Shareholders of SBA Communications Corp (SBAC) have the option to enhance their income through a December covered call at the $230 strike, offering a premium of $14.60, which translates to a 12.3% annualized return. This, combined with the current 2% annualized dividend yield, could yield a total return of 14.3% if the stock is not called away. However, if the stock price rises above $230, shareholders would lose any additional upside but would earn an approximate 8.1% return from their trading level along with prior dividends.

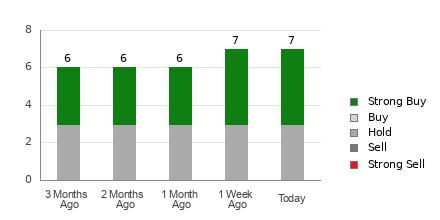

The current share price of SBA Communications is $226.58, with a trailing twelve-month volatility of 27%. On Wednesday afternoon trading, S&P 500 components reported put volume of 876,843 contracts and call volume of 1.66 million, resulting in a put:call ratio of 0.53, indicating a preference for call options in the market.