks Rank of #3 (Hold).

Discover the Top 7 Stocks for the Coming Month

Experts recently highlighted 7 leading stocks from an impressive roster of 220 Zacks Rank #1 Strong Buys. These stocks are considered “Most Likely for Early Price Pops,” indicating promising short-term opportunities.

Since 1988, this selected list has consistently outperformed the market, boasting an average annual gain of +24.3%. So, these carefully chosen stocks deserve immediate attention from investors.

Get your free stock analysis on Amazon.com, Inc. (AMZN).

Get your free stock analysis on Apple Inc. (AAPL).

Get your free stock analysis on Netflix, Inc. (NFLX).

Get your free stock analysis on The Walt Disney Company (DIS).

Read this article on Zacks.com to learn more.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`