New ETF Landscape: Growth of Derivative Strategies and Performance Insights

Significant capital is flowing into low-cost, traditional ETFs, yet the landscape is evolving rapidly. A rising number of newly launched ETFs are actively managed, incorporating increasingly complex strategies involving derivatives.

Recent regulatory shifts—including the “ETF Rule” and the “Derivatives Rule”—have facilitated the launch of ETFs and enabled the use of derivatives within their frameworks. This has led to a notable increase in the number of derivative-based ETFs entering the market.

Categories of New Derivative-based ETFs

The majority of these new products can be classified into three main categories:

- Buffer or defined outcome ETFs

- Leveraged or inverse single-stock ETFs

- Option-based income ETFs

Some of the latest offerings even merge options-selling strategies with leveraged single-stock ETFs. This article focuses on ETFs that use options on single stocks to yield exceptionally high returns, which are among the most popular offerings today. With enticing distribution rates, these products are attracting considerable attention on social media. However, they tend to underperform compared to their underlying stocks, even as investors seek their appealing monthly payouts.

YieldMax: A Leader in the Market

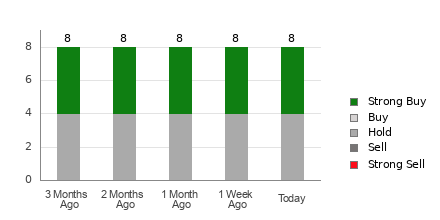

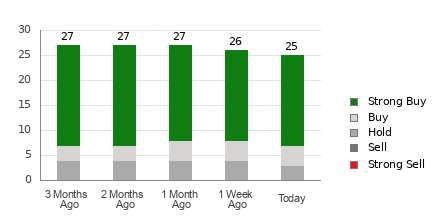

Our analysis spotlighted 24 single-stock covered call ETFs from the YieldMax suite, which leads this niche market significantly ahead of its competitors despite a recent influx of similar products. Several YieldMax ETFs launched in 2023, providing a relatively established performance history compared to their newer counterparts.

Notably, while these funds showcase substantial distribution rates, their performance on a total return basis is often lacking due to declines in share prices. Among the YieldMax ETFs analyzed, only two slightly outperformed their respective underlying stocks.

Understanding Option Income ETFs

YieldMax offers a suite of 48 ETFs with total assets exceeding $10 billion. Despite being relatively new—the oldest, TSLY, began in November 2022—the suite has grown rapidly, mainly driven by its striking distribution yields of 100% or more. The significant performance of these ETFs has inspired many similar products to enter the space.

According to the provider, the main goal of these funds is to generate current income, with a secondary aim of capturing price movement of the underlying stock, though this is capped.

These ETFs do not directly hold the underlying stocks. Instead, they gain synthetic exposure by taking long positions in call options while simultaneously shorting put options. Treasury securities are held for collateral and additional income.

Income generation occurs as fund managers sell call options against their synthetic long positions. Typically, these calls expire in about a month, with strike prices set 0%–15% above the current share price. To further boost yields, some managers implement covered call spread strategies.

Community Engagement and Popular Offerings

The YieldMax Reddit community consists of around 44,000 members who frequently discuss leveraging these ETFs for alternative income streams, including replacing traditional jobs or funding retirement.

The four standout products in the suite are linked to some of the most popular and volatile stocks. This volatility results in elevated option premiums, which enhances potential income. Each of these ETFs has attracted over $1 billion in assets under management (AUM).

Yields are derived by annualizing the most recent monthly payout and dividing it by the fund’s current net asset value (NAV). However, these yields can fluctuate significantly month-to-month based on various factors, including stock performance and implied volatility.

YieldMax ETF Performance Overview

We assessed the total returns—including distributions—for YieldMax ETFs since their inception compared to the underlying stocks. While some stocks experienced gains, others declined or remained flat. In all instances, except for those tracking PayPal (PYPL) and Marathon Digital (MARA), the ETFs underperformed their associated stocks.

The performance discrepancies among the four most popular products indicate that investors could be leaving significant returns on the table in pursuit of yield.

YieldMax MSTR Option Income Strategy ETF (MSTY)

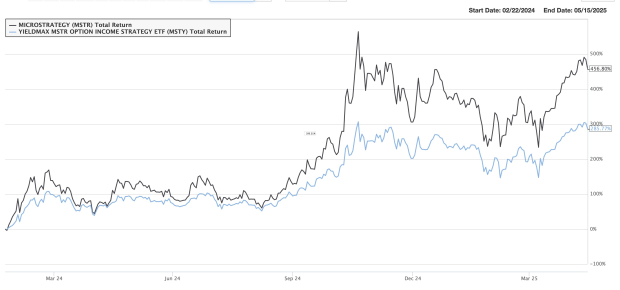

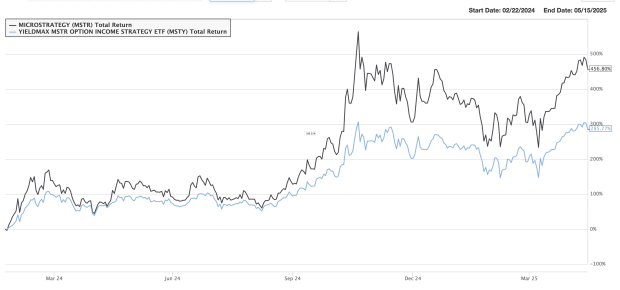

The most sought-after product in the YieldMax suite celebrated its first anniversary in February, with assets reaching $4 billion. It boasts a distribution rate of 136% and has delivered an impressive total return of 286%, while the MSTR stock itself has surged 457% during the same timeframe.

Image Source: Zacks Investment Research

Originally a lesser-known software firm, MSTR is now the leading corporate holder of Bitcoin and trades like a leveraged position on the cryptocurrency. Some experts raise concerns about the sustainability of the financial engineering behind MSTY given its premium valuation.

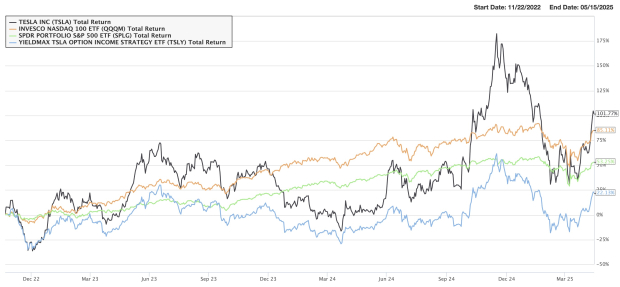

TSLA Option Income Strategy ETF (TSLY)

The oldest product in the suite, with $1.2 billion in assets, has gained roughly 22% since its November 2022 launch. In contrast, Tesla (TSLA) shares have increased about 102% in the same period. This ETF has also underperformed relative to the S&P 500 and Nasdaq-100, which have risen 53% and 85%, respectively.

Image Source: Zacks Investment Research

To provide context, low-cost index funds like SPDR Portfolio S&P 500 ETF (SPLG) and Invesco NASDAQ 100 ETF (QQQM) charge only 0.02% and 0.15% in fees, in contrast to most option income products that approach 1%. TSLY currently offers a striking yield of nearly 107%.

NVDA Option Income Strategy ETF (NVDY)

The second most popular product has achieved a total return of about 187% since its inception in May 2023. Shares of NVIDIA (NVDA), however, have increased approximately 372% during the same timeframe. Still, this ETF has attracted $1.3 billion in assets.

Image Source: Zacks Investment Research

YieldMax COIN Option Income Strategy ETF (CONY)

The CONY ETF, tracking Coinbase (COIN)—a major benefactor of Bitcoin’s rise—has returned 120% since its August 2023 debut. Over that period, COIN stock has seen a gain of approximately 209%. The ETF currently yields 97% and has about $1.1 billion in assets.

Exploring the Differences: Single-Stock vs. Diversified Income ETFs

Single-Stock Option Income ETFs Overview

Single-stock option income ETFs focus on selling one-month call options with strike prices just above the current stock price. This strategy results in an asymmetric risk-reward profile, where investors surrender significant upside potential if the stock price increases while shouldering the majority of the downside if the price falls.

A notable example is the JPMorgan Equity Premium Income ETF (JEPI), which has played a pivotal role in popularizing the covered call strategy. JEPI adopts a fundamental approach to assemble a diversified portfolio comprising roughly 125 stocks. It generates monthly income by selling out-of-the-money S&P 500 index call options, potentially minimizing extreme fluctuations often observed in more volatile stocks like Coinbase or others.

Investment Considerations

Investing in a fund that is tied to a single stock is advisable only if you maintain a positive outlook on that stock. Generally, in such cases, it’s more beneficial to own the stock directly. Conversely, if you anticipate a decline in the stock’s price, it may be prudent to avoid any related investment products.

If the underlying stock remains stable, these ETFs might offer solid performance. However, since they rely on market volatility for income generation, expecting substantial distributions may be unrealistic.

These funds might attract investors who are drawn to consistent monthly income, but it’s crucial to accept the associated asymmetric risk-reward dynamic and the potential for inconsistent tax implications.

ETFs have significantly broadened market access, fostering remarkable innovation. However, given the complexity of these products, investors must fully comprehend their mechanics and the potential outcomes they can yield.